FedEx Today

$215.74 +4.70 (+2.23%) As of 03:59 PM Eastern

- 52-Week Range

- $194.30

▼

$313.84 - Dividend Yield

- 2.56%

- P/E Ratio

- 13.75

- Price Target

- $297.71

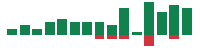

FedEx’s NYSE: FDX focus on efficiency in the face of troubled operating conditions is why this stock can set a fresh high this year. The fiscal Q4 results delivered exactly what the market wanted and more, suggesting momentum is building and guidance is cautious. Takeaways from the report include a pivot back to growth, wider margins, and an expectation for continued improvement this year. Ultimately, the story driving this stock is rapidly improving leverage, setting it up for a leveraged earnings recovery as the year progresses. The company’s DRIVE program delivers results sooner than expected and promises to keep the cash flowing and capital return growing.

FedEx Rockets Higher on Tepid Results

FedEx’s revenue result is not robust, barely outpacing the analyst's consensus, but it is growing, outpacing the consensus, and the guidance is favorable. The company reported $22.1 billion in net revenue for a gain of 0.9% over last year, beating consensus by 20 basis points. The critical detail is that revenue growth is due to volume growth in the core segment, reversing trends seen in F2024. Segmentally, volume growth in the Ground segment was offset by weaknesses in Freight and Express; all three segments contributed to margin improvement.

FedEx MarketRank™ Stock Analysis

- Overall MarketRank™

- 94th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 38.0% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Moderate

- Environmental Score

- -5.81

- News Sentiment

- 1.23

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 13.11%

See Full AnalysisThe margin news is what has the analysts gushing. The company’s DRIVE program resulted in lower operating costs across segments and accelerated bottom-line growth. The GAAP earnings are down YoY due to one-offs and non-cash impairments; the adjusted earnings of $5.41 are up 9.5% compared to the 0.9% top-line advance and beat the MarketBeat.com consensus estimate by a nickel.

Guidance is good and cautious. The company is guiding for low- to mid-single-digit revenue growth and for continued margin expansion. Revenue guidance may be on the mark, but earnings are where guidance may be cautious.

Earnings may be cautious because of plans to continue maximizing profitability, including closing seven freight centers and optimizing the air fleet. Freight center closures are intended to realign capacity with freight demand and significantly improve the segment margin. Capex is another reason why the guidance may be cautious because of planned investments in modernization, technology, and efficiency.

Analysts Lead FedEx Stock to a Fresh High

The analysts' response to FedEx’s news is among the catalysts for higher share prices. The handful of analysts who issued revisions and updates the day after the release includes several upgrades and numerous price target increases. The single naysayer is Morgan Stanley, who cautioned that the surge in price action was due to short covering. However, Morgan Stanley also raised its price target, and short interest is low, so any lift associated with that is minimal.

The highlights from the analysts’ chatter are that the DRIVE program delivers results faster than expected, and momentum is building. The company’s new CEO, Raj Subramaniam, is credited for the improvement and is giving FedEx a new identity, focused on profitable growth without relying on macroeconomic conditions to provide leverage. Regarding macroeconomic conditions, the longer-term outlook is for FedEx to sustain mid-single-digit growth in F2026 and margin improvement.

The consensus rating for FedEx is a moderate buy with a price target near $308 or about 8% above the post-release price action. A move to the consensus is likely because the latest revisions lead to the range's high end. A move to the range's high end is worth another 10% to investors and would be a new all-time high when reached. A move to the range’s high end may come sooner rather than later because of the capital return guidance. UPS plans to increase its dividend by 10% this year and to repurchase $2.5 billion shares by year’s end, $1 billion in Q1. $2.5 billion is worth about 4% of the pre-release market cap.

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for May 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.