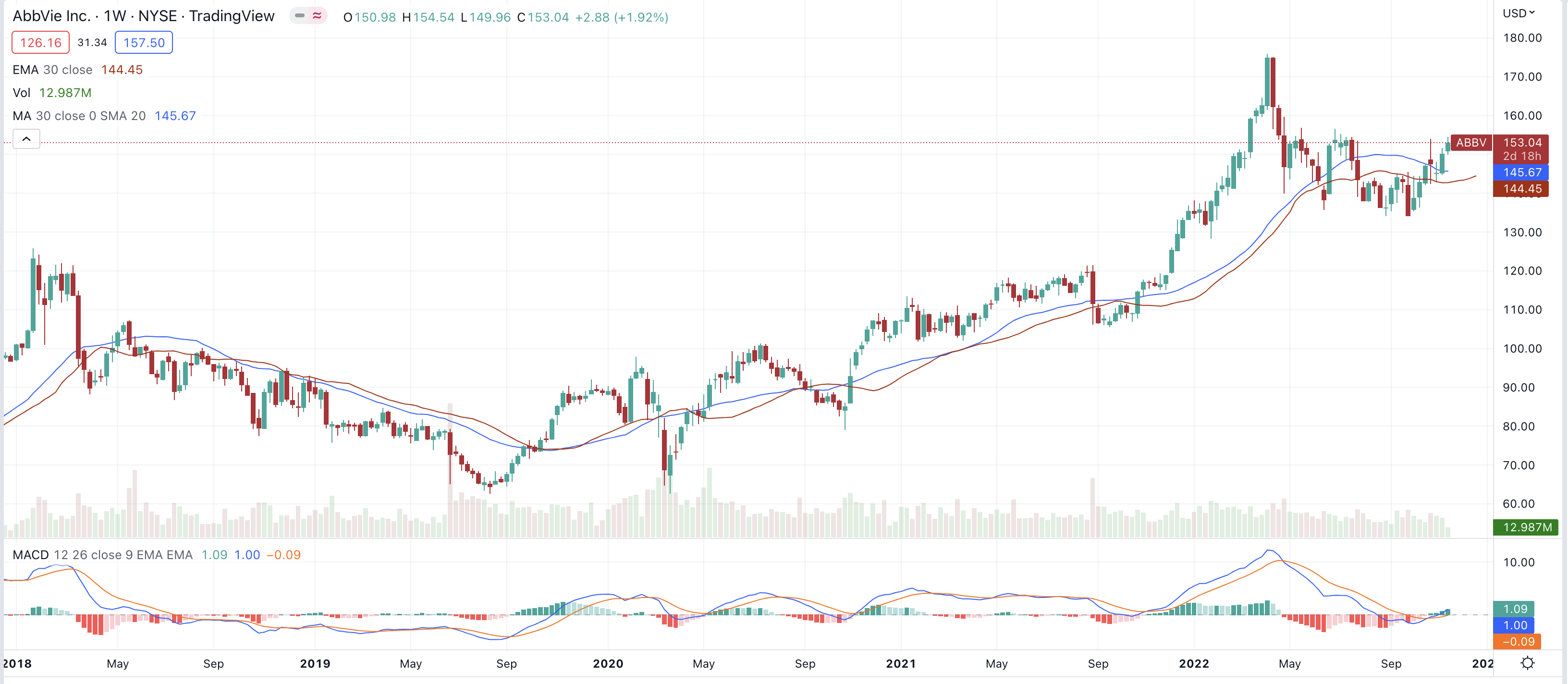

A 3.5% jump on Wednesday was enough to make shares of AbbVie (

NYSE: ABBV) among the best performing of US equities. The jump means shares of the big pharmaceutical are well on their way to undoing last week’s dip that sent them down 10% from multi year highs. To be sure, this quick recovery isn’t all that unexpected, with our column recommending investors

to buy the dip only earlier this week.

Wednesday’s pop came on the back of the Chicago headquartered company reporting their Q4 earnings that topped expectations. Revenue for the quarter, in particular, shone brightly, posting year-on-year growth of 59%. Richard A. Gonzalez, CEO, said with the report; "we successfully completed the transformative Allergan acquisition and delivered another year of strong results in 2020, despite the challenges presented by the global pandemic. Based on our broad portfolio of diversified growth assets and the robust momentum of our business, we expect impressive growth again in 2021."

Wall Street clearly wasn’t slow about buying into the strong potential alluded to by Gonzalez, with a raised forward guidance for 2021 doing no harm at all to the bid. Yesterday’s jump should put shares back on track to reclaim last month’s highs and set them up for a run at 2018’s all-time highs. They’re only around 15% off the latter so we could well be seeing a fresh print this quarter. There are more than enough internal and external factors there to keep the rally going.

Run Of Good News

Investors are still living off the major boost shares got at the end of October when AbbVie management raised their dividend by 10%. This is traditionally considered one of the strongest signals management can give to investors and suggests they’re confident about the company’s ability to deliver on its growth goals and targets. On the whole, this means AbbVie’s dividend yield is at a juicy 4.5%. When coupled with how well shares are appreciating right now, it makes for an attractive argument for inclusion in most any portfolio.

And with a price-to-earnings ratio of only 23, you won’t find many investors saying they’re overvalued. With many flashy tech stocks boasting PE ratios in the 4 digit range, AbbVie offers a welcome reprieve from any concerns about a bubble led rally.

Solid Momentum

It’s hard to argue that AbbVie doesn’t represent a safe pair of hands for some of your capital right now. They’ve a solid history of both raising guidance and then beating their own guidance quarter on quarter, combined with a track record of debt reduction and reputation for pipeline growth. To this end, they recently announced positive updates on several of their ongoing clinical trials, particularly those focusing on their Rinvoq and Skyrizi treatments. These are helping to build out an attractive catalyst roadmap that will be closely monitored by active and potential investors alike.

In a 13F filing last November, Berkshire Hathaway reported fresh additions to its AbbVie and other pharma positions. Having the Oracle of Omaha in the bull camp has gone a long way to building out the long term bull case currently in play, particularly as Berkshire trimmed some of their Big Tech positions in the same breath.

For investors thinking about getting involved at these levels, there’s really minimal downside to be had. AbbVie is still doing what AbbVie does best, raising and then beating their own forward guidance quarter after quarter whilst also offering a fat 4% dividend yield to investors. There’s no reason this pattern should end anytime soon.

Before you consider AbbVie, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AbbVie wasn't on the list.

While AbbVie currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.