Some of the biggest moves in the market happen on earnings releases. But growth isn’t always enough to send shares higher. Even beating consensus estimates is sometimes not enough to boost the stock price.

The key is expectations – particularly, the “whisper numbers.” The whisper numbers are the unofficial expectations that circulate among market participants.

Of course, there’s no way of pinpointing these numbers. But you can often figure out the ballpark numbers based on the market’s reaction to an earnings release.

eBay Probably Had High Whisper Numbers in Q2

eBay’s NASDAQ: EBAY Q2 2020 revenue and earnings both beat estimates and grew at much higher rates than recent quarters. But shares dipped by around 4% on the news, showing that the whisper numbers were likely higher.

A month before the earnings release, eBay was receiving upgrades galore.

E-commerce companies have been crushing it since the onset of the pandemic. So it wasn’t too surprising to see eBay beat consensus estimates and grow its top and bottom lines.

eBay’s growth rates are expected to slow down moving forward. But with shares trading at around 16x forward earnings, it wouldn’t take huge growth to make shares an attractive long-term proposition. I’m betting on eBay to grow past its valuation. Here are a few reasons why:

New CEO Hits The Ground Running

Jamie Iannone, who became the CEO of eBay around four months ago, is not messing around.

He has identified areas of improvement for eBay including:

- eBay estimates that the average household in its major markets has around $4,000 worth of items to resell, but they’re only selling less than 20% of those items online.

- The company has started providing real-time competitive pricing and traffic data.

- Promoted listings revenue was $196 million in Q2, up 124% yoy. Iannone wants to double down on promoted listings, saying, “we continue to augment promoted listings' capabilities.”

eBay is Focusing on Its Core Business

Back in February, eBay finalized its deal to sell StubHub.

Five months later, it agreed to sell its Classified business to Adevinta for around $9.2 billion.

On the Q2 earnings call, Iannone offered some perspective on the deal:

“We are excited to bring together two highly complementary businesses in order to create the world's largest online classified group, with leading positions in 20 countries covering 1 billion people around the world. With a strong partner in Adevinta, this structure allows us to dedicate our day-to-day focus on marketplace-to-marketplaces. It provides immediate value for shareholders and allows us to participate in the future growth of Classifieds.”

New Users Will Likely Stick With eBay

In Q2, Marketplaces volume grew 29% yoy, eBay’s highest quarterly growth rate in 15 years. The company expects Marketplaces volume to grow in the high teens in Q3, with “gradual growth moderation” through the quarter.

Volumes growth will likely continue to slow into late 2020 and early 2021. And then in Q2 2021, eBay will face tough comps with Q2 2020. But growth might not slow as much as you think. Part of the reason is Iannone and his initiatives.

But the other is new user growth; eBay added around 8 million buyers in Q2, giving the platform 182 million annual active buyers. This 5% increase compares favorably with the 2% increase eBay recorded in each of the previous two quarters.

Habits are sticky – a lot of these new users are likely to stay with eBay long after the pandemic ends.

So even though eBay’s revenue was flat or down yoy for each of the previous five quarters, the combination of Iannone’s leadership and habits formed during the pandemic give the company a realistic chance at high single-digit or low double-digit revenue growth over the next few years.

And if eBay can also take advantage of the returned merchandise opportunity?

Lookout.

eBay Shares Are Basing

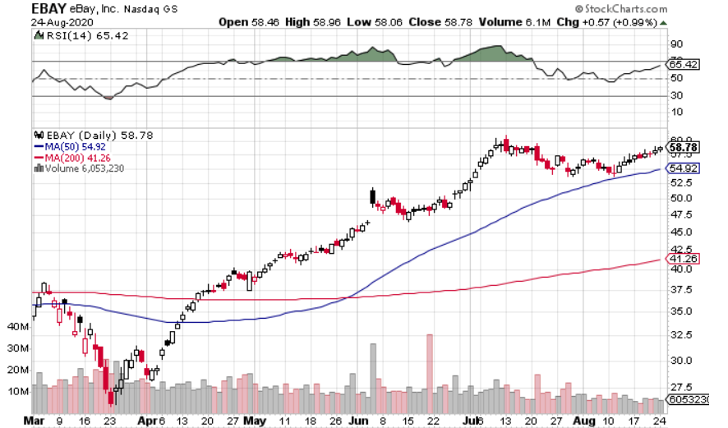

eBay shares plunged to around $25 in March, but soared to more than $60 a share by mid-July. Over the past six weeks, shares have taken a much-needed breather, basing between around $54 and $61.

Shares have started to climb to the top of the range and look primed for a breakout. Ideally, you would get a one or two week consolidation around $60, followed by a convincing breakout above $61.

eBay Has a High Floor and High Ceiling

Some investors are spooked by eBay’s sluggish pre-pandemic growth rates. But the company is taking tangible steps to position itself for long-term growth.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.