Consumer foods maker

General Mills NYSE: GIS stock is one of the few stocks that haven’t been ravaged by the

sell-off in benchmark indexes with positive performance for 2022. This is impressive since it undershot earnings expectations in its fiscal Q2 2022 report setting off a sell-off before rebounding towards the $69.47 potential double top. While

supply chain and

logistics disruption cut into margins, the management feels it’s a transitory situation. As the benchmark indexes sold-off, a flight to safety has caused a surge of buying in General Mills shares amidst fears of rising interest rates. The makers of branded,

organic, and processed consumer foods is a steady play in the

consumer staples sector which can act as a defensive play in falling markets as demonstrated in 2022. Prudent investors seeking a steady play through a monetary tightening period can watch for opportunistic pullbacks in shares of General Mills.

Q2 Fiscal 2022 Earnings Release

On Dec. 21, 2022, General Mills released its fiscal second-quarter 2022 results for the quarter ending November 2021. The Company reported a profit of $0.99 per share missing consensus analyst estimates for $1.05 per share by (-$0.06. Revenues rose 6% year-over-year (YoY) to $5 billion beating consensus analyst estimates for $4.86 billion. Organic net sales rose 5% while adjusted gross margin fell 330 basis points. The Company adjusted EPS guidance to be (-2%) to 1% or $3.71 to $3.83 versus $3.79 consensus analyst estimates.

Conference Call Takeaways

General Mills CEO Jeff Harmening set the tone responding to questions, “We've been around for 155 years because we play the long game. What I would say, in this environment there is a huge trade-off, but I'm not sure there is a trade-off between higher service level cost and that's because if we were to take our foot off the gas on service, what you would -- what we would find is that we create more deleverage and we would incur fine because and be more inefficient and get fine for our retail customers because the more efficient and then we'd be shipping truckloads stuff that we're probably most efficient, and so there really isn't a cost trade-off. So, I don't -- we would not be making more money if we look less at our service. We feel it's our responsibility at the end of the day is to the end consumer and making sure they have the products they want to our retail customers and by filling that we're doing our job. The only thing we would gain by lessening service on margins look at the moment better, but our sales will be down, but we wouldn't make any more money for General Mills' shareholders, we certainly are going to generate more cash then we're generating now either.

He chimed in on supply chain issues. But some of these supply chain disruptions, they will be transitory, and we would expect them to improve for the rest of our fiscal year as noted by Kofi earlier.

But over the longer term, I mean the supply chain will get more efficient. We had a terrific Asia now productivity capabilities and so we are highly confident that these costs over time are costs that business will not bear. So, even if September conversation we have with retailers now, we are confident that over time once the market stabilizes, these are costs that we can recoup in our P&L.”

He concluded, “One of the thing that I'm most proud of Wendy that you did note, and I'm glad you noted is that we've gained share over a long period of time, and we've been doing in North America Retail, we’ve been doing in our pet business. We've been doing it in Europe and China and Brazil. And so, one of the things I'm most proud of even in this tough environment, we continue to keep very, very effectively and I think that's a sign of the quality of our execution and our customer service levels. And so, no matter what -- and that was happening before the pandemic, it's happened through the pandemic, it's happening now and so I think that is the most important thing. A lot of the time our competitors we're not constrained by supply, and they did not have material disruption. And so those things come and go and we take them as they come and go. But one of the things I am most pleased about is our performance. We've have been able to do all of that while reshaping our portfolio and so we've added pet brands, and this worked really well. We've divested our yogurt business in Europe and now announced a dough business and we restructure our organization. So, we've been able to have all this competitive quality with that, while navigating a lot of changes internally as well as externally.”

GIS Opportunistic Price Levels

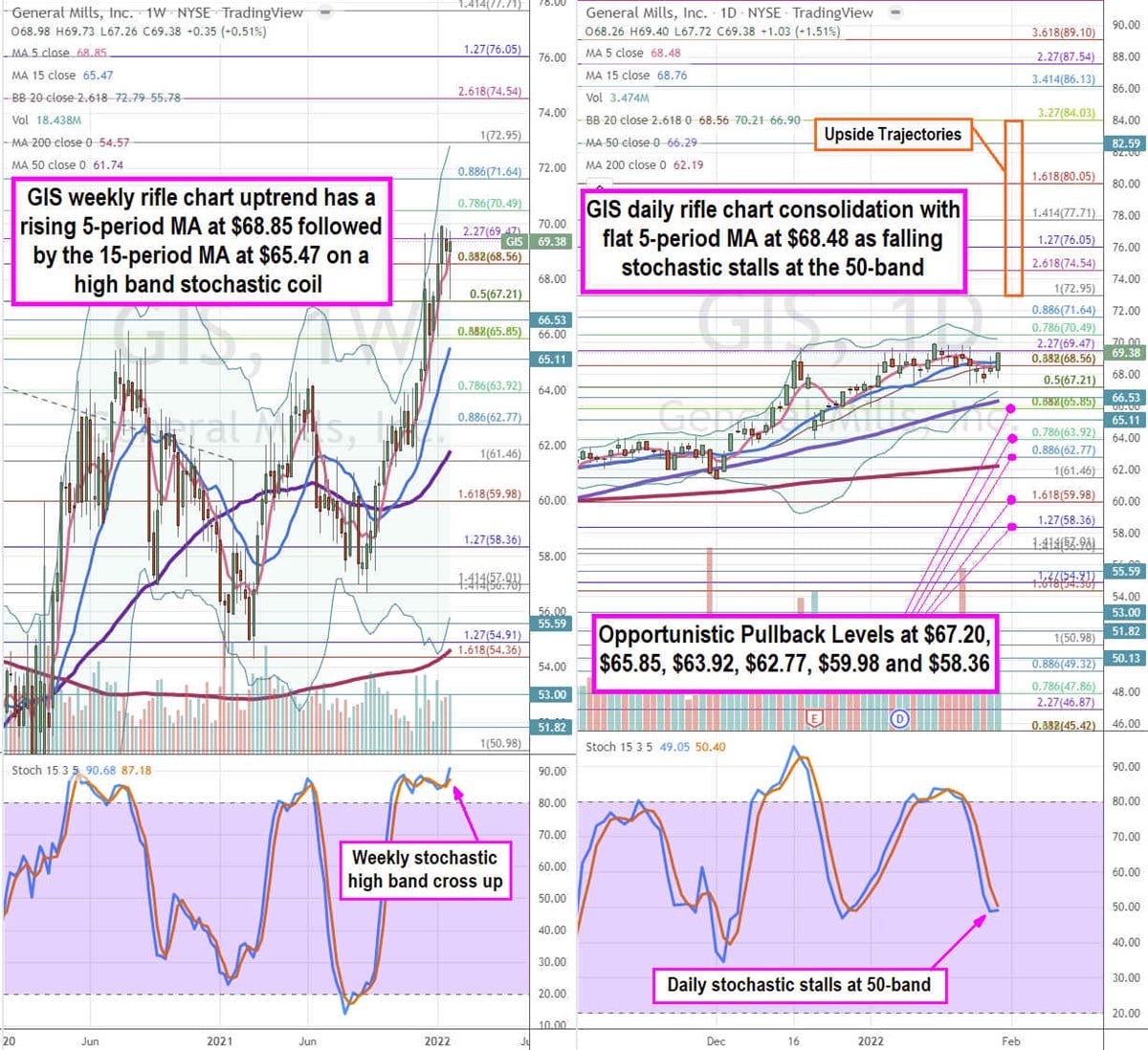

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for GIS stock. The weekly rifle chart recently held pullbacks near the $67.21 Fibonacci (fib) level. Shares continued to rally on the weekly uptrend with a rising 5-period moving average (MA) support at $68.85 followed by the 15-period MA at $65.47 as it stretches towards it weekly upper Bollinger Bands (BBs) at $72.79. The weekly stochastic coiled again at the high bands bouncing up to the 90-band. The daily rifle chart is starting to consolidation with a flat 5-period MA at $68.48 as BBs compress at $68.56 and $68.76 on the upper and lower BBs, respectively. The daily stochastic has been falling but stalled at the 50-band for a cross up or a mini inverse pup back down. The daily market structure low (MSL) buy triggered on the breakout through the $65.85 fib level. The BB compression precedes a price range expansion, but the direction has yet to show its cards. Prudent investors can watch for opportunistic pullbacks at the $67.20 fib, $65.85 fib, $63.92 fib, $62.77 fib, $59.98 fib, and the $58.36 fib level. Upside trajectories range from the $72.95 fib up towards the $84.03 fib level.

Before you consider General Mills, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Mills wasn't on the list.

While General Mills currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.