EOG Resources Today

EOG

EOG Resources

$110.53 +2.29 (+2.12%) As of 04/17/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $102.52

▼

$138.18 - Dividend Yield

- 3.53%

- P/E Ratio

- 8.90

- Price Target

- $144.19

EOG Resources NYSE: EOG is a small, diversified energy play and a cash flow gusher on track to hit new all-time highs in 2025. Despite numerous headwinds, the company is ramping up production, improving operational quality, sustaining a robust cash flow and FCF growth, and delivering a robust capital return to its investors. The guidance for Q4 included expecting additional quality gains, ensuring the outlook for capital returns, and other catalysts are in play to drive the stock price in 2025. Analysts forecast the business will return to growth in 2025, and their estimates for the stock price are rising after hitting bottom earlier in the year.

EOG Resources: Boosts Capital Return with Dividends and Buybacks

EOG Resources' capital return includes dividends and repurchases. The latest updates are a 7% increase in the distribution and a $5 billion add-on to the repurchase authorization that is worth nearly 7% of the market cap with shares near $125.

EOG Resources Dividend Payments

- Dividend Yield

- 3.53%

- Annual Dividend

- $3.90

- Annualized 3-Year Dividend Growth

- 23.07%

- Dividend Payout Ratio

- 34.73%

- Next Dividend Payment

- Apr. 30

EOG Dividend HistoryCapital return in Q3 aligned with the target of 85% of free cash flow, which is solid and expected to remain so in Q4 and F2025. Despite the top-line contraction, the company’s Q3 FCF was flat compared to the prior year, resulting in a 25% FCF margin and sustained balance sheet health. The dividend is worth $3.90 annualized, or about 3%, and buybacks reduced the average quarterly count by more than 2%.

The only red flag is the company’s decision to increase its debt. However, the company’s balance sheet is a fortress; the increase in debt aligns with trends and historical debt loads and will boost available cash, ensuring the pace of capital return can continue. At the end of Q3, the balance sheet highlights include a net cash position and ultra-low leverage, about 0.15x equity, and less than 0.3x equity adjusted for the expected increase, which leaves the company in a healthy financial condition.

EOG Resources Boosts Cash Flow and FCF in Q3: Analysts Boost the Price Target

EOG Resources had a decent Q3 despite the 1% top-line contraction. The company is boosting production to offset lower realized prices and compounding production gains with margin improvement to drive strength on the bottom line. Other details include increased cash from operations, reduced spending, decreased debt, and increased cash and equivalents. Bottom-line results include a year-over-year contraction, but the $2.89 was $0.12 or 430 basis points better than expected. The guidance was also above consensus, with higher volume, volume growth, and lower costs than the prior forecast.

The analysts' response to the news is mixed, including one reiterated rating and a single downgrade, but the balance of data is bullish for the market. The reiterated rating includes an above-consensus price target, the downgrade includes a price target increase to above the consensus, and the four increased targets all point to a consensus or better stock price within the next 12 months. This is significant because the consensus is 13% above the price action in early December and a new all-time high when reached.

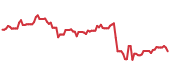

Institutions Cap Gains for EOG Resources in Q4

The risk to the stock price outlook is institutional activity. While institutional activity was bullish on balance for the first three quarters of the year, it turned bearish in Q4 and capped the stock price. EOG is moving sideways within a trading range and may be unable to move above it with this factor because the group owns about 90% of the stock. However, rising support within the range suggests the market is winding up for its next move, which is likely higher.

The critical support for EOG stock is near the 150-day EMA. It and the long-term-oriented buyers it represents have supported the stock’s price since 2021 and are unlikely to change. The likely scenario is that this market will retest support at that level, resulting in another bounce. The question is whether the bounce will gain traction and take the stock price back to the range top or higher or if the market will continue to move sideways within its range. If the institutions revert to buying on balance, a move to new highs is likely. The critical resistance targets are near $140 and $149.

Before you consider EOG Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EOG Resources wasn't on the list.

While EOG Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.