Strong Comps Drive Dollar Tree Higher

I became interested in Dollar Tree (NASDAQ:DLTR) over the summer for a couple of reasons. The analysts were bullish where the market was not, the company’s results allowed the resumption of stock buybacks, and there was a value proposition to be considered. In the time since my last look at the company, shares drifted higher on an expectation of good things to come and, guess what? They did. The company beat the consensus target for all metrics in the 3rd quarter putting the company on track for significant growth in the coming year. Not only are same-store comps on the rise but margins are improving and there are plans to continue the company’s aggressive expansion.

“Since acquiring Family Dollar, the Company has produced strong cash flow from operations, paid down debt aggressively, repurchased $400 million in shares, mitigated the majority of impacts from tariffs proactively, consolidated its two store support centers and realigned leadership under one executive team. These actions enhance the Company’s ability and flexibility to better leverage the two powerful brands to drive improved productivity, efficiencies and returns,” says the company in the 3Q report.

Dollar Tree Beats The Consensus, Shares Rise

The Dollar Tree reported a great 3rd quarter with only a single bad thing about it. Where results at some other retailers saw an acceleration in the 3rd quarter the Dollar Tree did not. The company reported $6.18 billion in consolidated revenue for 7.5% YOY growth, a slight deceleration from the 9.35% posted in the 2nd. The mitigating factor here, if one is needed, is that unofficial guidance has Q4 comps running above the 3Q level.

Regardless, the company is growing at a high-single-digit rate and beat the consensus by a full percentage point. On a segment basis, comps improved at both brands with a 4.0% increase at Dollar Tree stores and 6.4% at Family Dollar. Moving down the report, the company saw its gross margins improve by 150 basis points to 31.2% of sales due to the strength in sales. The company was able to leverage merchandise costs, occupancy, and pricing (lower/less markdowns) to drive a solid beat on the bottom line.

At the operating level, margins improved to 7.5% of sales from last year’s 6.2% and beat the consensus by 110 basis points. On a segment basis, the Dollar Tree stores led with an increase of 50 basis points to 12.7% of sales to help boost profitability by 28%. On the bottom line, the GAAP EPS of $1.39 beat by $0.23 increasing both the company’s cash position but also allowing share repurchases repayment of debt. The company is sitting on more than $7 per share in cash with a super-low 2.85X FCF leverage ratio; a situation that leaves this company in fantastic shape for 2021.

The Analysts Aren’t Bullish Enough On Dollar Tree

The analysts are, on balance, bullish on this stock but perhaps not bullish enough. There has been only a single analysts call out since the last reporting seasons and it, along with the ones before, merely reiterated their previous stance and most lowered their price target. Now, with the 3Q report in the bag, the company is on track to soundly beat the FY consensus and continue to grow in the coming year. In that light, I expect to see no few price-target increases along with rating-upgrades.

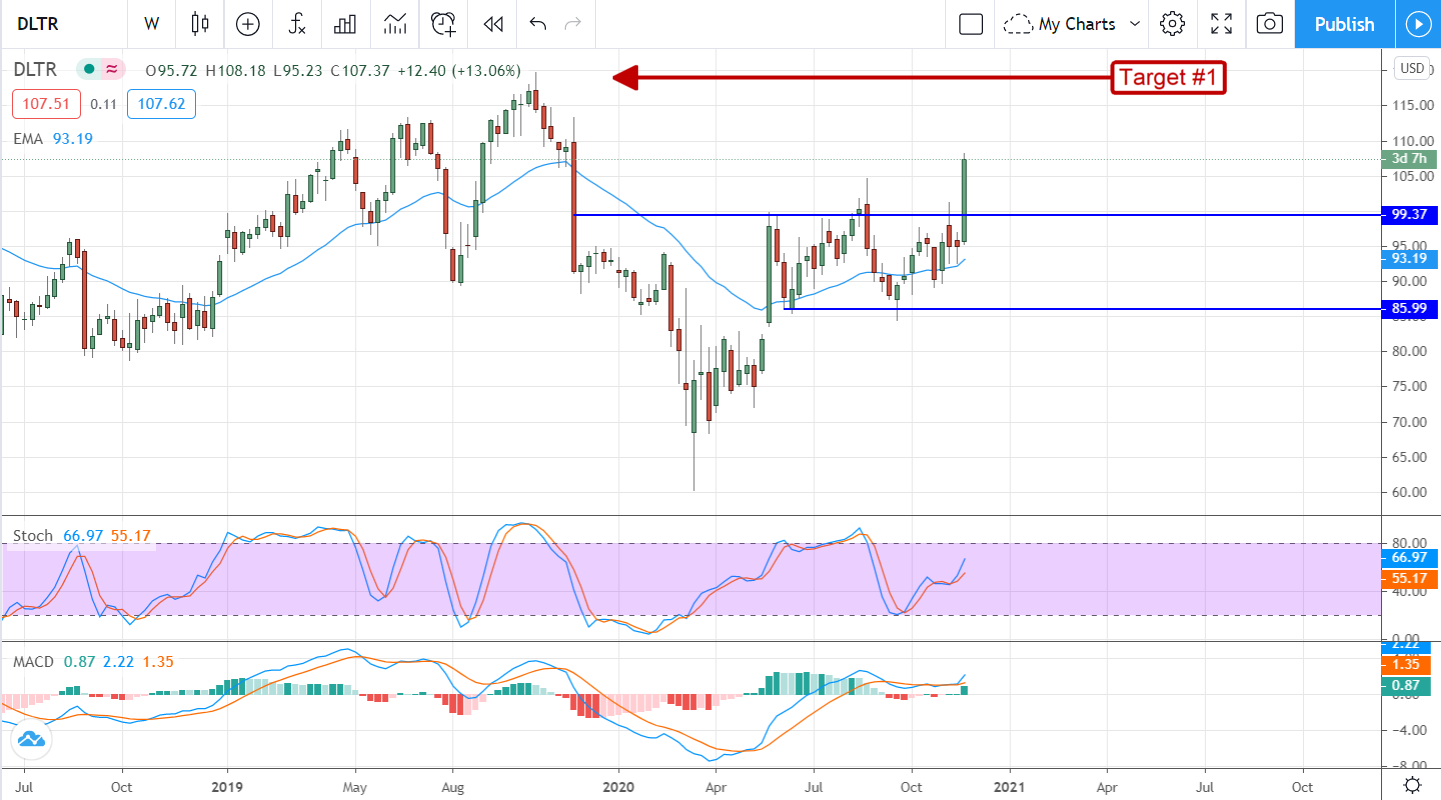

On a technical basis, the 3Q news has shares up 10% and on their way to retest the all-time high set in late 2019. The weekly chart is especially telling as it shows an asset confirming the short-term moving average, breaking to a new high, confirming an uptrend, and all supported by the indicators. In the near-term, I see this stock delivering upside in the mid-teens to low 20% range with more to come over the long-term.

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.