Expeditors International Is A Global Company With A Deep Moat

Expeditors International (NASDAQ:EXPD) is a global logistics company so it is no surprise it’s had a good year. Others in the business like United Parcel Service (NYSE:UPS), FedEx (NYSE:FDX), and J.B. Hunt (NASDAQ:JBHT) have all reported similar success attributed to rebounding economic activity and eCommerce. What is surprising is that shares are falling despite a robust 3Q report and an outlook for more of the same over the next year. The news has price action down nearly 2.0% and trading at a two-month low where it will either bounce or move lower. The question? Is Expeditors International a bust or a buy?

Expeditors International Blows Past The Consensus

Expeditors International had a great quarter no two-ways about it. The company reported $2.46 billion in top-line revenue to beat the consensus by 2.9%. Beating consensus is good enough on its own but it is compounded by strong year-over-year growth as well. On a YOY basis, revenue is up 19% despite a 5% decline in both airfreight and ocean-container volume. The decline in volumes was offset by strong pricing that was reinforced by high demand and pandemically constrained capacity.

“The effects of COVID-19 continued to impact volumes for all products, although not as significantly as in the prior sequential quarter. While we have experienced increased demand in many of our markets for a mix of products, capacity constraints in air, and to a lesser extent in ocean, have led to a continued buy/sell rate imbalance,” said Bradley S. Powell, Senior Vice President, and Chief Financial Officer.

Moving down the report the company’s income increased in tandem with the jump in revenue. Operating income increased by 22% to drive GAAP EPS of $1.12. GAAP EPS beat the consensus of $0.13 and helped improve what was already the most unencumbered balance sheet I have ever seen. This company carries virtually no debt and is sitting on a large cash position. The company’s debt-to-equity is running near 20% and long-term-debt-to-capital about 14% leaving free-cash-flow unrestricted. Over the past year, cash and cash equivalents have increased 19% and that trend should continue into the coming year.

“While we remain uncertain about the pace, strength, or evenness of an economic recovery, we will continue to use our strong financial position to make important strategic investments that are necessary for our future growth, while continuing our focus on controlling costs and improving operational efficiencies,” Mr. Powell added.

Count On Expeditors Dividend If Nothing Else

Expeditors International has one of those dividends you can really count on. Not only is the balance sheet, earnings, and cash flow sufficient to support the already modest 1.20% yield but there is also an expectation of future increases. The company has been increasing the yield for 23 years and is almost a Dividend Aristocrat which is not something that management will give up easily. Based on the 10% CAGR the next increase should be substantial as well but there is more. Unlike most dividend-growers, this company is not increasing its distribution annually but biannually which makes it all the more attractive.

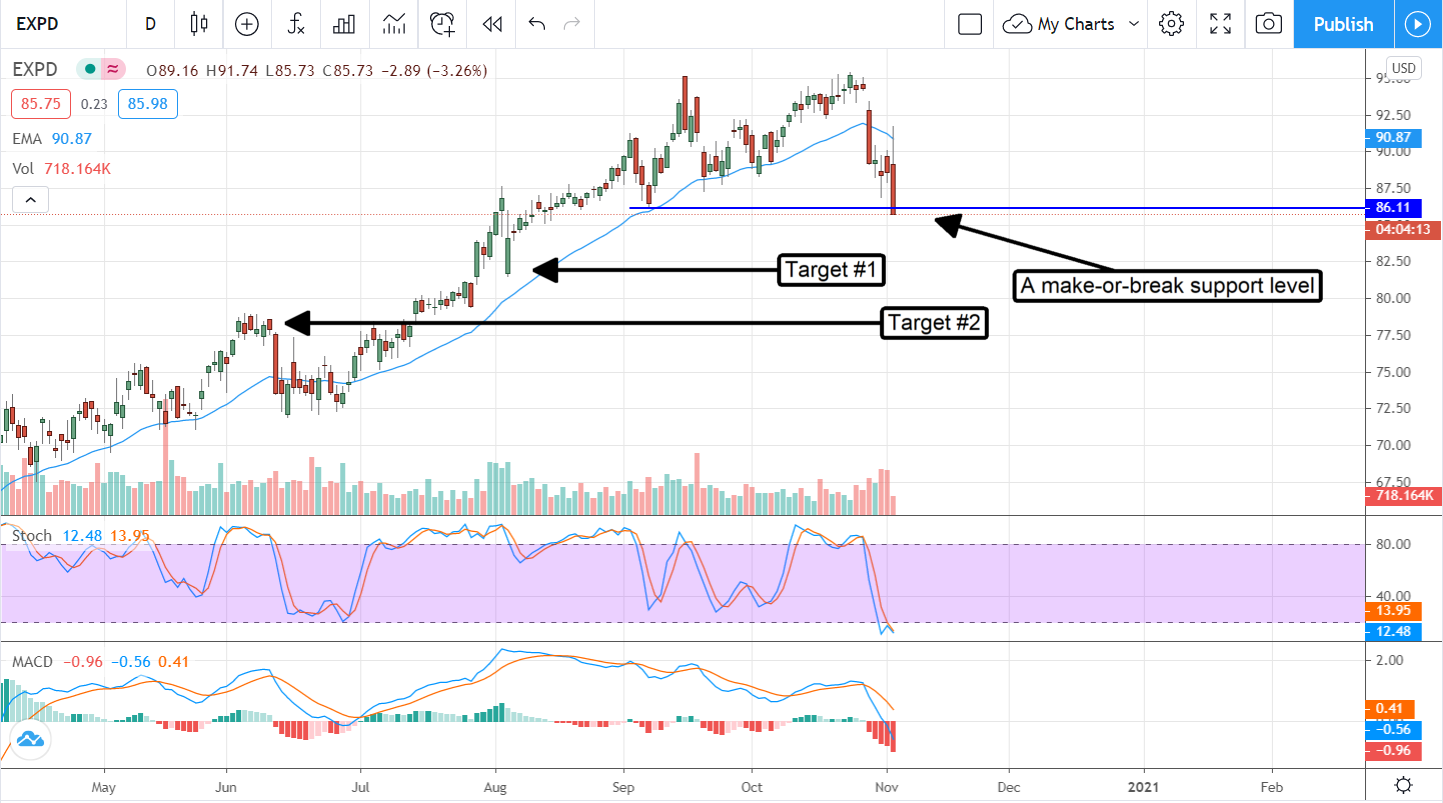

The Technical Outlook: A Downtrend Confirmed, Maybe

The price action sparked by the 3Q report is not bullish by any means but it may not be as bad as it looks. The candle formed is large and red, it confirms resistance at the short-term EMA, and it is accompanied by weakening indicators but there is a catch. Today’s action has prices right down at a potentially strong support line where buyers may be lurking.

To answer the question is Expeditors International a bust or a buy we need to see more. The fundamental business is great, the outlook steady, and the dividend growing so I am leaning toward buy. The risk is in the market, does the market think the same way I do or not and the way to know that is in the price action. If support kicks in at this level the market agrees with me. In that scenario I see EXPD moving up within its new range for the foreseeable future. If not then this stock is going to offer a deeper value, possibly as much as $10 more.

Before you consider Expeditors International of Washington, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Expeditors International of Washington wasn't on the list.

While Expeditors International of Washington currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.