Mattel, Hasbro Both Fall On Shaky Results

As good a company as Mattel (NASDAQ: MAT) is, Hasbro (NASDAQ: HAS) may be a better buy for today’s times. Both companies outperformed the consensus expectations and provided a positive outlook but one thing stands out between them. Mattel is not paying a dividend and there is some concern about slowing consumer spending in the economy at large and for margin compression specifically. On the other hand, Hasbro pays an excellent 3.4% yield and is only trading at an ever so slightly elevated valuation regarding the earnings multiple.

Mattel Wows Market With Results

Mattel had an excellent quarter with robust growth in all segments and categories. The company reported $1.24 billion in revenue for a gain of 20.4% over last year that outpaced the Marketbeat.com consensus by 1200 basis points. The gains were driven by a 30% increase in North America that was compounded by a 20% gain in the International segment. The International segment was impacted by FX conversion, however, which shaved 800 basis points off of the reported figure. On a category basis, strength was reported in all categories with Action Figures, Building Sets, and Other given top billing.

Moving on to the income, the margin news is mixed but favorable to the bottom line. The gross margin compressed as it did with Hasbro but, like with Hasbro, the operating margins were improved. Adjusted EBITDA, operating income, and net income all improved versus last year, the net income reversing a loss, under the combined influences of price increases, internal efficiencies, and revenue leverage as well as the sale of assets. On the bottom line, the $0.18 beat the consensus estimate by $0.12 which is a much wider margin than Hasbro but it is the guidance that counts.

Mattel issued favorable guidance but it also reflects the influence of increasing inflationary pressures. The company reiterated the guidance for both revenue and earnings which has revenue above the consensus and earnings below. In comparison, Hasbro’s guidance included margin expansion and top and bottom line figures that were both above the consensus.

The Analysts Prefer Mattel

The analyst's sentiment is bullish for both companies but tilted in favor of Mattel. Mattel is rated a Buy with a consensus target about 40% above the current action compared to Hasbro’s Hold and 24% of upside. This may shift now that earnings and guidance are out. As for Hasbro, it’s received four optimistic commentaries although they all included price target reductions as well. The takeaway here is that Hasbro has already seen a lot of the downgrades and price target reductions that may also be on the way for Mattel and may be in a better position to rebound later in the year.

The Technical Outlook: Is Mattel Poised For A Fall?

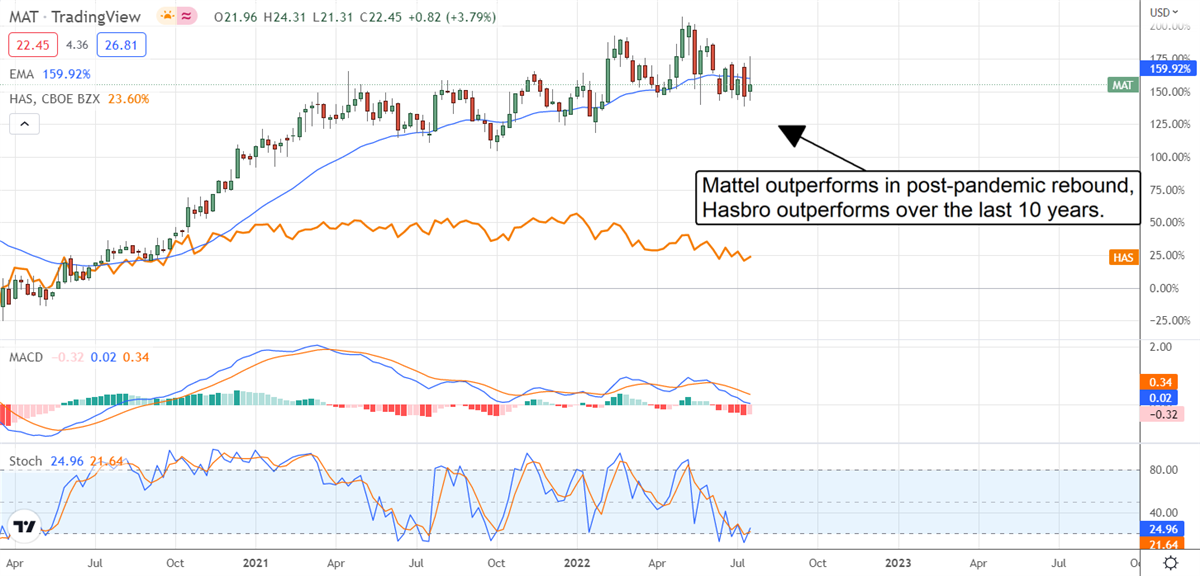

Shares of Mattel have greatly outperformed Hasbro in the wake of the pandemic but those days may be numbered. The company stock is trading at the highest levels in months and does not have an appreciable catalyst for higher prices in our opinion. Based on the dimming outlook for consumer spending and the difference in dividend payments, we are expecting the market to shift out of Mattel and into Hasbro (which has given the best returns over the past 10 years, including the post-pandemic period).

Before you consider Mattel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mattel wasn't on the list.

While Mattel currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.