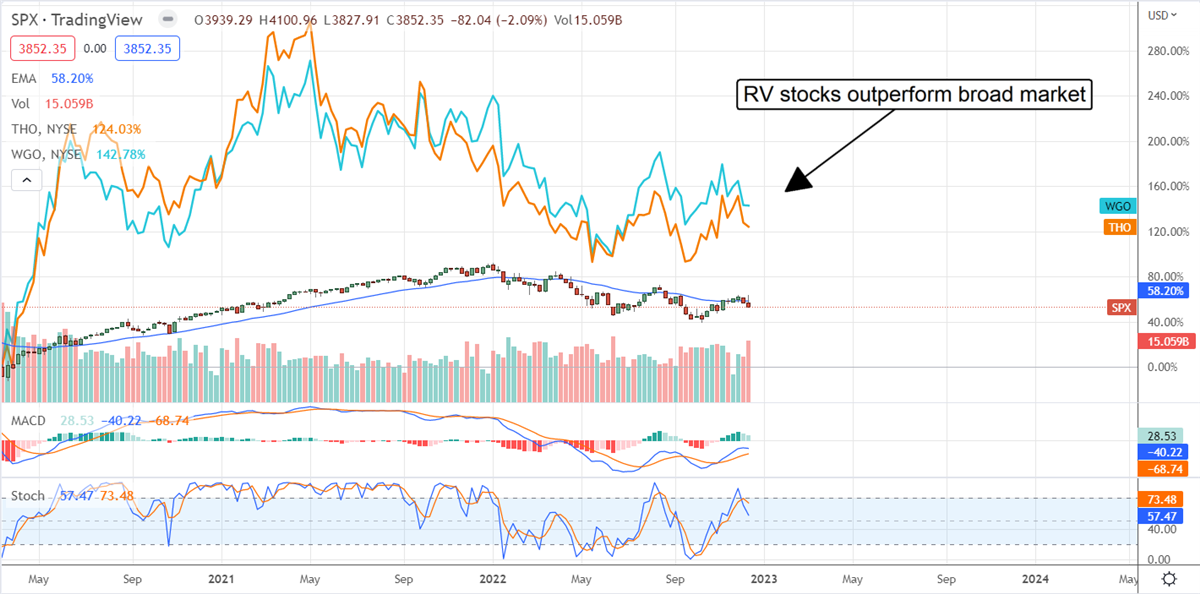

The RV industry may not seem like the best choice for inflation-weary investors. Still, the story within the industry is one of sustained profitability, normalization, and dividends more than anything else. While the slowdown in RV business related to the pandemic-induced spike in demand is the focus of many, this news is so well-priced into the market that it no longer matters.

Instead, what matters now is that these highly undervalued dividend-paying stocks are trading at deep values and paying market-beating yields with distributions expected to grow in 2023.

Winnebago And Thor Industries Cautious For 2023

Both Winnebago NYSE: WGO and Thor Industries NYSE: THO reported substantial calendar Q3 periods while also issuing cautious guidance for the coming year. The good news is that backlogs reached record proportions in 2021 and are sustaining a business while demand is slowing.

In addition, demand remains at “normalized” pre-pandemic levels, which means a soft landing is possible for this industry. In the case of Winnebago, its diversified model is also aiding the business. The company has successfully built out its marine division and grabbed market share.

These stocks are among the lowest yielding in the RV industry regarding dividends and capital returns, yet both pay above the broad market average. Winnebago yields about 1.95%, with shares trading beard the bottom of a long-term trading range and above critical support, while Thor is the higher-yielding stock at 2.25%. In addition, both come with a degree of safety and an outlook for growth with payout ratios below 10% and balance sheets in healthy condition.

LCI Industries Provided Better Value and Yield

LCI Industries NYSE: LCII is among the best-positioned RV stocks with its exposure to OEM and aftermarkets and adjacent industries such as boating and general automotive. Its CQ3 results were mixed, with revenue falling short but earnings outperforming, but the takeaway is the same. Normalization of the RV business will do nothing to damage the dividend safety, and the dividend is attractive.

The stock is trading at 5.4X its earnings and offering one of the deepest values within this undervalued sector, and the yield qualifies as “high” at 4.45%. Regarding safety, the company is paying out a mere 35% of its 2023 consensus earnings estimate to easily sustain dividend increases.

“Our results continue to demonstrate the effectiveness of our diversification strategy, which has positioned Lippert to maintain strong performance during a downturn in RV demand. During the third quarter, we delivered growth in adjacent markets and leveraged our flexible cost structure to support profitability as the RV industry adjusts to softened consumer demand and macroeconomic uncertainty,” commented Jason Lippert, LCI Industries’ President, and Chief Executive Officer.

10% yield? Pitch A Tent With Camping World

Camping World (NYSE: CWH) is a well-diversified RV stock with OEM and aftermarket business, the best value, and the highest yield. The 10% yield may be a red flag for most stocks, but not with this one. Camping World is among the best-managed companies on the stock market and is in an excellent position to continue paying at the current level if not grow the distribution in 2023. Among the trends within the business is improving used RV and aftermarket sales which are helping to offset the slowdown in the new RV business.

“In this current environment, our Company is focused on growing our overall used RV business, strategic and opportunistic dealership acquisitions, and tightening SG&A and capital expenditures with precision,” said Marcus Lemonis, Chairman and CEO of Camping World Holdings, Inc.

Before you consider Winnebago Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Winnebago Industries wasn't on the list.

While Winnebago Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.