Hospital and healthcare facilities operator HCA Healthcare NYSE: HCA stock has been performing relatively strong compared to the benchmark indices during this bearish market sell-off. The nation’s largest hospital operator felt inflationary pressures as labor costs cut into margins more than expected. The labor challenges resulted in capacity restraints in the quarter, which impacted the number of treatments and services for patients. While COVID still impacts operations, the dissipating of infections has led to an increase in non-COVID admissions including inpatient surgeries. The Company has numerous initiatives in place to recruit and retain workers as well as ease capacity restraints but still expects a slower return to normal in the face of a tight labor market. HCA Healthcare has grown its facilities by 15% to approximately 2,500 by the end of 2021 and shares trade at 13X forward earnings. Prudent investors seeking exposure to a top healthcare provider can watch for opportunistic pullbacks in shares of HCA Healthcare.

Q1 Fiscal 2022 Earnings Release

On April 22, 2022, HCA Healthcare reported its fiscal Q1 2022 earnings report for the quarter ended March 2022. The Company reported an earnings-per-share (EPS) profit of $4.14 excluding non-recurring items versus consensus analyst estimates for a profit of $4.24, a (-$0.10) miss. Revenues grew 6.9% year-over-year (YoY) to $14.95 billion beating analyst estimates for $14.72 billion. Cash flows from operating activities totaled $1.345 billion. Same facility admissions rose 2.1% and same facility equivalent admission rose 5%. HCA Healthcare CEO Sam Hazen commented, “In the first quarter, we had a number of positive volume and revenue indicators. Unfortunately, they were offset by higher than expected inflationary pressures on labor costs.”

Lowered Guidance

HCA Healthcare lowered its full-year fiscal 2022 EPS of $18.40 to $19.20 versus $18.79 consensus analyst estimates. The Company expects revenues to come in between $60 billion to $62 billion versus $61.14 billion.

Conference Call Takeaways

CEO Hazen noted that the Omicron surge continued to influence it results in the quarter. The margins were compressed due to a challenging labor market, but the positive volume and revenue indicators were encouraging. Same-facility admissions rose 2% YoY. The Company delivered medical care to 49,000 COVID inpatients. Non-COVID admissions rose 2.2% YoY. Inpatient surgeries rose 1% YoY. Outpatient volumes improved as same-facility emergency room visits rose 15% YoY. Same-facility outpatient surgeries rose 7% and outpatient cardiac-related procedures rose 7%. CEO Hazen reassured, “We continue to believe that overall demand for health care remains strong in our markets across most categories, with favorable population trends and other contributing factors that developed during the pandemic driving it.” He did admit the bottom-line results were disappointed but topline metrics were positive. The Company experienced higher labor costs than expected, but they expect it to normalize through the year. The challenging labor contracts also resulted in constraining capacity at its facilities. This is also improving, and transfer centers are operating back to normal. The Company has numerous initiatives meant to offset labor pressures and focus on recruitment, retention, and capacity management. He concluded, “We do, however, have numerous initiatives underway around retention, recruitment, capacity management, and new care models that we believe will help offset some of these labor pressures. However, we now believe the improvement in our labor cost will be slower than originally anticipated. This factor primarily influenced our revised outlook for 2022.”

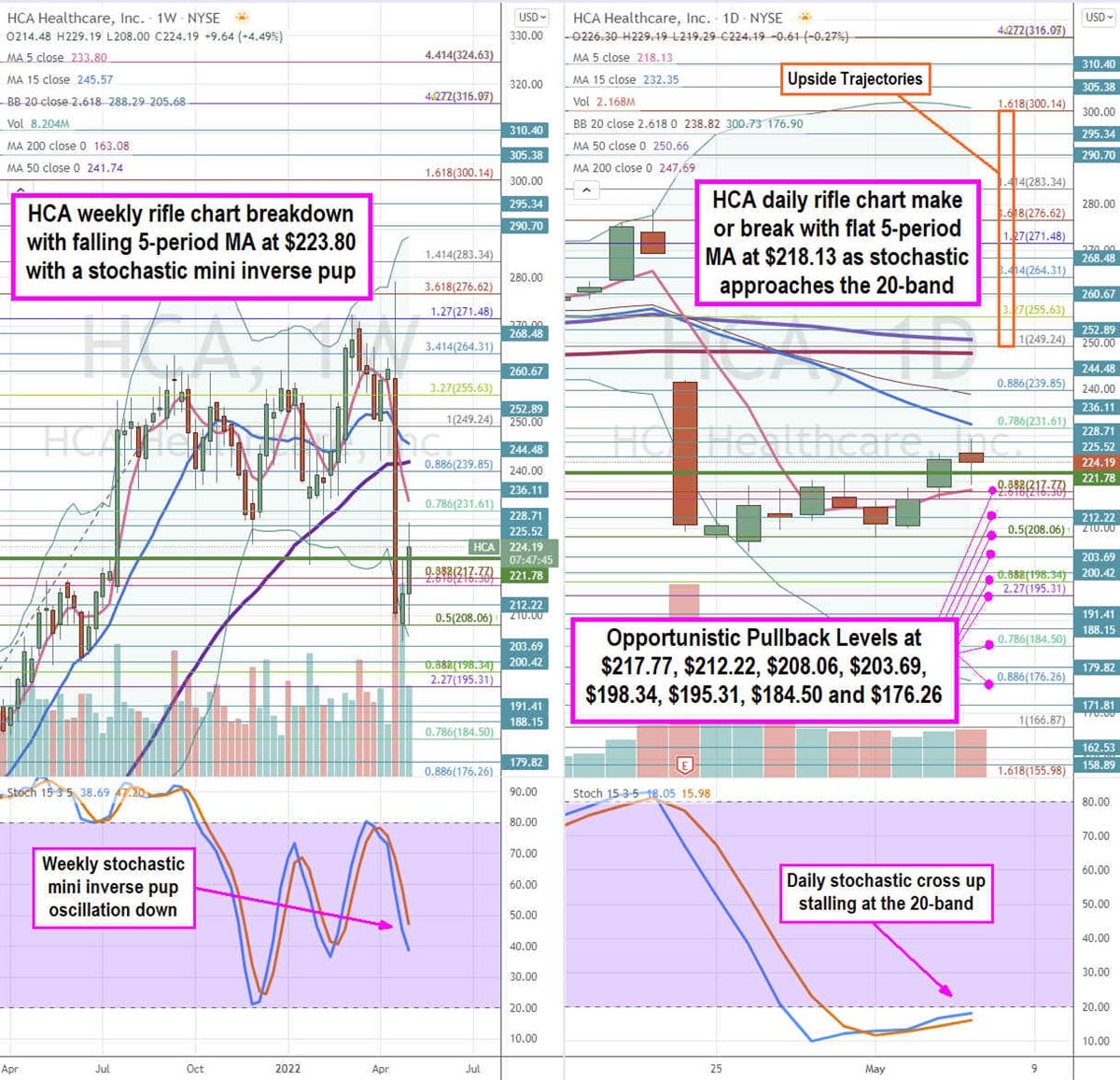

HCA Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames enables a precise view of the price playing field for HCA. The weekly rifle chart peaked around the $271.48 Fibonacci (fib) level. The weekly rifle chart pup breakdown triggered the sharp collapse in the earnings release. Shares fell through the weekly 50-period moving average (MA) at $241.74 as the falling 5-period MA is at $233.80 followed by the 15-period MA at $245.57. The weekly lower Bollinger Bands (BBs) sit ta $205.68. The weekly market structure low (MSL) triggers the breakout through $221.78. The daily rifle chart has a stalled downtrend with a flat 5-period MA at $218.13 and a falling 15-period MA at $232.15 as the stochastic bounce stalls just under the 20-band for a make or break. The daily lower BBs sits at $76.90 with daily 200-period MA resistance at $247.69 and 50-period MA at $232.35. Prudent investors can patiently wait for opportunistic pullback levels at the $217.77 fib, $212.22, $208.06 fib, $203.69, $198.34 fib, $195.31 fib, $184.50 fib, and $176.26 fib level. Upside trajectories range from the $249.24 fib up to the $300.14 fib level.

Before you consider HCA Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCA Healthcare wasn't on the list.

While HCA Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.