The Goldman Sachs Group NYSE: GS is one of the most-followed stocks and has long been an industry leader and at the forefront of innovation in the banking and financial sector.

The company, which boasts a market capitalization of $126.49 billion, is a Dividend Aristocrat with a 2.84% dividend yield and moderate dividend strength. Offering a stable dividend yield and a P/E of 17, the stock is no stranger to value, long-term conservative investors.

The company's stock has returned a modest 4.84% over the previous year without considering its dividend yield. However, in more recent times, over the last three months, it has returned an impressive 18.39%. A return significant enough to see it outpace the overall sector, which has returned 15.39% over the same period.

With earnings out of the way and the stock displaying recent relative strength to its sector, might GS be a top financial play for the remainder of the first quarter? The stock warrants a closer look due to the recent outperformance and based on how it has formed in terms of technical analysis. As GS's bullish consolidation has formed, let's see if a breakout might loom for the financial giant.

Goldman Sachs tops earnings expectations

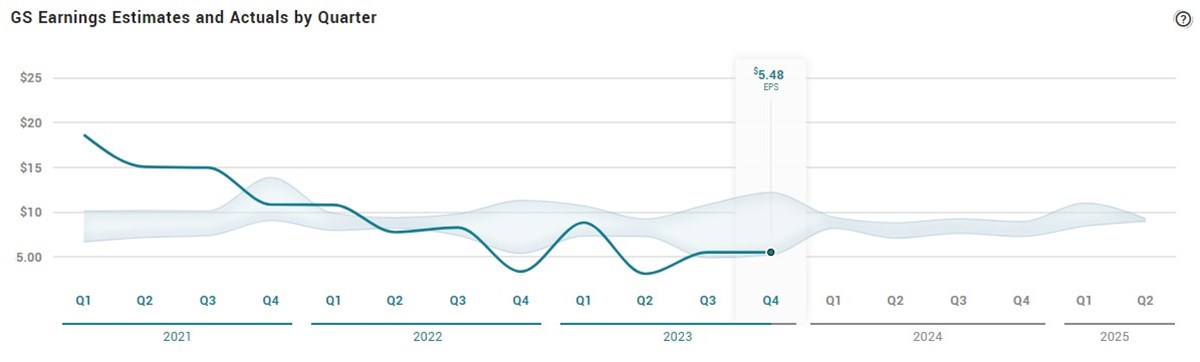

On January 16, Goldman Sachs reported its fourth-quarter results that beat analysts expectations. The company reported a significant increase in earnings for the quarter, with a 51% jump to $2.01 billion, or $5.48 per share, compared to the previous year.

A rise in companywide revenue drove this growth, which increased by 7% to $11.32 billion. Despite facing challenges in the past year, CEO David Solomon is optimistic about the future, especially with a focus on the asset and wealth management division, which saw a 23% increase in revenue.

While some divisions met or slightly missed expectations, equities trading performed well, offsetting a decline in fixed-income trading. According to Solomon, investment banking fees fell, reflecting a broader industry trend, but there's hope for a rebound in mergers and capital markets activity in the latter half of 2024.

GS is trading in the high-end of its range

Shares of Goldman Sachs are now trading at the high end of its 52-week range, last trading at $287.86. Notably, the stock has spent over a month consolidating in a tightening range, with support now at $380 and resistance near $390.

As the stock consolidates above a rising 200 and 50-day simple moving average (SMA), the trend is firmly to the upside.

Participants and those looking for potential momentum continuation should closely monitor the price action near resistance. A break and hold above short-term resistance and an uptick in volume might confirm a breakout and momentum shift.

The sentiment is bullish

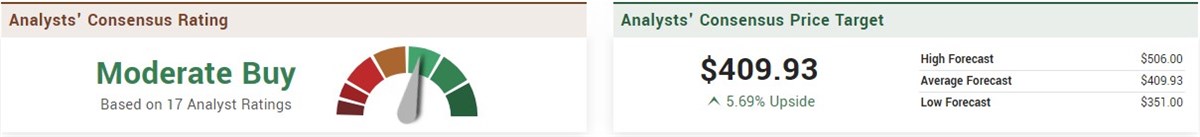

Based on 17 analyst ratings, GS holds a "moderate buy" rating with a consensus price target indicating a nearly 6% upside potential. Notably, this rating is more favorable than the current consensus rating for finance companies, which is "hold," and the overall S&P 500 consensus, which also stands at "hold."

Following its fourth-quarter results, many analysts took action on the name. Namely, Oppenheimer boosted its target from $491 to $506, calling for an impressive 30.83% upside at the time of the report.

Morgan Stanley upgraded its rating for GS from "equal weight" to "overweight" and boosted its target from $333 to $449. The high forecast on GS is now $506, thanks to the upgrade from Oppenheimer. The low forecast is $351, a price target Atlantic Securities gave in August last year.

Before you consider The Goldman Sachs Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Goldman Sachs Group wasn't on the list.

While The Goldman Sachs Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.