The world’s largest airport duty-free retailer

Dufry AG OTCMKTS: DUFRY stock has been recovering from the resurgence in airline travel stemming from the

vaccine rollouts driving further

re-openings. Shares got pummeled during the pandemic along with the airlines. While share have rallied, they haven’t reached the January 2020

pre-COVID levels near $10.25. The Switzerland-based retailer operates its duty-free shops throughout the U.S., Europe, Asia, Africa, Australia, Latin America, and the Middle East. The Company operates over 2,000 duty-free and duty-paid shops in

airports,

cruise lines, seaports, railways stations, and downtown tourist areas in over 430 locations in 64 countries across six continents. The recovery of travel are the key drivers for shares as this little-known player has grown its airport retail market share to 20% with its August 2020 acquisition of Hudson. The Company also received a 6.1% investment stake from e-commerce giant

Ali Baba NYSE: BABA. Prudent investors looking for exposure into the travel recovery segment can monitor shares of Dufry for opportunistic pullback levels.

Full-Year2020 Earnings Release

On March 9, 2021, Dufry released it’s full-year 2020 earnings results. The Company reported turnover of CHF 2,561.1 million, down (-71.1%) year-over-year (YoY). Gross profit fell (-74.%) to CHF 1,377.3 million. Organic growth fell (-69.8%) in 2020 due to reduced passenger traffic and unprecedented levels of travel restrictions resulting in temporary shop closures due to the COVID-19 pandemic. Net debt amounted to CHF 3,344.2 million. Adjusted operating cash flow reached (CHF-405.9 million) in 2020, compared to CHF 960 million in 2019. The Company ended 2020 with CHF 360.3 million and available credit lines of CHF 1,441.3 million and available and uncommitted lines of CHF 104.1 million. Total gross retail space opened during 2020 account for 9,600 sq. meters representing 2% of the overall retail space operated by Dufry. Highlights include new brand paradise ANECDOTE at the Circle, Zurich Airport, an exclusive duty-paid landside store and winning a 12-year concessions contract at Turkey’s second-largest airport. The Company expects to be well-positioned for the re-opening and growth acceleration beyond the current crisis. The Company expects recurring fixed cost savings of CHF 400 million. As of the end of February 2021, approximately 1,300 Company shops have reopened globally representing 60% in sales capacity. In line with industry association figures, Dufry expects to return to 2019 levels between the end of 2022 and 2024.

Conference Call Takeaways

Dufry CEO, Julian Diaz, highlighted the product mix, “Demand for core categories remain better than other types of product mix because the recovery has been led by general shops, selling categories like confectionary, fashion and cosmetics, alcohol and tobacco. There is also a second important remark, convenience stores selling souvenirs, food, bottled drinks, electronics, convenience products in general due to the U.S. and other countries with this type of business, were also and in most cases, resilient. But in any case, still perfumes and cosmetics… represents 31% of total business, food and confectionary 19$, wine and spirits 17%, luxury goods 11% and tobacco products 12%” CEO Diaz has noted that the re-opening and organic growth evolution has commenced, “We have also realized a significant spend increase in spend per passenger and in spend per ticket. In 2020, spend per passenger increased by 4% and average transaction value sales per ticket by 8.8%.”

Ali Baba Investment

Chinese e-commerce behemoth took a 6.1% stake in Dufry along with Private equity firm Advent International taking a 11.4% stake as part of the $900 million capital increase with a minimum six-month lock-up period. Alibaba will also invest CHF 68.5 million in three-year mandatory convertible notes with a 4.1% coupon convertible to 2.1 million shares at 33.22 francs each. They will also form a joint venture combining Alibaba’s digital technology with Dufry’s travel retail business. As travel restrictions get lifted, Dufry should continue to see a recovery. Prudent investors can watch for opportunistic pullbacks for exposure into this travel recovery play.

DUFRY Opportunistic Pullback Levels

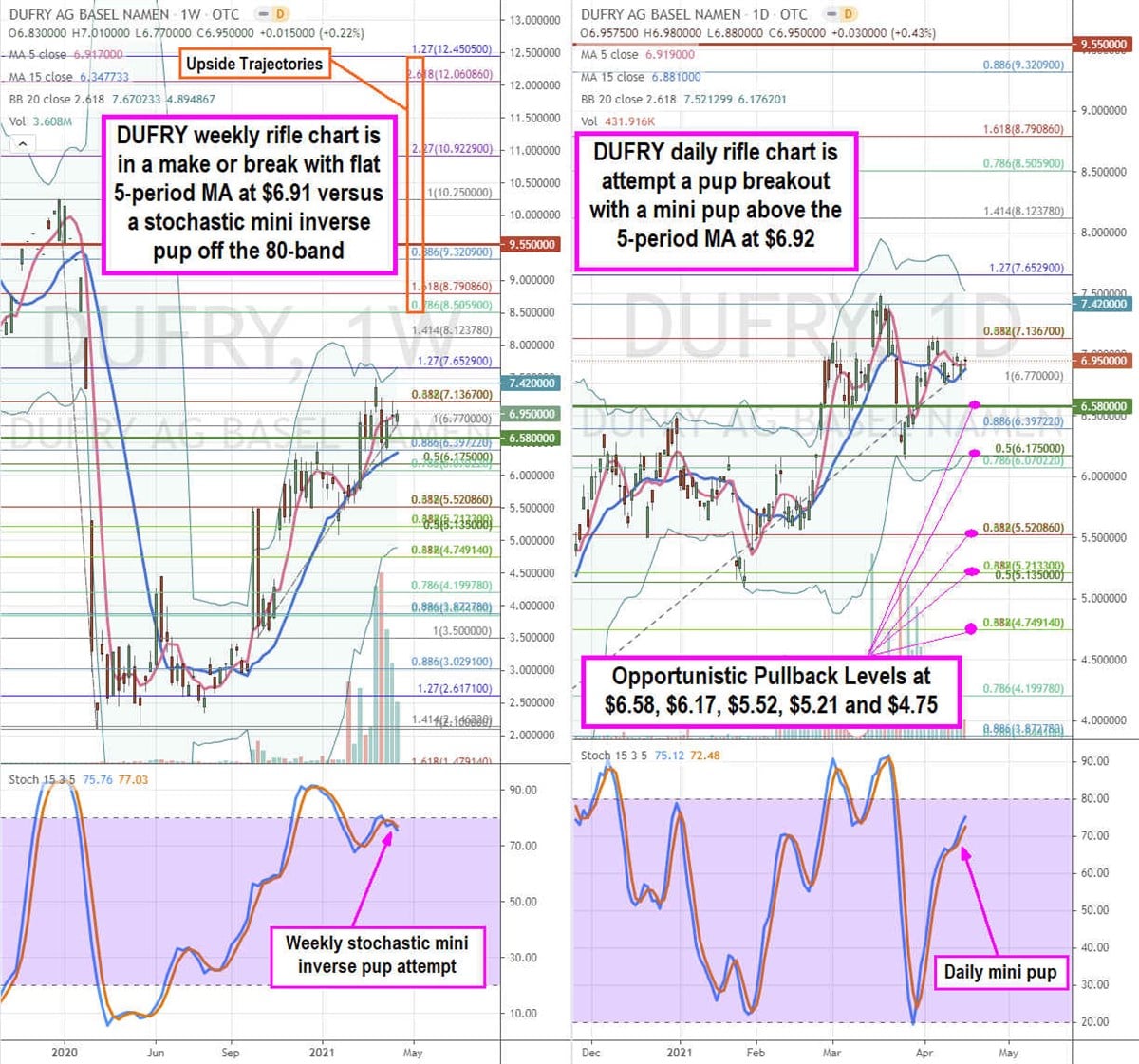

Using the rifle charts on weekly and daily time frames provides a broader view of the landscape for DUFRY stock. The weekly rifle chart has a pup breakout with a riding 5-period moving average (MA) support at $6.91 with upper Bollinger Bands (BBs) at the $7.65 Fibonacci (fib) level. The weekly stochastic is forming a mini inverse pup under the 80-band which can set-up a channel tightening move to the weekly 15-period MA near the $6.39 fib. The daily rifle chart triggered a market structure low (MSL) buy on the $6.58 breakout and is attempting to form a pup breakout powered by the daily stochastic mini pup towards the $7.50 daily upper BBs. Opportunistic pullback levels sit at the $6.58 daily MSL trigger, $6.17 fib, $5.52 fib, $5.21 fib, and the $4.75 fib. Upside trajectories range from the $8.50 fib upwards to the $12.45 fib level.

Before you consider Avolta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avolta wasn't on the list.

While Avolta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.