Media company

Discovery Networks NASDAQ: DISCA stock has been recovering since the lows of the Archegos Capital margin call forced liquidation fiasco that plunged the stock from $78.14 highs to $21.66 lows in 2021. In the meantime, Discovery made a deal with

communications giant

AT&T NYSE: T to merge with Warnermedia segment which is responsible for managing the DC Extended Universe. It’s the DC Comics version of the Marvel Cinematic Universe (MCU) owned by

Walt Disney NYSE: DIS. The combined company is a

streaming content powerhouse and should continue to improve costs and efficiencies along the way as Warner Bros. Discovery with the deal expected to close in Q1 2022. Prudent investors seeking exposure in unique reality

streaming and motion picture content can watch for opportunistic pullbacks in shares of Discovery.

Q3 2021 Earnings Release

On Nov. 3, 2021, Discovery Networks released fiscal Q3 2021 results for the quarter ending in September 2021. The Company reported earnings per share (EPS) of $0.24 excluding non-recurring items, missing consensus analyst estimates of $0.42, by (-$0.18). Revenues grew 23% year-over-year (YoY) to $3.15 billion, beating analyst estimates for $3.14 billion. The Company ended the quarter with 20 million direct-to-consumer (DTC) subscribers, up 3 million in the quarter. Discovery CEO David Zaslav commented, “We made great strides in the quarter operationally, financially and creatively. The team drove solid momentum in our direct-to-consumer business, which we grew to 20 million paid subscribers at quarter-end on the strength of our global brands and fan-favorite content, including the Summer Olympic Games and Shark Week. Additionally, we delivered double-digit growth in both advertising and distribution revenues, as we doubled next-generation revenues year over year. This strong performance once again drove very healthy cash flows during the quarter, further strengthening our balance sheet and financial profile. We are very excited about our pending merger with WarnerMedia and the opportunity to bring these two companies together, combining iconic and globally cherished franchises and brands, and positioning us to more efficiently drive global scale across the combined portfolio."

Conference Call Takeaways

CEO Zaslav commented, “The transformative upside from the merger is, of course, the global direct-to-consumer opportunity. And while we appreciate some of the questions that a number of you have asked regarding clarity and specifics regarding the product, investment, and go-to-market roadmap, it is still premature for us to provide details given where we are in the ongoing regulatory review process. That said, having conducted further operational and strategic diligence, I can share with you some broad strokes around what underpins our confidence and enthusiasm in our global go-to-market attack plan. First, it's all about the content. From the start, under one roof, will be a combination of two companies whose common culture of creative excellence, iconic characters, and franchises will result in a differentiated competitive offering. I believe the biggest and most compelling menu of IP for consumers in the world. Spanning comedy to true crime, kids and family, lifestyle to adventure, drama to documentaries, news, and sports, and of course, sci - fi and superheroes. I believe the most complete and balanced portfolio offered in one service in the world. And secondly, we view our ability and commitment to tactically invest in our content portfolio as a critical strategic driver, building upon our respective long tenor track records of producing relevant and complementary programming around the globe. This should help to make our service uniquely global and local, at the same time. Third, given the breath of our content offering, we expect the combined service will appeal broadly to all demographics, young and old with strong male and female genres. Again, very complementary, such that our global total adjustable market should be on par with the biggest streaming service. Assessing the overlap in respective subscriber basis, at least here in the U.S., we believe less than half of Discovery+ subscribers are also HBO Max subscribers, which with the right packaging provides a real opportunity to broaden the base of our combined offering. And with our global appeal, infrastructure, and local market capabilities, our international roadmap is very much still untapped and provide meaningful upside over the coming years.”

He concluded, “And we look forward to closing the transaction so that we can coordinate and maximize our marketing, technology and content spend for the enhancement of the combined effort. Until such time, we continue to roll out new and exciting content to entertain and sustain our subscribers around the globe. And our metrics look great. Roll -to-pay remains near 75% globally. Churn, particularly in the U.S., to continues to look strong and approaching peer group lows, while App Store ratings are firmly at the top, while monetization and engagement continued to exceed our expectations. All of which helps to solidify our Discovery+ base as we endeavor to roll into and formulate a more comprehensive and broader offering with HBO Max. In closing, this is an exciting and dynamic time for us as we plan our next steps. And we are as eager to share them, as we know you are to hear them. And we expect that will be in short order. While the opportunity for course capture and enhanced efficiency is both tangible and material, our Northstar our right to play, will be in achieving long-term sustainable financial growth resulting from the combination of these two great content companies.”

DISCA Opportunistic Pullback Levels

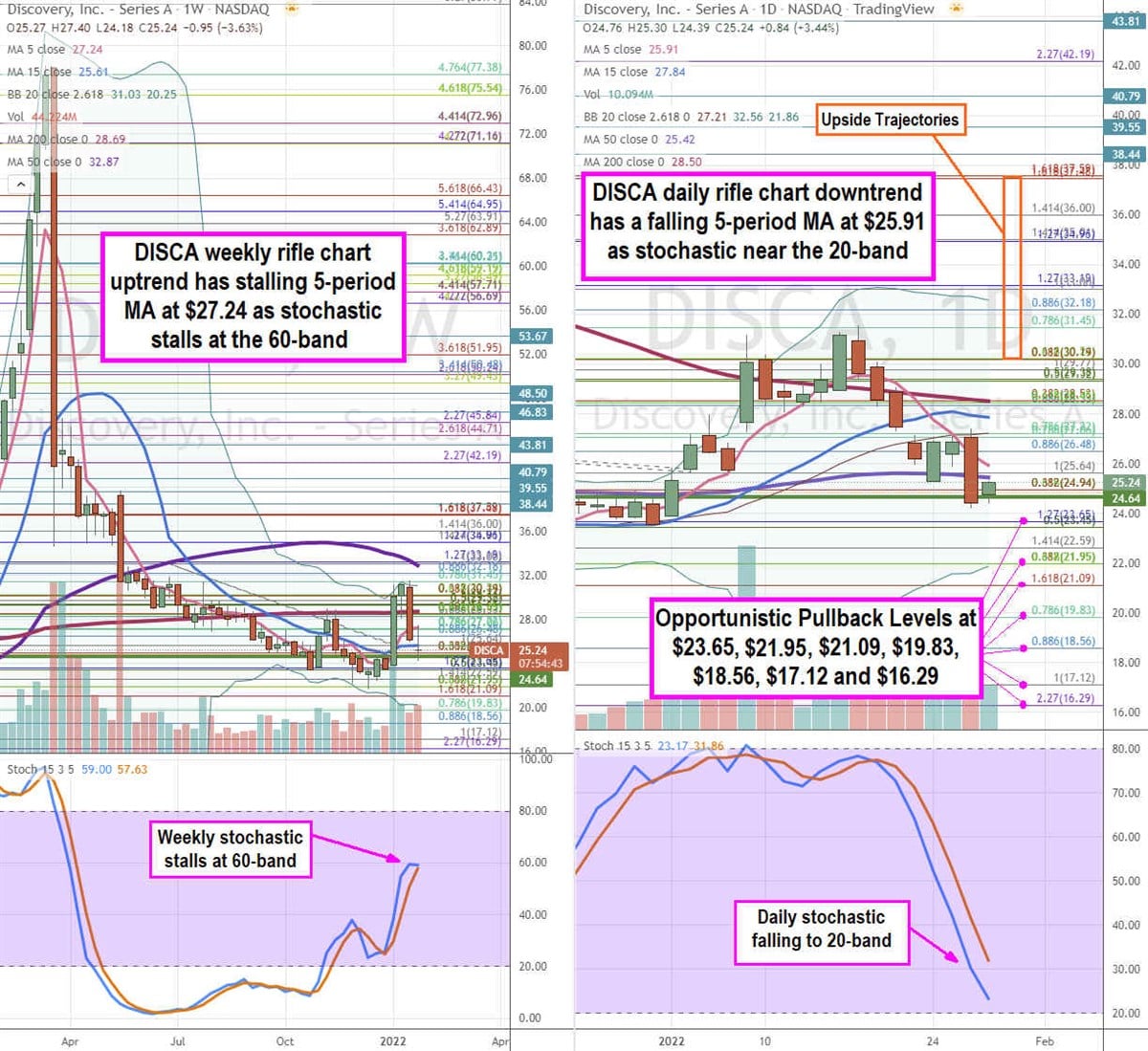

Using the rifle charts on weekly and daily time frames provides a near-term view of the landscape for DSICA stock. The weekly rifle chart has an uptrend with a rising 5-period moving average (MA) that peaked near the $31.45 Fibonacci (fib) level. The weekly 15-period MA is flat at $25.61 as the weekly stochastic stalls abruptly at the 60-band. The weekly market structure low (MSL) buy triggered above $24.64 level. The weekly 200-period MA sits at $28.69 and 50-period MA sits at $32.87. The daily rifle chart has a downtrend that broke down through the 50-period MA at $25.42 with a falling 5-period MA at $25.91 followed by the 15-period MA at $27.84. The daily lower Bollinger Bands (BBs) sit at $21.86. Prudent investors can watch for opportunistic pullback levels at the $23.65 fib, $21.95 fib, $21.09 fib, $19.83 fib, $18.56 fib, $17.12 fib, and the $16.29 fib level. Upside trajectories range from the $30.19 fib up towards the $37.59 fib level.

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.