That Was Then, This Is Now

That Was Then, This Is Now

There’s been growing speculation that tech, and specifically software, are in a bubble. The biggest comparison is the mad run-up to all-time highs set in the 1999/2000 time period but I have to say, that was then and this is now. Then, the market was speculating on what the Internet and technology might become, now the market is rushing into those names that have proven their worth.

If nothing else, the COVID-19 pandemic has proven that technology works. I’ve said it before and I’ll say it again, the global shift to technology was already underway. The pandemic accelerates that shift at ALL levels. When you think about it, it takes three things to make the internet work and software is one of them. You have to have the infrastructure of technology, the cables, and networks, you have to have the hardware to connect, the computers laptops and mobile devices, and you have to have the software to make them do whatever it is you want them to do. To drive you need the car and the gas to make it go.

A Leader In Digital Entertainment

Digital entertainment is one of the biggest winners from the pandemic and Electronic Arts (NASDAQ: EA) results prove it. While folks have been shut in at home they’ve been turning to games and gaming as one of their pass-times. In terms of the business, Electronic Arts saw its revenue surge 87% from the prior year’s Q1 on rising demand across all platforms.

To put the company’s strength in perspective, the $1.39 billion in net-bookings exceeded consensus by $0.33 billion and the company’s own guidance by $0.39 billion or 40%. Thinking about this in terms of the full-year consensus, the full-year consensus is already too-low and likely to be increased very very soon.

On a segment basis, Apex: Legends was the highest performing title in the lineup. Apex: Legends saw its user engagement at the highest since the first season. Madden Football, another of the company’s top-selling brands, saw its user base grow 140% while FIFA soccer grew 100%.

“Player engagement through the first quarter was exceptionally high, and well above our forecast,” said COO and CFO Blake Jorgensen. “Our Stay Home, Play Together initiatives have been a strong tailwind for the business, as players look for safe and social entertainment in these difficult times.”

Looking forward, Electronic Arts has raised guidance to a range above the current consensus and I see no reason why it won’t be raised again. The COVID-19 pandemic is far from over and rising rates of infection are sending people back indoors. Guidance for the year is now $5.95 million net bookings versus the $5.63 consensus and EPS in the range of $2.97.

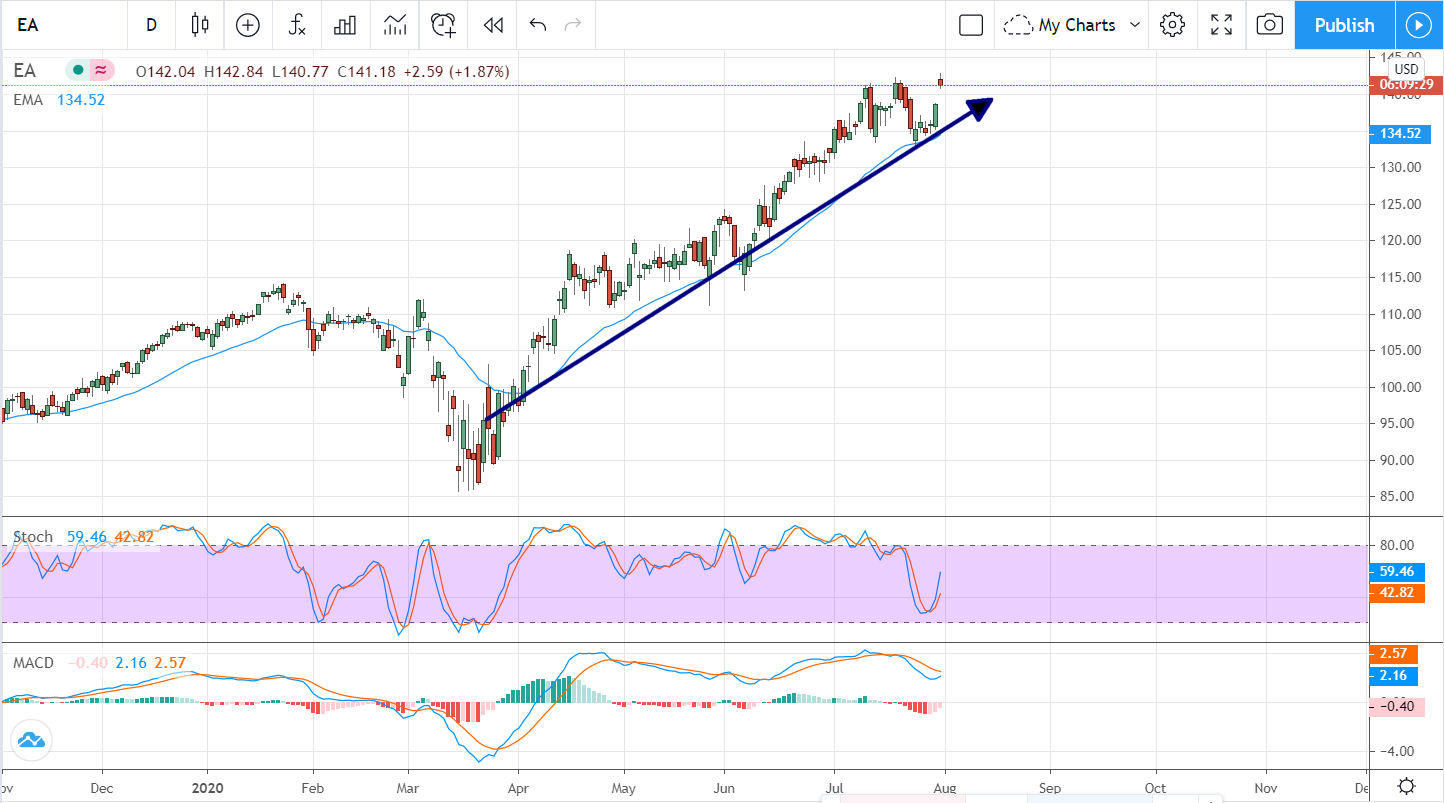

The Technical Outlook: Breaking Out To New Highs

Shares of Electronic Arts have been moving steadily higher since hitting their March lows. Like other perfectly positioned pandemic-plays, the rebound from the lows not only recouped the losses but went on to set new high after new high. Today’s news has the shares up again, about 2.2% in early action, and breaking out to yet another new high.

The indicators are lagging a bit, stochastic is firing a bullish crossover but MACD hasn’t, so there is reason to be cautious but the overall picture is bullish. Provided the stock can maintain a close above what should now be new support I see price action moving up to retest the all-time high near $150. If price action breaks above that level we could see this stock double.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.