GitLab Today

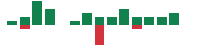

$54.56 -0.17 (-0.31%) (As of 04:27 PM ET)

- 52-Week Range

- $40.19

▼

$78.53 - Price Target

- $66.38

The market for GitLab NASDAQ: GTLB collapsed in late May when it announced high-severity flaws in its platform. The news was especially shocking coming from a DevSecOps platform, but the impact on the share price has been short-lived. The market is already rebounding from its lows and is likely to head higher because GitLab is a leader in secure developer operations. The truth is that no platform is entirely safe; cybersecurity is more about deterrence, the difficulty hackers face, than actual prevention, and GitLab has already issued its patches. The takeaways from the Q1 report are that enterprise-level clients continue flocking to the platform, outperformance is expected for Q2, and the growth outlook is robust.

GitLab is Building Momentum With AI

GitLab had a solid quarter with revenue, earnings, and guidance above consensus forecasts reported by MarketBeat.com. The company’s revenue performance was driven by growth in clients led by large clients producing more than $100,000 in annual revenue. Large clients grew by 35%, and services' deepening penetration compounds the strength. The net retention rate or measure of the revenue generated from existing customers was 125% of last year’s level, giving evidence of the platform's utility.

The guidance is also solid and potentially cautious, given the trend of outperformance, client growth, penetration of services, and remaining performance obligations. RPO is a measure of contracted business that has yet to be recognized, up 48%. Regardless, the guidance calls for another quarter of nearly 30% growth; the only downside is that growth will slow from Q1’s 33% to an average of almost 28% for the year. Looking forward, analysts expect the company to sustain growth in the mid-20% in 2025, and that outlook may also be light.

GitLab MarketRank™ Stock Analysis

- Overall MarketRank™

- 62nd Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 20.7% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- N/A

- Environmental Score

- N/A

- News Sentiment

- 0.31

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- Decreasing

See Full AnalysisAnalysts lowered their targets for the stock following the Q1 release and are setting the market up for a rebound. The analysts will likely start raising targets in the second half because the Q2 results will be strong, and further guidance improvement is also expected.

As it is, the 25 analysts tracked by MarketBeat show a high conviction for this enterprise tech stock and rate it as a Moderate Buy. The consensus is down compared to last quarter, but marginally, and is still nearly 30% above the current action, providing ample incentive to the market, and the low target is also significant. Several firms issued a low target of $50, the lowest target on record, a floor for the price action in this tech stock.

Insiders Sell GitLab Shares; Institutions Buy Them

Insiders have been selling GitLab, but there are so many offsetting factors that it doesn’t matter. To start, insider activity is light, the pace of selling has slowed sequentially for three quarters, and activity is spread among numerous execs, pointing to sales related to share-based compensation. Another offsetting factor is the institutional interest. The institutions have bought this stock on balance for five consecutive quarters, and the selling virtually dried up in Q2. Over the past twelve months, the activity has total institutional ownership up to 92% and is growing, providing a strong tailwind for the market.

GitLab Rebounds, Reversal in Play

Shares of GitLab are moving higher, confirming support at the $44 level. The price action has moved above the analysts' low $50 target, which should act as market support now. The next hurdle is the long-term moving average near $54. That level will likely be reached soon. The question is if the market will move above it quickly or enter a correction. In either case, this stock is a good buy and will likely move above $60 by the year’s end.

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.