Athletic footwear and apparel retailer

Foot Locker NYSE: FL stock has fallen despite blowout earnings and raised guidance.

Consumer demand remains strong despite

supply chain disruptions and rising inflation. The Company blew out its recent Q3 2021 earnings by $0.53 per share while revenues only grew 4% annually. The Company’s FLX loyalty memberships grew to 28 million members in Q3 as it continues to grow its digital footprint and

e-commerce sales. The Company operates brands including Foot Lock, Kids Foot Locker, Champs, Eastboy, Sidestep, Atmos, and WSS. While footwear sales

demand slipped,

apparel and accessories offset the pullbacks. Prudent investors seeking exposure in the retail footwear segment can watch for opportunistic pullbacks in shares of Footlocker.

Fiscal Q3 2021 Earnings Release

On Nov. 19, 2021, Footlocker released its fiscal third-quarter 2021 results for the quarter ended October 2021. The Company reported diluted earnings-per-share (EPS) profit of $1.93, beating consensus analyst estimates for $1.37 by $0.56. Revenues grew 3.9% year-over-year (YOY) to $2.19 billion, beating of analyst estimates for $2.14 billion. Comparable store sales rose 2.2% YoY. Footlocker CEO Richard Johnson commented, “The third quarter was another period of strong performance for our Company that reflects the powerful connectivity we have built with our customers. These impressive top and bottom-line results were against a robust back-to-school season from last year and in spite of the ongoing supply chain challenges. On top of that, we successfully completed the acquisition of WSS in the third quarter, and subsequently closed the atmos transaction as well, welcoming both of these great teams to the Foot Locker, Inc. family. The combination of robust demand and fresh inventory, coupled with more full-priced selling, led to gross margin expansion of 380 basis points to 34.7%, from the 30.9% in the prior year period," added Andrew Page, Executive Vice President and Chief Financial Officer. "In addition, we bolstered our already strong balance sheet with the issuance of $400 million of Senior Notes due in 2029, the Company's new credit benchmark and its first offering in over 20 years."

Upside Full-Year Guidance

Footlocker raised its full-year 2022 EPS guidance between $7.53 to $7.50, up from $7.00 to $7.15 previous guidance, versus $7.01 consensus analyst estimates. The Company sees revenue growth in the low tends.

Conference Call Takeaways

CEO Johnson set the tone, “Whether it's home fitness, running, training, hiking, or any number of other sport fitness categories, we see consumers are turning to and returning to Foot Locker to meet their fitness needs. And we see this trend increasing. And third is the overall athleisure trend and further casualization of society. Some of this is aided by the continued work-from-home environment, some of it by the new return-to-work hybrid model, but overall, people want to be more comfortable. And that certainly plays into our strengths, especially around footwear, but also in our apparel business, which has been performing extremely well this year. All of this to say, consumer demand remains strong, driven by megatrends in consumer adoption in demand that favors the brands in the categories we sell. Spending continues to be fueled by people wanting to look good as they venture out again. In terms of the global supply chain, we're all aware of the challenges. It's a fluid situation that we are making every effort to manage. And we do have a few advantages. First, we are truly multi-branded retailer with a diversified product mix, serving a broad range of consumer needs across price points. We like our position in terms of our assortment of brands, and we benefit from the very strong partnerships we have built with them over many decades. In times like these, our partnerships are mutually beneficial, enabling us to look together as far into the future as possible, to plan, collaborate, and be solution-oriented. Second, carrier capacity is something we always keep a close eye on. We are much better position this year than in the past with FedEx, UPS, and our pool carriers and with the US Postal Service as another alternative. We've got better visibility than we've ever had on where their hotspots are, so we can manage customer expectations appropriately. Third, we feel good about our distribution center staffing and capacity levels.”

He concluded, “Overall, our financial position remains strong. Our vendor relationships are very strategic in nature, and we continue to obsess around our customers, whether it's through our digital channels, social media, FLX, or an in-store customer experience. Our solid Q3 performance is why we remain optimistic about the strength of our portfolio, the power of our assortments, and the loyalty of our customers. We are confident that this positive momentum will continue into 2022 and beyond.”

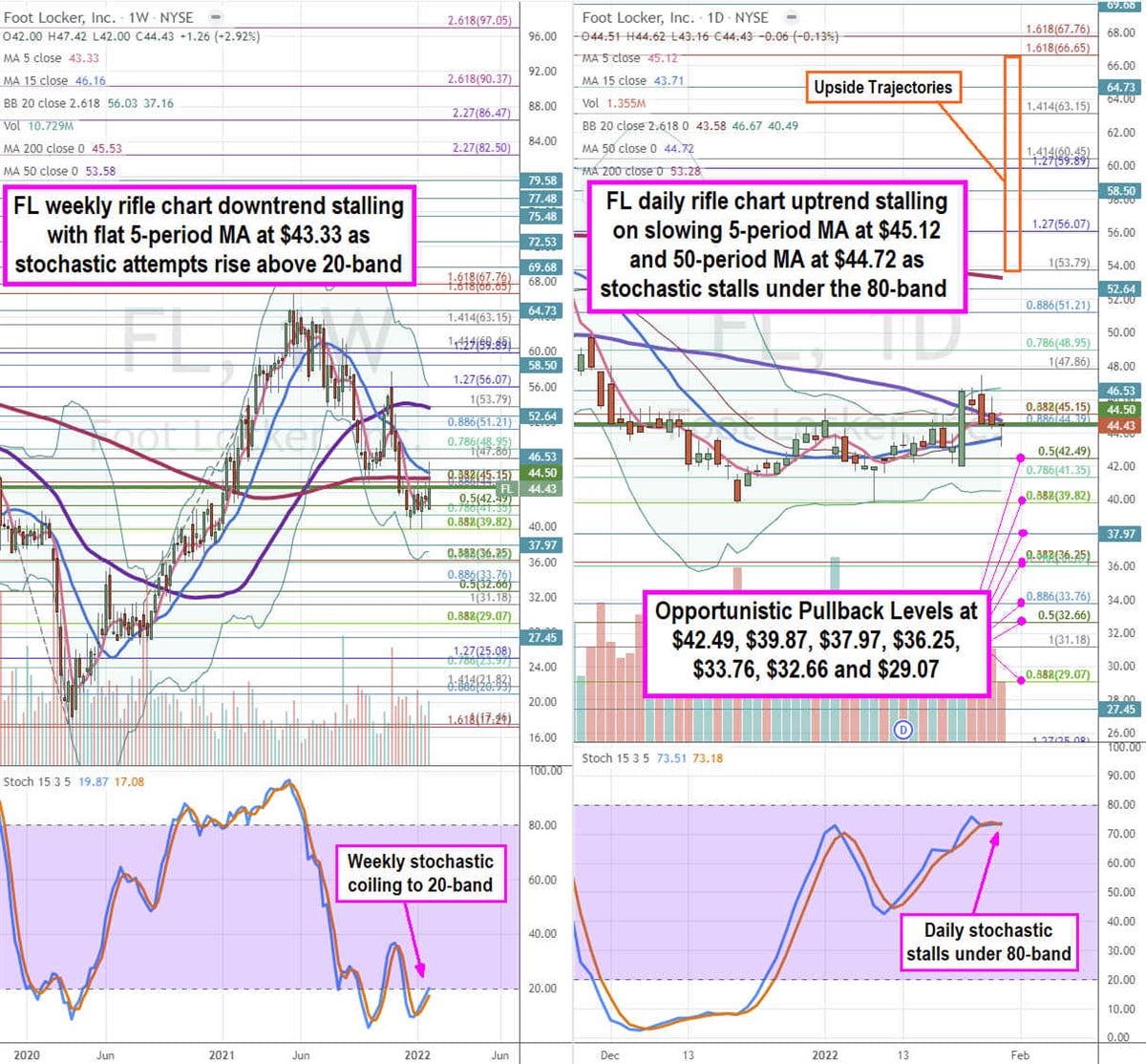

FL Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for FL stock. The weekly rifle chart peaked as the $66.65 Fibonacci (fib) level before plunging to the $39.82 fib before coiling back up. The weekly rifle chart downtrend is stalling with a flat 5-period moving average (MA) at $43.33 with the 200-period MA at $45.53 and 15-period MA at $46.16. The weekly stochastic is attempting to bounce through the 20-band. The weekly market structure low (MSL) buy triggers above $44.43. The daily rifle chart has been uptrending until it rejected off the 50-period MA at $44.72 sliding under the flattening 5-period MA at $45.12. This caused the daily stochastic to stall at the 74-band. The rising 15-period is at $43.71. Prudent investors can watch for opportunistic pullback levels at the $42.49 fib, $39.87 fib, $37.97 fib, $36.25 fib, $33.76 fib, $32.66 fib, and the $29.07 fib level. Upside trajectories range from the $53.79 fib up towards the $66.65 fib level.

Before you consider Foot Locker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Foot Locker wasn't on the list.

While Foot Locker currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report