$265.56 -1.57 (-0.59%) (As of 10:16 AM ET)

- 52-Week Range

- $224.69

▼

$313.84 - Dividend Yield

- 2.08%

- P/E Ratio

- 15.41

- Price Target

- $314.74

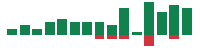

Despite rallying for the entire week leading up to last Thursday’s earnings report, shares of FedEx Corporation NYSE: FDX delivered a major disappointment. The 15% they’ve shed from their pre-earnings high should tell its own story, as it was one of the worst days in the stock’s recent history.

FedEx missed analyst expectations for both headline numbers, which is never good. Earnings came in 24% lighter than the consensus, and revenue not only landed light but also was down year-over-year. In addition, the company’s forward guidance was light, with management lowering its expected revenue growth rate to a “low single-digit percentage rate,” having previously guided for it to be a low-to-mid single-digit percentage increase.

Despite Weak Outlook, FedEx Stock Shows Resilience in the Market

This only compounded matters, as it’s one thing to deliver a bad earnings report for the quarter just gone. Still, offering weaker-than-expected forward guidance for future quarters is considered nearly worse. Understandably, then, in that context, FedEx shares gapped down last Friday, but an interesting thing happened yesterday: They fell no further. FedEx shares closed up on the day, suggesting the market has already digested last week’s report and decided it might not be as bad as first thought.

Usually, when a company delivers that kind of update, it leads to multiple red days, especially if, as in the case of FedEx, it had been enjoying nearly two years of a rally up to that point. Even the eight green days leading up to last week’s report suggested that investors were expecting a blowout report, hence the expectation that there’d be a run of red days in response to the massive disappointment.

Bullish Analysts Back FedEx Shares Despite Recent Dip

- Overall MarketRank™

- 4.94 out of 5

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 17.9% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Moderate

- Environmental Score

- -5.78

- News Sentiment

- -0.19

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 15.16%

See Full AnalysisHowever, the fact that the buyers outweighed the sellers during Monday’s session after having the weekend to think it over is powerful. Supporting the theory that this could be a serious entry opportunity is the fact that several of the heavyweight analysts have already been vocal in their support of FedEx shares. A handful, like Robert W. Baird and TD Cowen, reiterated their Outperform and Buy ratings while reducing their price targets. But some, like Bernstein Bank, reiterated their Overweight rating and went so far as to boost their price target on FedEx shares.

Considering FedEx shares closed below $260 on Monday evening, some of the analysts' targeted upside here is seriously tempting. Take Bernstein Bank’s boosted price target of $337 or JPMorgan Chase & Co.’s $350. These are pointing to potential gains of around 35% in the coming weeks, which would not only make for a stunning comeback in FedEx shares but also have the company back trading at an all-time high.

FedEx’s RSI Suggests Quick Rebound With Upside Potential

Even though FedEx missed badly while offering weaker-than-expected forward guidance, much of the downsize was priced into the stock by the time the bell rang to end Friday’s session. As JPMorgan analyst Brian Ossenbeck wrote in a note to clients, last week’s “significant miss” was a reminder that parts of the business are particularly sensitive to any drop in demand. However, he and his team still expect FedEx to eventually spin off its underperforming freight operation, which means there’s a ton of upside that last week’s dip has only increased.

It doesn't get much better for investors with a risk appetite and who love a bargain. From a technical perspective, FedEx’s shares are extremely oversold, as shown by the stock’s relative strength index (RSI). The RSI is a popular technical indicator that looks at a stock’s recent trading history and spits out a number between 0-100. Anything at or above 70 suggests the stock is considered extremely overbought, while the opposite is true when it’s at or below 30.

FedEx’s RSI dipped below 30 last week and was still there yesterday. If its shares can continue to consolidate above $255 this week, the comeback rally the analysts are calling for could happen very quickly.

Before you consider FedEx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FedEx wasn't on the list.

While FedEx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.