Electrical wiring manufacturer

Emcore Wire Corporation NASDAQ: WIRE stock surged on its absolute blowout Q2 2021 earnings causing shares to violently reverse the downtrend and surge back up to all-time highs. The massive earnings blowout was largely due to rise in copper prices in addition to the demand surge from the reopening trend accelerated by

COVID vaccinations. The

housing boom and return to the office are tailwinds that supported the tremendous 193.5% year-over-year (YoY) growth in top-line sales. The Street severely underestimated the surge in demand as evidenced by the sharp reversal in share prices to the $88.05 peak after gapping up from the $71.42 close prior to its report. The Company's operations are running on all cylinders as the Company continues to capture market share in this growth environment. Further

tailwinds could come from the federal

infrastructure bill once passed. Prudent investors looking for a strong

reopening, construction, and infrastructure play can watch shares of Emcore Wire for opportunistic pullbacks.

Q2 FY 2021 Earnings Release

On July 27, 2021, Emcore Wire released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) profit of $8.82 excluding non-recurring items versus consensus analyst estimates for $1.38, a $7.44 beat. Revenues rose 193.5% YoY to $744.4 million trouncing analyst estimates for $456.52 million. Gross profits for H1 2021 was 30.4% compared to 14.8% for the year ago period. The average selling price for copper wire increased 82% per pound YoY. The Company generated $224.2 million in net income in H1 2021 compared to $31 million in H1 2020. The Company closed the quarter with $157.9 million cash on hand with no long term debt and revolving credit line paid down to zero. Emcore Wire CEO David Jones commented, ““The unprecedented results in the second quarter ended June 30, 2021 are grounded in the rich history and core values of the Company. Unbeatable customer service, nimble operations, and quick deliveries coast to coast. Our one-location, vertically integrated business model, strong management team, and deep raw material supplier relationships allowed us to remain fully operational while maintaining our high standard for fill rates to meet surging demand in the current environment. By continuing to meet this value premise to our customers, we were able to increase copper volumes sold over the first quarter of 2021. We believe we can sustain this volume growth, compared to prior period levels, for the remainder of 2021.”

Conference Call Takeaways

CEO Jones set the tone, “Copper unit volumes increased 33.4% on a comparative quarter basis and 15.1% on a sequential-quarter basis. COMEX copper prices experienced upward volatility throughout the second quarter, peaking in May before pulling back slightly to end the quarter. The upward volatility had a positive impact on spreads. Copper spreads increased 234% on a comparative quarter basis and 109.2% on a sequential-quarter basis. We believe Encore Wire remains well-positioned to capture additional market share and incremental growth in the current economic environment.” He concluded, “As we address the near-term challenges, we remain focused on the long-term opportunities for our business. We believe that our superior order fill rates and deep vertical integration continue to enhance our competitive position. As orders come in from electrical contractors, our distributors can continue to depend on us for quick deliveries from coast to coast.”

WIRE Opportunistic Pullback Levels

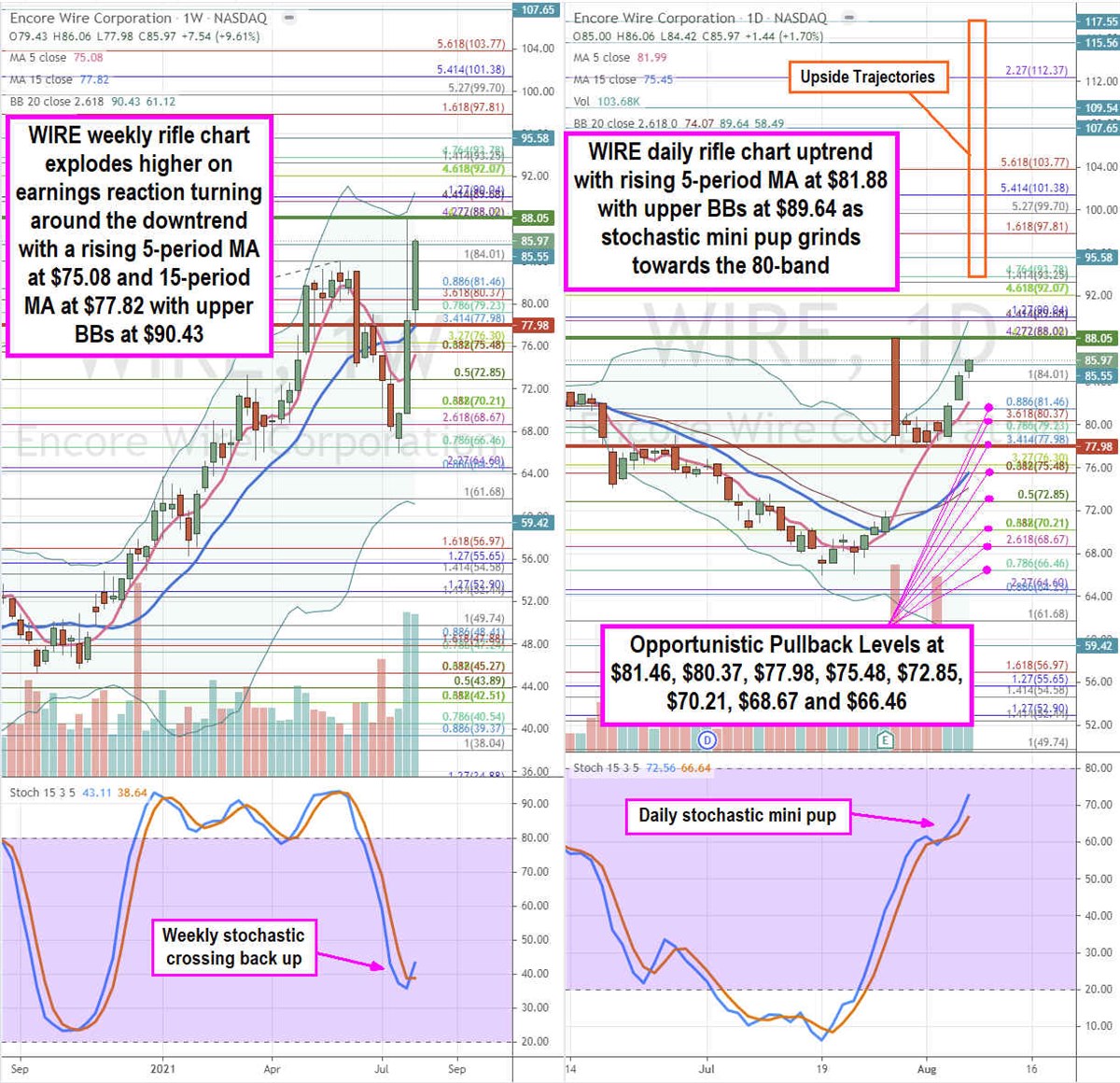

Using the rifle charts on the weekly and daily time frames provide a precision view of the price action playing field for WIRE stock. The weekly rifle chart exploded higher on earnings reaction as it peaked off the $88.02 Fibonacci (fib) level. Incidentally, weekly market structure low (MSL) triggers on a breakout through $88.05 with a weekly market structure high (MSH) sell trigger on a breakdown under $77.98. The weekly 5-period moving average (MA) support is sloping up at $75.08 as it attempts to cross the 15-period MA back up at $77.82 to form a breakout. The weekly stochastic crossed back up through the 40-band as it is recharged for another oscillation back up. The daily rifle chart has been uptrending with a rising 5-period MA at $81.99 and upper BBs at $89.64. The daily stochastic mini pup is rising towards the 80-band. Prudent investors can watch for opportunistic pullback levels at the $81.46 fib, $80.37 fib, $77.98 fib, $75.48 fib, $72.85 fib, $70.21 fib, $68.67, and the $66.46 fib. The upside trajectories range from the $93.25 fib up to the $117.55 price level.

Before you consider Encore Wire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Encore Wire wasn't on the list.

While Encore Wire currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.