Fantasy sports betting platform

Draft Kings (NASDAQ: DKNG) shares have accelerated as a pandemic beneficiary play. The absence of live sports events has caused fans to embark upon fantasy sports to meet their fix with the potential to win cash and prizes. Stay-in-shelter isolation mandates generated unprecedented headwinds for Draft Kings to provide not just sports fans but eSports and reality show enthusiasts to compete in free-to-play pools and contests for recognition and rewards. The Company launched sports betting in Colorado and iGaming in Pennsylvania during the month of May. The platform is quickly transitioning into “The only U.S.-based pure-play sports betting and iGaming company”, as per CEO, Jason Robins. DraftKings is uniquely positioned as a pandemic beneficiary on the fantasy sports and a post-pandemic beneficiary with a sportsbook thereby capturing a dual narrative. Investors may want to take advantage of pullback opportunity levels to take positions before the real growth engine kicks in.

Q1 2020 Earnings Results

On May 15th, DraftKings reported Q1 2020 earnings for a loss of (-$0.04)-per share versus (-$0.16)-per share analyst estimates with a 30% year-over-year (YoY) growth. The Company completed its merger with SBTech on April 23rd. They have $450 million in cash, no debt, and a monthly cash burn of $15m to $20 million. The Company thrived through COVID-19 and doesn’t anticipate any negative impact in FY2021. DraftKings launched eSports including eNASCAR, Counterstrike and Rocket League, and new sports like table tennis and Korean baseball.

MUPs and ARPMUP

There are two key metrics with DraftKings to pay attention to. The monthly unique payers (MUP) is defined as the number of unique paid users per month who had a paid engagement. These are the revenue-generating players. For the Q1 2020 ending March 31st, the MUPs rose to 720,000 up from 619,000 in 2019. The second key metric is the average revenue generated per MUP (ARPMUP). This figure rose to $41 for Q1 2020 from $37 in Q1 2019. The trajectory should rise sharply for Q2 2020 when the COVID-19 isolation mandates were implemented in full force. The sportsbook revenues are sure to climb as sporting event schedules resume.

Brokerage Ratings

Various brokerage analysts chimed in with upgrades following the earnings report. Northland Capital raised the target price to $33 from $24-per share. Canaccord Genuity raising their target to $35-per share expecting a “very strong rebound in the second half with major sports likely returning to normal schedules”. Morgan Stanley has an overweight rating with a $25-per share price target with a long-term bull case of $75-per share forecasting $1.4 billion in sales by 2025. It is worth noting that low expenses compared to brick and mortar casinos on the strip make DraftKings an “asset-light” play in all market climates. Goldman Sachs started coverage with a neutral rating and a $32-price target.

DraftKings a Dual Narrative Play

As of May 15th, there are 14 U.S. states actively considering sports betting legalization and four states that have passed legislation to permit online sports betting: Illinois, Michigan, Tennessee, and Virginia. DraftKings successfully launched retail and online sports betting in Iowa and iGaming in Pennsylvania during Q1 2020. In May, DraftKings also launched sports betting in Colorado. As states restart their economies by phasing out isolation restrictions, the Company feels momentum is growing for more states to try to recoup lost tax dollars by legalizing online sports bettering. This is the key to growth by parlaying the sports book from a growing base of fantasy sports fans. This makes DraftKings both a pandemic beneficiary on the fantasy sports side and a restart narrative play on the sportsbook side as live sports events resume, especially if fan attendance is prohibited and/or limited. Prudent investors understand the real growth driver hasn’t even started.

Opportunistic Entry Levels

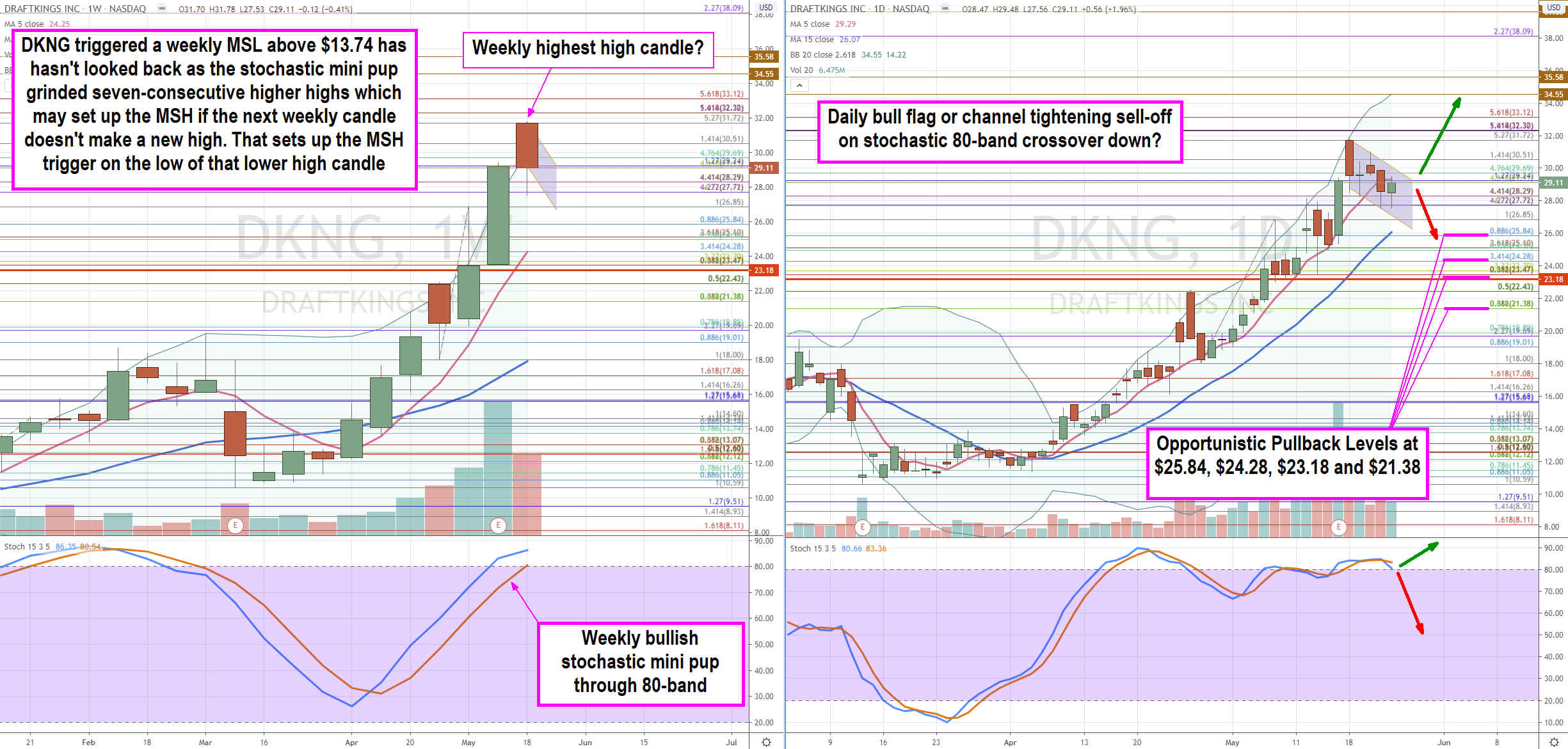

Using

the rifle charts on a weekly and daily time frame provides a broader view of the landscape for DKNG stock. The weekly rifle chart formed a

market structure low (MSL) buy triggered above the $13.74

Fibonacci (fib) level. The weekly stochastic has been in a bullish stochastic mini pup oscillation straight through the 80-band stochastic as shares peaked out at the $31.72 fib. This could be a market structure high if the next candle (this week) forms a lower high. This would then set the low of the lower higher candle as the MSH trigger. The weekly 5-period moving average (MA) is climbing at the $24.28 fib. The daily rifle chart is in a make or breaks with the stochastic testing the 80-band for a possible slip or a bounce off the 80-band to trigger a daily flag breakout above $30.51 fib. The

opportunistic pullback levels are $25.84 daily 15-pd MA/fib, $24.28 weekly 15-pd MA/fib, $23.18 daily MSH trigger, and $21.38 super fib. Nimble traders can scalp the coils off each of the fibs, while more long-term risk-averse investors can scale in at the pullback levels in a pyramid scaling model.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.