Media and entertainment giant

The Walt Disney Company NYSE: DIS stock was recently punished on its recent Q2 2021 earnings release. The perceived slowdown of Disney+ member growth, coupled with lower ARPUs and losses from its Disney Parks and Experiences segment resulted in bearish sentiment. However, investors are ignoring the post-pandemic

reopenings taking shape with the acceleration of

COVID-19 vaccinations in the U.S. The Phase IV rollout of the

Marvel Cinematic Universe is underway as

theaters are reopening for the summer blockbuster season to resume. Disney parks are opening again as CDC lifts mask-wearing and COVID restrictions in the U.S. The bar has been set low moving forward as the weakest segment should

recover with the pent-up demand for Disney Parks and Experiences as the

return to normal gets well underway. Prudent investors seeking exposure in the

rebound can watch for opportunistic pullback levels on Disney shares to scale into a position.

Q2 FY 2021 Earnings Release

On May 13, 2021, Disney released its second-quarter fiscal 2021 results for the quarter ending March 2021. The Company reported an adjusted earnings-per-share (EPS) profit of $0.79 excluding non-recurring items versus consensus analyst estimates for $0.27, a $0.57 beat. Revenues fell (-13.4%) year-over-year (YoY) to $15.61 billion, falling short of consensus analyst estimates for $15.99 billion. Direct-to-consumer (DTC) sales rose 59% to $4 billion as operating losses decreased from $0.8 billion to $0.3 billion credited to improved business with its Hulu and ESPN+ segments. Disney+ subscribers grew to 103.6 million subscribers, up from 33.5 million in year-ago same period. Disney+ average revenue per user (ARPU) fell (-29%) to $3.99 versus $5.63 in year-ago period due to the launch of Disney+ Hotstar. Domestic Channels revenue for the quarter decreased (-4%) to $5.4 billion and International Channels revenue dell by (-4%) to $1.3 billion. Disney Park, Experiences and Products revenues fell (-44%) to $3.2 billion and operating losses were (-$406 million) due to park closures and limited operations due to COVID-19 effects.

Conference Call Takeaways

Disney CEO Bob Chapek set the tone, “Our strategic focus continues in three key areas. First is direct-to-consumer. We successfully launched our streaming offerings, Disney+ and Star, in a number of markets internationally… At the same time, we are also closely monitoring the recovery of theatrical exhibitions, as consumers begin to return to theatres… Finally, we are focused on the ongoing recovery of our parks business and the resumption of Disney Cruise Line.” CEO Chapek presented a highlight of things to come, “We are especially excited that after being closed for 412 days, we welcomes our first guests back to Disneyland two weeks ago and the response has been overwhelmingly positive.” The Company was able to quickly recall back 10,000 furloughed cast and workers at the California theme park. The Disney Shanghai Resort is operating at or above FY 2019 levels. The Avengers Campus is scheduled to open on June 4, 2021, at Disney California Adventure. Studio productions are nearing full production levels as they are “gradually increasing output” of 15 to 20 films to fuel the entertainment offerings and platforms. CEO Chapek summed it up, “We re uniquely positioned with the most compelling brands and franchises in entertainment. And we continue to deliver the high-quality, one-of-a-kind content that consumers want. That’s clearly reflected in the success of Disney+, which amassed nearly 104 million paid subscribers as of the end of the second fiscal quarter. We are on track to achieve our guidance of 230 million to 260 million subscribers by the end of fiscal 2024.”

Forward Catalysts

CEO Chapek laid out the forward catalysts which is the rebound of the Disney Parks and Experiences segment. The reopening of theme parks and lifting of restrictions will naturally boost top-line growth expectations. The Disney cruise lines has also started taking reservations again as the newest boat the Disney Wish scheduled to set sail in 2022. The continued rollout of the slate of studio projects should continue to fuel the growth of Disney+ subscriptions. Prudent investors can watch for opportunistic pullbacks as fundamental improve in its weakest segments from the pent-up demand coming to fruition.

DIS Opportunistic Pullback Price Levels

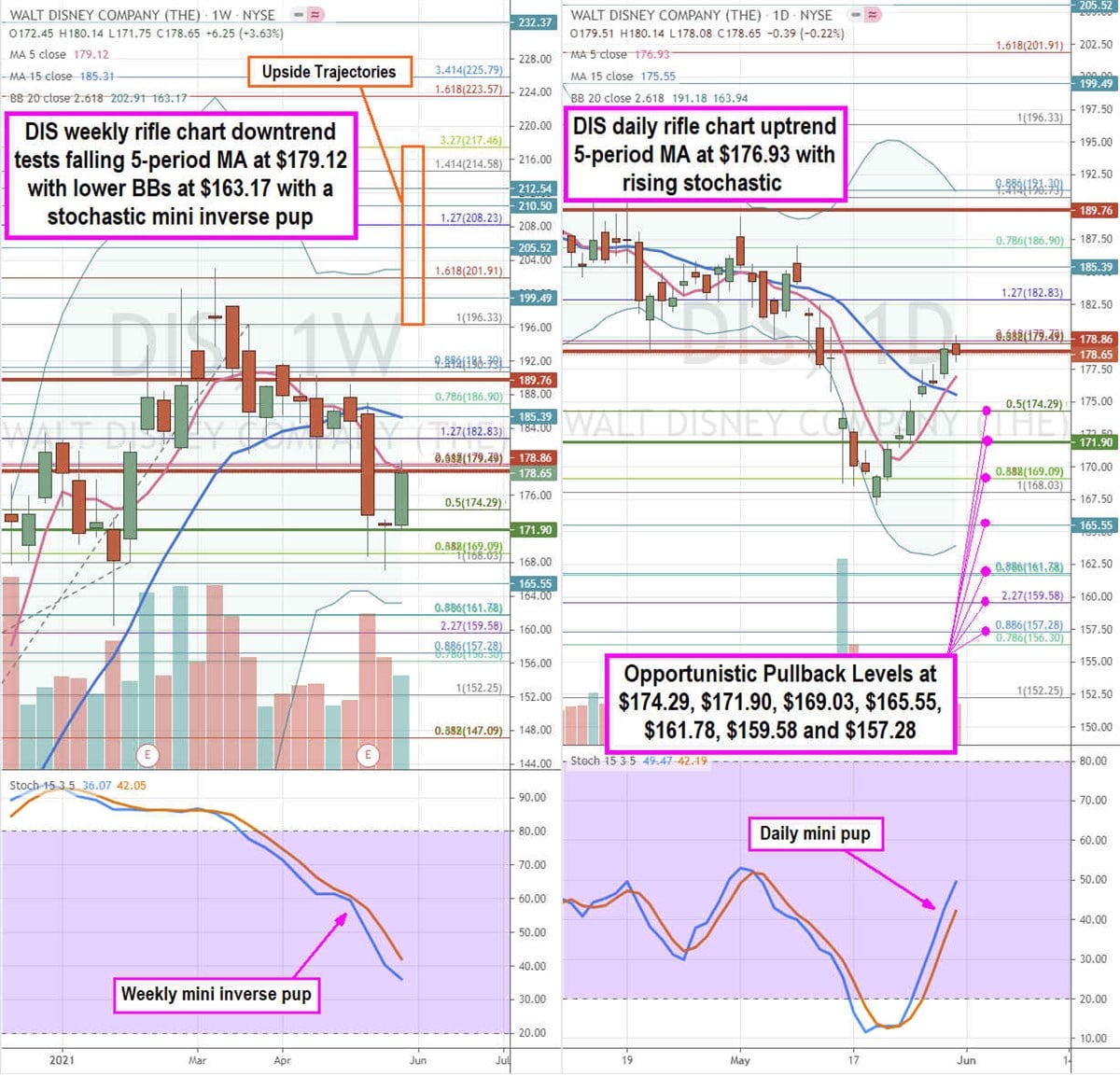

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for DIS stock. The weekly rifle chart downtrend is testing the falling 5-period moving average (MA) near the $179.20 Fibonacci (fib) level. The weekly stochastic has a mini inverse pup that will resume the downtrend upon rejection off the weekly 5-period MA and the monthly market structure high (MSH) sell trigger under $178.86. The weekly lower Bollinger Bands (BBs) sit at $163.17. The daily rifle chart formed an uptrend on the market structure low (MSL) breakout through $171.90. The daily 5-period MA is rising at $176.93 with a 15-period MA at $175.55. The daily stochastic has a mini pup grinding up through the 50-band as it fights to break through the weekly MSH trigger at $178.85, otherwise risking a daily MSH. After a spring-like coil off the $167.50 lows, a reversion is likely. Prudent investors can monitor for opportunistic pullback price levels at the $174.29 fib, $171.90 daily MSL trigger, $169.09 fib, $165.55 sticky 5s level, $161.78 fib, $159.58 fib, and the $157.28 fib. Upside trajectories range from $96.33 fib up to the $217.46 level.

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.