With

shares of Tesla (NASDAQ: TSLA) on a tear to new all-time highs this week and numerous headlines breaking about how they now have

a bigger market cap than Ford (NYSE: F) ever did, investors of the latter could have done with a good earnings report. Unfortunately, their Q4 earnings which were released after Tuesday’s session did not deliver.

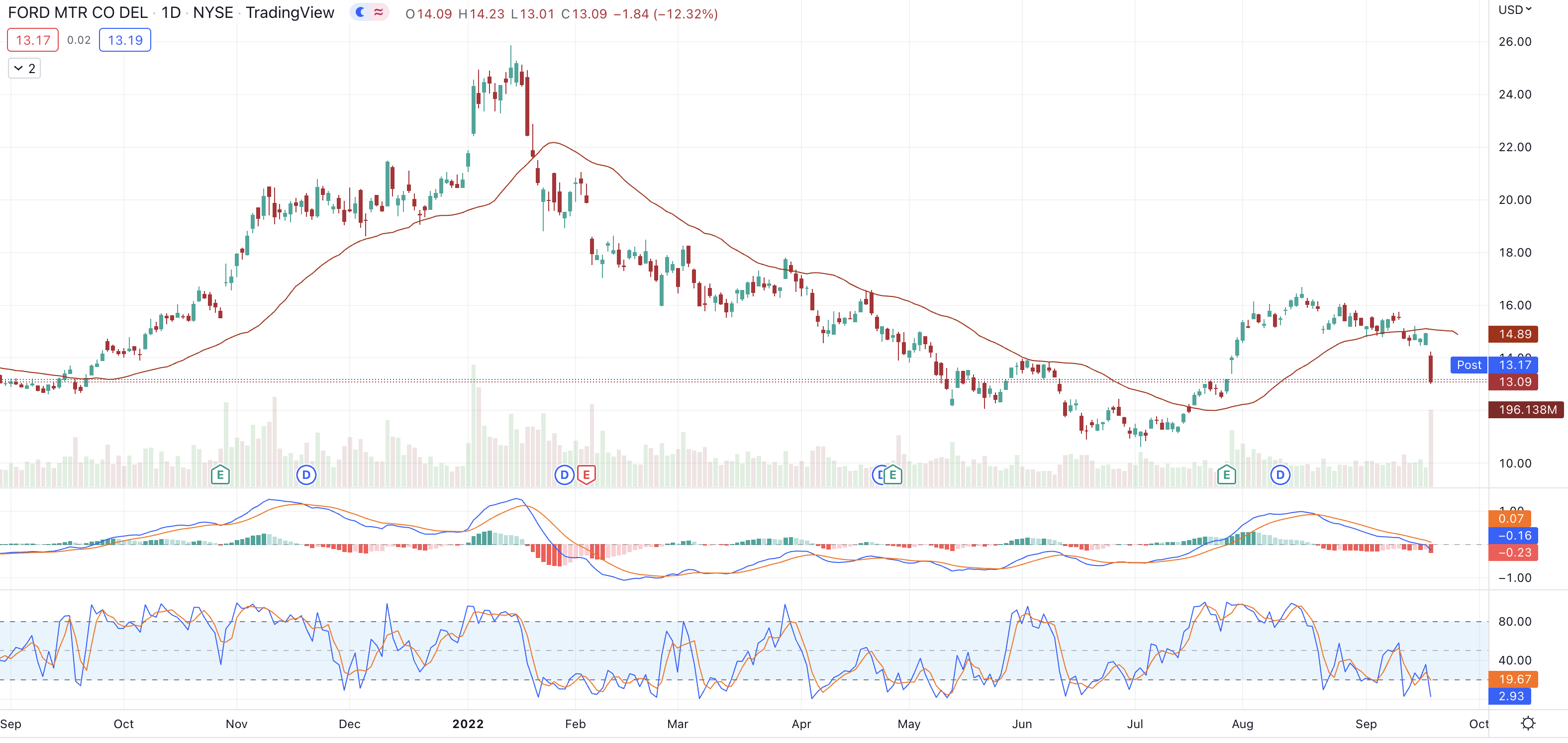

A dirty miss on analyst expectations for both EPS and revenue sent shares tumbling down almost 10% during early trading on Wednesday. GAAP EPS was far deeper in the red than expected while revenue growth showed a contraction of over 5% year on year. On top of this, EBIT for 2020 also came in below expectations. Wednesday’s spiral downwards only adds to the downtrend that shares have been fighting over 5 years and puts them close to decade lows. They’re down a full 54% from 2014’s high and are down close to 80% from all-time highs set back in 1999 and the automotive industry has certainly changed night and day since then.

For example, Ford, Chrysler (NYSE: FCAU) and GM (NYSE: GM) were all bailed out by the US government in the aftermath of the 2008 crash. Whilst performance-wise at least Ford’s shares were able to gather some momentum in the first couple of years after it, they’ve slowly but surely been giving up that ground since. And it’s hard to see them turning it around from here based on recent news plus reports. Consumer demand is dipping industry-wide and there’s strong momentum gathering in the electric car space.

Uphill Battles

Even before this week’s earnings release, Ford was fighting an uphill battle to remain competitive. A sales update from early January showed Ford brand sales were down over 2% while the likes of Lincoln were up 17%. Their truck sales might have grown by 16% but this was easily offset by a 4% fall in SUV sales and an eye-watering 41% fall in car sales. Their China sales numbers plunged 26% in 2019, making it the third year in a row that they’ve taken a roasting while their German and Japanese competitors have gained market share. Industry-wise, auto sales are expected to contract in 2020 which doesn’t bode well for Ford which is already at the back of the pack.

Out of all the big name, US-listed auto-makers, it’s the clear laggard. Since last July, its shares are down 18% compared to GM who are down 10%, Fiat Chrysler who are down 4% and Honda who are about flat. In the past three years, Ford’s stock is down 34%, Honda are down 16%, GM down 7% while Fiat Chrysler are up 19%. Going back to 2010, Ford have been at the bottom of the pack for the vast majority of the time.

Bleak Days Ahead

Even as it looks ahead to launching its all-electric Mustang Mach-E car later this year, they’re really only hoping to hang onto the tails of Tesla who have stormed into the electric car market in recent years and firmly made it their own. It’s almost unfair to compare Ford’s stock to Tesla’s but even for 2020 so far, the former is down 10% while the latter is up 60%.

2018’s low around the $7.50 mark is the next major level of support and things could get really ugly for Ford if that doesn’t hold. Considering the traditional automotive industry as a whole is under pressure due to falling consumer demand and that Ford is clearly lagging its peers, the future does not look too bright for this once giant name in the business.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.