GameStop NYSE: GME is experiencing a massive rally in pre-market trading, with shares soaring nearly 100% following news that Keith Gill, famously known as "Roaring Kitty" on YouTube and "DeepF------Value" on Reddit, disclosed an enormous position in the video game retailer. The stock was up 70% at 5:40 a.m. ET after initially surging close to 100% earlier in the morning. This resurgence is reminiscent of the 2021 meme stock frenzy that Gill helped ignite.

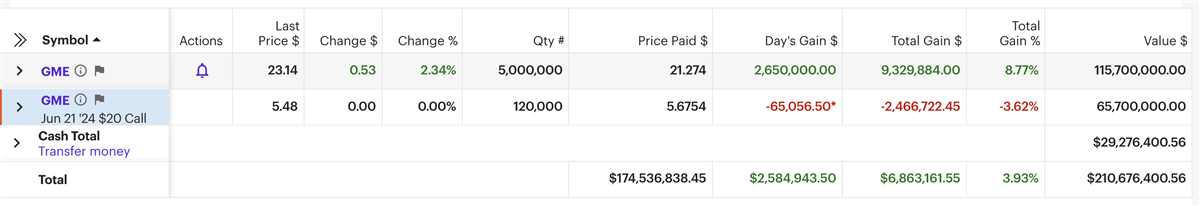

Gill reappeared on Reddit’s r/SuperStonk forum on Sunday night, posting a screenshot that purportedly shows his portfolio holding a significant amount of GameStop common shares and call options.

According to the post, Gill's portfolio includes 5 million shares of GameStop valued at $115.7 million as of Friday’s closing price and 120,000 call options with a $20 strike price expiring on June 21st, purchased at approximately $5.68 each. GameStop shares closed Friday at $23.14.

Recent Meme Mania in May

GameStop Today

$29.82 +0.82 (+2.83%) (As of 12/20/2024 05:45 PM ET)

- 52-Week Range

- $9.95

▼

$64.83 - P/E Ratio

- 165.68

- Price Target

- $10.00

Last month saw a flashback to the meme stock mania of 2021, when Keith Gill, under his "Roaring Kitty" alias on Twitter (X), spurred a renewed frenzy among retail traders. Shares of meme stocks like GameStop and AMC Entertainment NYSE: AMC surged on significant trading volumes as Gill began posting again after a several-year hiatus. However, the excitement was relatively short-lived as both companies announced stock offerings, diluting shares and causing swift price declines.

The stocks initially spiked due to retail investor enthusiasm but retraced just as quickly. Over the last several weeks, GameStop’s stock dropped by almost 50% from the May meme mania high, near $50, as the company diluted its stock and reported declining first-quarter sales. It filed to sell up to 45 million common shares in an at-the-market offering, further diluting existing shares.

However, during May mania, Gill did not directly post a position on Reddit or about the stock. Retail traders and those who closely follow Gill might see this development as a game-changer, especially considering the position size.

Analysis of GameStop’s Position

Despite the current frenzy, GameStop continues to face operational challenges. The company is struggling to transition from brick-and-mortar video game purchases to online gaming, and investors are relying on CEO Ryan Cohen to eventually reinvent the company.

Analysts remain skeptical about its long-term prospects, especially given the dilution of shares, which may further strain investor sentiment. Based on one analyst rating from Wedbush, the stock has a strong sell rating and a $7 price target, which forecasts almost 70% downside as of Friday’s close.

However, it’s worth noting that GameStop recently completed its stock sale, raising nearly $1 billion. This capital infusion could be pivotal if used strategically to restructure and revitalize the company.

Investor Caution with GameStop

While the excitement around Gill’s renewed interest in GameStop has driven a significant pre-market rally, investors should be cautious. Historically, GameStop has experienced dramatic spikes followed by steep declines. Considering whether Gill will exercise his options and how long he plans to hold is important. And, of course, that information or plan isn’t known. It’s all speculation.

If his stake surpasses the 5% threshold post-options exercise, he will need to file a Form 4, potentially triggering further stock surges. Nonetheless, the stock’s history of volatility suggests that long-term holds should be approached with caution.

While Keith Gill’s involvement has sparked significant interest and a notable rally in GameStop shares, the company’s underlying challenges and historical volatility warrant careful consideration for investors.

Before you consider GameStop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GameStop wasn't on the list.

While GameStop currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.