First Solar Today

$141.86 +5.42 (+3.97%) As of 04/25/2025 04:00 PM Eastern

- 52-Week Range

- $116.56

▼

$306.77 - P/E Ratio

- 12.22

- Price Target

- $249.96

First Solar's NASDAQ: FSLR stock price was corrected to lower levels in early summer because of mounting concerns centered on political risk, but its operational quality continues to shine. The upcoming election threatens the solar market in several ways but nothing to offset the growing demand for solar power generation and the secular tailwind that has begun to blow. That tailwind is derived from the inflation data and outlook for interest rates expected to fall soon. The takeaway is that easing economic conditions will help boost demand for an in-demand product and drive results for this profitable business.

First Solar Has a Robust Quarter, but Bookings Slow

First Solar had a solid quarter, with demand driven by the data center segment. Data centers are turning to solar power generation to help offset the enormous cost of powering AI. The company reported $1 billion in net revenue, outpacing the consensus estimate by 60 basis points as growth surged 23% YoY and 25% sequentially. The gains were made on increased volume, compounded by higher realized prices, which leveraged strength on the bottom line.

First Solar MarketRank™ Stock Analysis

- Overall MarketRank™

- 99th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 76.2% Upside

- Short Interest Level

- Bearish

- Dividend Strength

- N/A

- Environmental Score

- -0.14

- News Sentiment

- 0.86

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 56.09%

See Full AnalysisThe margin news is impressive and includes improved gross margin and operating costs. The gross margin improved by 1000 basis points, compounded by reduced costs. The net result is that operating and net income more than doubled, driving a 75% increase in GAAP earnings. The GAAP earnings were impacted by mild dilution, with the diluted share count up about 20 bps compared to last year. Dilution is related to share-based compensation and is not a red flag for investors today.

Among the attractions of a First Solar investment are its profitability, cash flow, and financial strength. The company had a cash flow-negative quarter. However, one-offs, including start-up costs at new facilities and the repayment of short-term operating capital loans in India, offset that detail. The salient details include a net cash position of $1.2 billion, low leverage, and an 8.4% increase in shareholder equity. Regarding leverage, the company’s total liabilities are about 0.5x equity and long-term debt about 0.05x equity, leaving it in a robust position to reinvest in the business as needed, and capital return is a growing possibility.

Among the hurdles for First Solar’s stock price is bookings. Booking growth slowed in Q2, attributed to political uncertainty and economic conditions, leaving the backlog down 2.4 GW sequentially or 3%. The 3% contraction is not large but sufficient to offset quarterly strength, leading management to reiterate guidance despite those strengths.

Analysts Look Past Elections to First Solar’s Bright Future

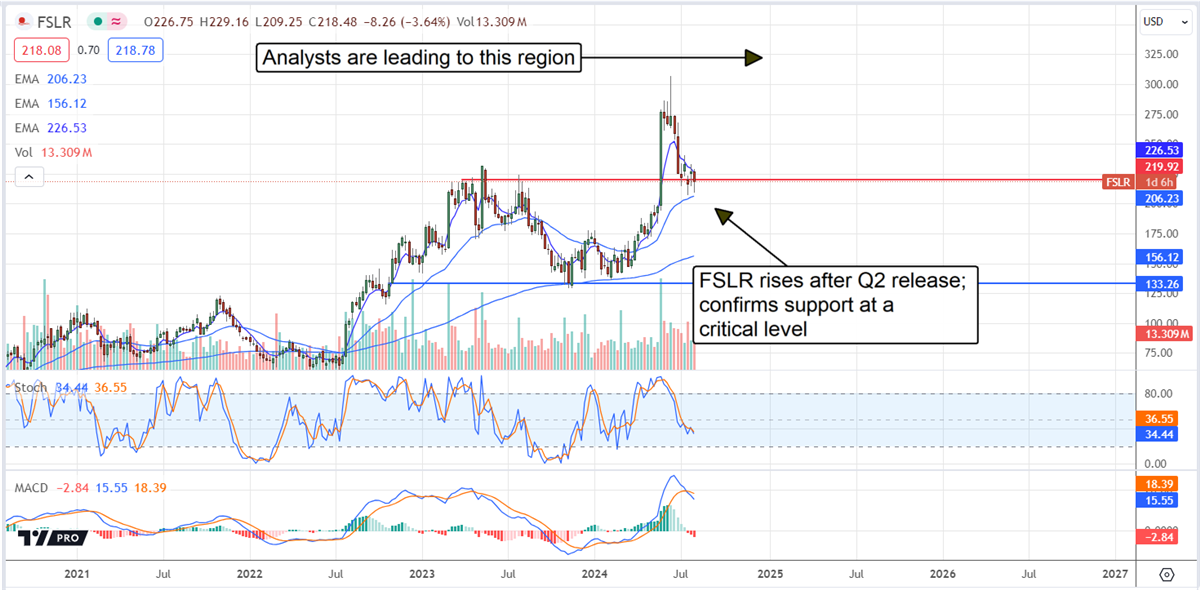

The analysts' response to the Q2 results is positive, including numerous upward price target revisions. The talk on the street is that bookings slowdown and policy risk are a concern but offset by secular growth drivers, including data center demand and pricing power. Potential catalysts for outperformance and higher share prices include technological advances and increased efficiency for First Solar’s industry-leading products. The takeaway is that analysts' revisions are leading to a range above the consensus target, implying at least a 30% upside and the probability new highs will be set. The $273 consensus target aligns with the current all-time high, but the freshest targets range from $300 to $350, well above it.

First Solar’s stock price is rising following the Q2 release and showing support at a critical level. That level aligns with the 2023 highs broken earlier this year. The pullback to $220 and show of support at that level confirms the breakout, setting the market up to continue the rally. The next price movement is likely upward and may reach $250 to $275 before the next quarterly release. If the company continues showing strength, new highs are likely before the end of the year.

Before you consider First Solar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Solar wasn't on the list.

While First Solar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.