Online marketplace platform eBay Inc. NASDAQ: EBAY shares had rallied to new all-time highs in July 2020 after plunging to multi-year lows during the COVID-19 pandemic plunge that also sank the benchmark S&P 500 index NYSEARCA: SPY by (-34%) in five weeks. Since its peak, eBay shares have been continuing to lose ground despite the SPY making new all-time highs. As a benefactor of the stay-in-shelter mandates, eBay rode the wave of momentum sending e-commerce stocks through the roof. However, it’s top line sales may have seen its best day behind it as the restart narrative takes shape. As regional economies resume activity and workers return to work, eBay faces more headwinds from recent policy changes that have angered long time sellers on its platform. The writing is on the wall as prudent investors may want to ring the register unwinding positions into reversion bounces at key price inflection levels.

Q2 FY 2020 Earnings Release

On July 28, 2020, eBay released its second-quarter fiscal 2020 results for the quarter ending Jun 2020. The Company reported earnings-per-share (EPS) profit of $1.08 excluding non-recurring items beating consensus analyst estimates for $1.06 by $0.02 per share. Revenues grew 18.5% year-over-year (YoY) to $2.87 billion beating consensus estimates of $2.8 billion. eBay’s managed payments system expanded in July as its Operating Agreement with PayPal, Inc. NASDAQ: PYPL concluded. The Company reached a milestone managing payments for 48,000 sellers to process $4.7 billion in gross merchandise value (GMV). eBay also raised its forward guidance for Q3 2020 lifting revenue estimates to $2.64 billion to $2.71 billion. The Company raised Q3 EPS guidance to $0.81 to $0.87 versus $0.81 consensus analyst estimates. The Company raised full-year 2020 guidance with revenues of $10.56 to $10.75 billion from $9.56 to $9.76 billion.

Covid-19 Upside Effects

eBay saw turbocharged migration and acceleration to eCommerce during pandemic peaks as the stay-at-home mandates accelerated online shopping. Literally all verticals saw upticks in traffic and sales including Electronics, Fashion, Home and Garden, Auto Parts and Collectibles. The Company benefitted from isolation mandates and virus concerns driving eCommerce and online shopping higher. The unprecedented volume and rate of layoffs also resulted in more platform traffic as laid off and furloughed workers try to cash by selling personal possessions. eBay added 8.5 million new users to the platform. However, the shares gapped down (-4%) after the release. Much of the upside was already forecast in the April 2020 update. The larger question looming is whether eBay can maintain the growth spurt seen during the pandemic.

Downsides of eBay Payment Management System

While eBay purports the benefits of its payment management system, many sellers are outraged over the policies accompanying the migration. For example, PayPal payments were instantaneously deposited into the seller’s PayPal accounts prior to the new system. Sellers under the new payment management system won’t actually receive the payment in their accounts until eBay processed the payment which can take up to seven days. This presents potential cash flow problems for many small businesses not to mention having to send out the merchandise before actually receiving payment. eBay has world class customer service and often sides with buyers in transaction disputes. Sellers feel the deck being stacked against them as eBay inadvertently extends the revenue cycle, which can be detrimental for small businesses.

Elliott Management Unwinding Shares?

On July 21, 2020, eBay sold its Classified Group business to Adevinta for $9.2 billion in cash and stock. CFRA raised its rating on EBAY to hold from sell. On Sept. 11, 2020, activist shareholder Elliott Management’s Jesse Cohn announced he is stepping down from the Board of Directors. Elliott Management last reported ownership of 9.9 million shares as of its 13-D filing for Paul Singer on Aug. 14, 2020 . Elliott Management had pressed eBay to sell its StubHub and Classifieds Group business, which it accomplished in 2020. Relinquishing its BOD seat may imply the potential unwinding of Elliott Management’s position which could induce more selling. It may be time to ring the register on eBay before the restart narrative takes full shape as the coronavirus spike may be short-lived.

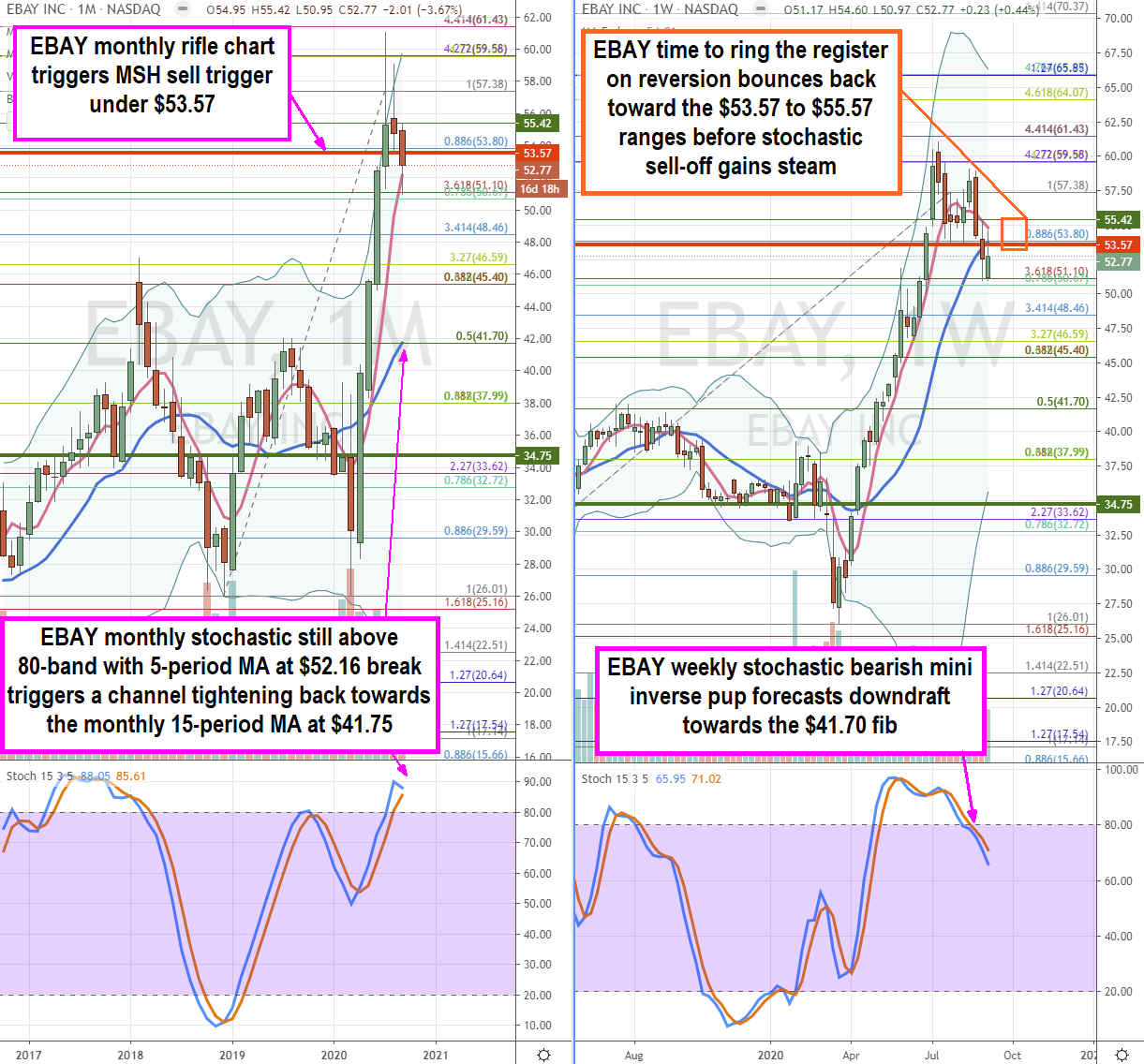

EBAY Price Trajectory Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for EBAY stock. The monthly rifle chart triggered a market structure low (MSL) buy trigger above $34.75. The weekly stochastic completed a full oscillation towards the 100-band before peaking twice forming a divergence top and mini inverse pup back down through the weekly 80-band. This sets-up a downside target near the $41.70 Fibonacci (fib) level and potential to the lower weekly Bollinger Bands near $38. Investors looking to ring the register and take profits can use the nominal reversion bounces back towards the weekly market structure high (MSH) trigger and weekly 5-period MA range between $53.57 to $55.57. If the weekly stochastic manages to bottom out and cross back up, then further upside towards the $59.58 monthly upper BBs is a longshot probability.

Before you consider eBay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and eBay wasn't on the list.

While eBay currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.