Video game maker

Electronic Arts NYSE: EA stock has been in consolidation and starting to break the weekly trading range. The video game behemoth has continued to grow its digital online

gaming business during the

pandemic and continues to expand despite the return to normal

and back to the office trend accelerating with COVID vaccinations. More than 140 million players engaged with EA SPORTS games in the last year. Season 9 of Apex Legends has over 13 million weekly

active players. Business hasn’t slowed down however the shares are continuing to pull back. Digital gaming represents 58% of its full gaming units sold. The Company should also continue to gain with backup in

next-gen consoles like

PlayStation 5 NYSE: SONY, and

Xbox Series X NASDAQ: MSFT. Prudent investors can watch for opportunistic pullbacks in shares of Electronic Arts ahead of the holiday shopping season to gain exposure.

Q1 Fiscal 2022 Earnings Release

On Aug. 4, 2021, Electronic Arts released its fiscal first-quarter 2022 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) profits of $0.71 beating analyst estimates for $0.39, by $0.32. Revenues fell (-3.9%) year-over-year (YoY) to $1.34 billion beating $1.28 billion consensus analyst estimates. Net bookings for trailing 12 months was up 3% to $6.136 billion. “We’ve had a very strong start to the fiscal year with our incredible teams delivering experiences that continue to bring hundreds of millions of players together,” said Andrew Wilson, CEO of Electronic Arts. “Our new launches, leading games, and live services all had an outstanding quarter. With our expanding EA SPORTS portfolio, more amazing experiences in Apex Legends, the groundbreaking new Battlefield 2042, and our leading live services including mobile, we’re set to deliver more great games and content to players this year.” Electronic Arts COO and CFO Blake Jorgensen commented, “We delivered a big beat this quarter, primarily driven by outperformance from our recent launches coupled with continued strong execution in our live services. We’re looking forward to the launches of our sports titles this quarter and Battlefield 2042 in time for the holidays. Based on our strong performance this quarter and supported by our ongoing confidence in our live services, we are raising our outlook for the full year. Our strategic position has never been stronger, with growth drivers in place for this year, next year, and beyond.”

Raised Forward Guidance

Electronic Arts raised Q2 fiscal 2022 revenue guidance seeing GAAP EPS at $1.54, up from $1.34, but shy of $2.64 consensus analyst estimates. The Company sees fiscal 2022 net booking revenues at $7.4 billion, up from $7.3 billion, but shy of $7.44 billion consensus analyst estimates.

Conference Call Takeaways

CEO Wilson set the tone, “EA SPORTS continues to extend its leadership position through the global strength of our franchises and growing portfolio. More than 140 million players have engaged with our EA SPORTS games over the last 12 months. At the center of this, our FIFA franchise is growing around the world. Over 31 million players have joined FIFA 21 on console and PC since launch, and FIFA Ultimate Team continues to engage more soccer fans, which FUT matches up 48% year-over-year in Q1. In China, FIFA Online 4 set all-time records for monthly, weekly, and peak daily active players, driving new records for our business there. On a global basis, FIFA is growing as part of the social fabric of soccer, and we are connecting players through our games and live services on more platforms and more geographies than ever. We've also launched F1 2021, the first F1 experience to be part of our EA SPORTS portfolio in nearly 20 years. With an incredibly high-quality game that has won praise from fans and critics, F1 2021 is bringing fans into the excitement of the sport during one of the most memorable seasons in recent history. Sales were up significantly year-over-year, and total active players have grown by nearly 10% since launch over last year's game, demonstrating the power that comes from the amazing team at Codemasters, a great game, and our EA distribution and marketing strength. Momentum continues to build for F1, which like soccer is one of the few truly global sports, and we see a major opportunity to continue growing the franchise to reach a larger audience of players and viewers.”

He concluded, “Over the past year, we've expanded our mobile-native talent. And with their leadership, we are now growing these titles to reach new and broad audiences on a global scale. We're also delivering our blockbuster franchises to mobile players, including Apex Legends and Battlefield experiences rolling out for mobile later this year. With the ability to bring new teams together with EA's powerful IP, we are building mobile into a growth center for Electronic Arts with long-running live services at the core of our strategy. Underpinning these growth drivers are the fact that games, and particularly our portfolio experiences at Electronic Arts, are creating social connection for more and more people around the world. More than 0.5 billion players are coming together through the social networks formed in and around our games, and we see this continuing to grow. With some of the most talented teams in the industry, a deep pipeline of innovative experience in established and new IP, new content partnerships and more ways to connect and experience play, we are positioning our business for continued growth and leadership this year and beyond.

EA Opportunistic Pullback Levels

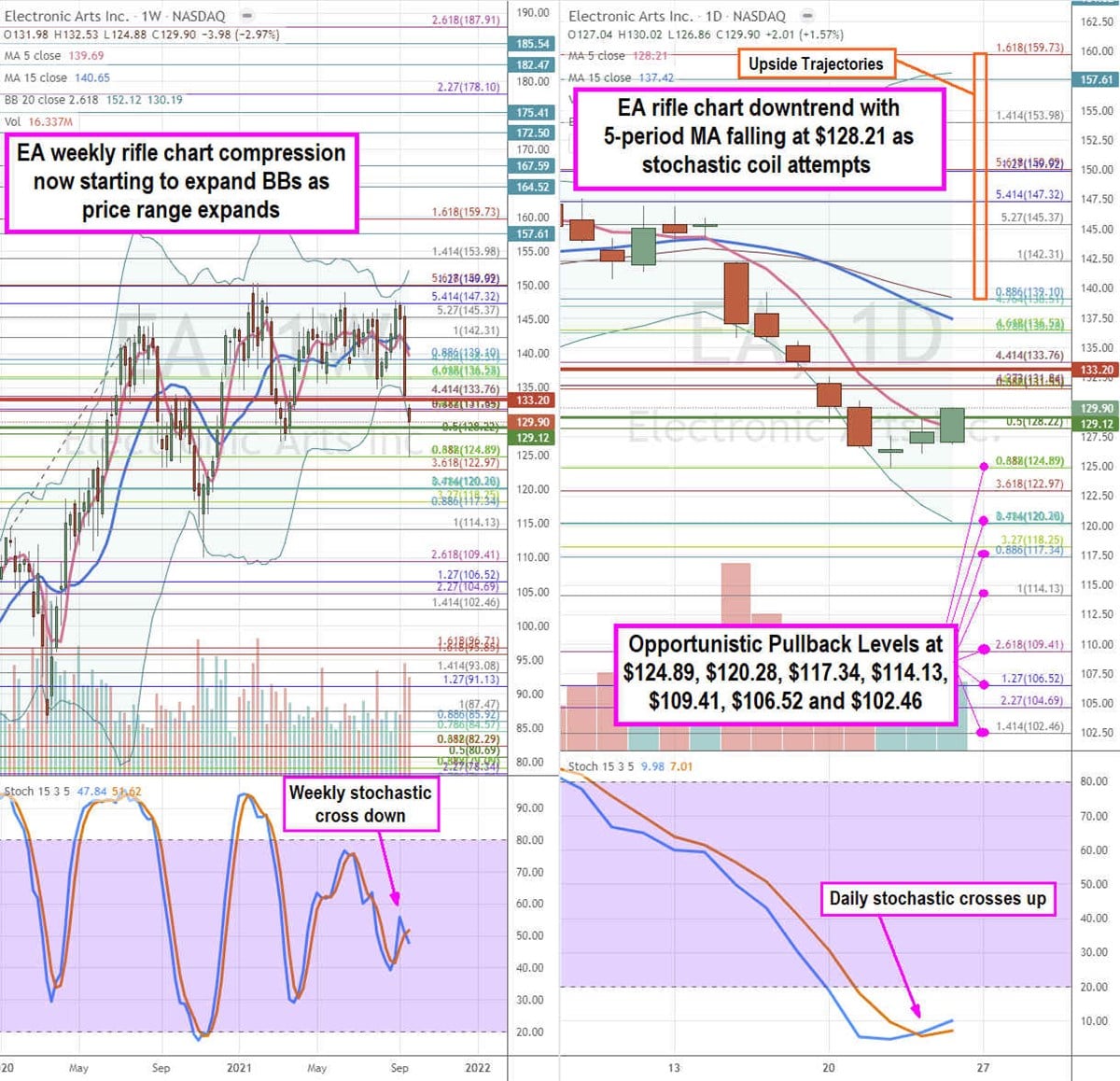

Using the rifle charts on the weekly and daily time frames provides a precision view of the playing field for EA shares. The weekly rifle chart has been in a price compression as illustrated by the inward slope of the upper and lower Bollinger Bands (BBs) for month. However, they are now starting to enter the expansion phase as they point outwards again indicating a price range expansion to come. The weekly 5-period and 15-period moving average (MAs) are nearly overlapped at $139.69 and $140.65, respectively. The $149.92 Fibonacci (fib) level has been a firm resistance as the weekly stochastic starts to cross back down. The weekly market structure high (MSH) sell triggered under $133.20 as it overshot the weekly lower BBs at $130.19. The daily rifle chart has a downtrend that is stalling with 5-period MA at $128.21 as shares attempt to trigger a market structure low (MSL) above $129.12. The daily stochastic crossed back up but needs to coil up through the 20-band to stage a channel tightening towards the daily 15-period MA at $137.42. Prudent investors can watch for opportunistic pullback levels at the $124.89 fib, $20.28 fib, $117.34 fib, $114.13 fib, $109.41 fib, $106.52 fib, and the $102.46 fib. The upside trajectories range from the $139.10 fib up towards the $159.73 fib level.

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.