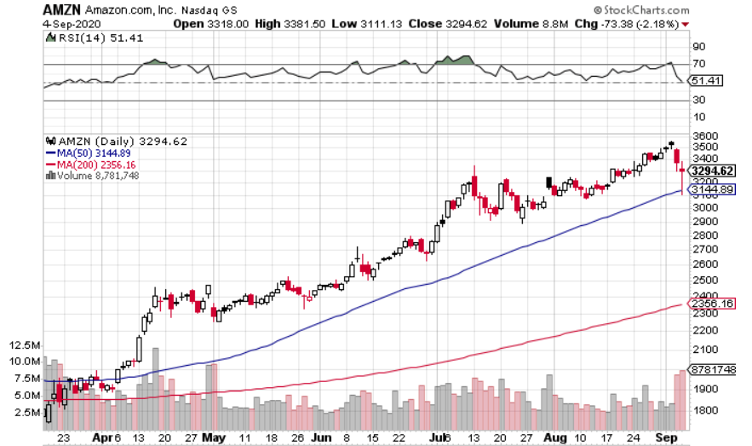

Amazon NASDAQ: AMZN just did something it hadn’t done in five months: Touched its 50-day moving average.

On Friday, shares dipped a little below the 50-day, but quickly recovered and closed near the day’s highs.

Amazon has been one of the biggest pandemic winners. After shares dropped around 25% between mid-February and mid-March, they quickly recovered, setting all-time highs less than a month later. AMZN has since been a constant presence on the all-time high list.

Just over a month ago, Amazon reported its Q2 2020 earnings. The company saw massive revenue growth (even by its own lofty standards) and record quarterly earnings. The company-wide outlook is better than ever – we’ll start by looking at it.

Then we will turn our focus to Prime Video – a sometimes overlooked piece of Amazon’s business that is showing potential.

Massive Growth & Record Quarterly Earnings

Amazon is coming off an incredible Q2 2020. Here are some of the highlights:

- $88.9 billion in sales, up 40% yoy and well-above expectations of $81.45 billion.

- E-commerce revenue up 47.8% yoy to $45.9 million, beating estimates of $39.89 billion.

- Amazon Web Services revenue up 28.9% yoy to $10.8 billion, but below expectations of $11 billion.

- Net income of $5.2 billion, nearly double Q2 2019 and a quarterly record.

The 40% revenue growth was Amazon’s highest since Q1 2018. So much for slowing down after racing past a $1 trillion market cap…

And even though earnings remain a secondary concern for Amazon investors – the massive growth is worth sacrificing short-term earnings where necessary – it’s nice to see Amazon moving in the right direction there.

Amazon Web Services was the main driver of the earnings performance, with that business responsible for $3.36 billion of Amazon’s $5.84 billion in operating profit.

Prime Day was again pushed back, however, and is now slated for Q4. But the news for Prime Video was decidedly better.

Worldwide Streaming Video Hours Doubled

With people stuck at home, they are streaming video more than ever and Amazon has been a prime beneficiary – pun intended.

In Q2, “Worldwide streaming video hours doubled year-over-year driven largely by Prime video.”

A recent survey showed that around one-third of U.S. adults added a steaming service between March and May 2020.

Innovative Marketing to Drive Prime Video Growth

Amazon has not been shy about sacrificing short-term earnings for long-term market share.

Amazon has also not been shy about thinking outside the box.

So it’s not surprising to see Amazon link up with Kellogg’s NYSE: K Cheez-it brand for an unusual promotion:

Amazon prime members can now sign up for an offer that will give them $5 in Amazon Prime Video credit and another $5 that can be applied to Cheez-It purchases through Amazon.com. It’s not exactly a free lunch though:

Users will have to steam select Prime Video content for eight hours in the month of September to get the credit. And this isn’t a one-time thing, as the same offer will be available in October… And perhaps beyond.

Yes, Amazon is essentially offering $1.25 in credit per hour for its customers to watch videos. But the thing is, it’s pocket change for Amazon. And if the promotion helps to get millions of people using Prime Video, which remains an afterthought in the streaming world, it would have been well worth it.

Now is a Good Time to Buy AMZN

Amazon put in a base between around $2,900 a share and $3,300 between mid-July and mid-August, before breaking out to all-time highs. Shares raced out to over $3,500 a share before pulling back – along with the general market – over the past two sessions.

Shares closed just below $3,300 on Friday, right around the recent breakout point. This is what you want to see – a stock getting support near the breakout point and, as mentioned earlier, getting support at the 50-day moving average.

I’d consider getting into AMZN today. You can place a stop-order just below Friday’s lows – and the 50-day moving average – and give yourself a downside of around 6%.

The Final Word

You may get queasy when you see Amazon’s $1.6T+ market cap. And when you see that it is trading at 104x forward earnings.

But Amazon is positioned for huge growth for many more years to come. And once Amazon’s revenue growth does slow down, my bet is that the company will be able to achieve respectable margins. Those margins will likely come on revenue that is much higher than it is today, so Amazon still has a lot more room to run.

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.