Over the last month, the overall market has experienced significant selling amid increased uncertainty. The S&P 500 ETF Trust NYSE: SPY has traded almost 5.5% lower in that period, and wherever you look, it might seem that nothing has managed to buck the trend.

However, that’s not the case. The healthcare giant UnitedHealth Group NYSE: UNH has been a standout performer, especially in terms of relative strength, over the last month. Over the previous month, shares of UNH have surged almost 10% higher despite the overall selling seen in the market.

Why does this matter? Well, stocks with relative strength to the overall market are likely to continue higher even after the market reverses. So, taking a closer look at UNH is worthwhile as the recent price action points to continued momentum.

UnitedHealth Group NYSE: UNH

UnitedHealth Group is a prominent healthcare company in the United States, operating globally in four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. It ranks as the 7th largest company globally by revenue and is the largest insurer based on annual premiums. It holds the 11th position on the Forbes Fortune 500 list and boasts a market capitalization of about $484 billion. In 2022, its total revenue exceeded $320 billion.

UNH currently has a P/E ratio of 23.38 and trades near the high end of its 52-week range of $445.68 - $558.10. The company pays a meaningful dividend of 1.44%, higher than the bottom 25% of all stocks that pay dividends. UNH has steadily increased its dividends over the previous 14 years and has a dividend payout ratio of 33.65%.

UNH Recent Performance

Shares of UNH have significantly outperformed the market in recent weeks and now find itself up over 8% already in October. Notably, the stock recently broke above a critical resistance level, around $513. Previously, this level had been tested multiple times in July, and on the many occasions that the stock traded into it, it failed to hold above.

However, that all changed last week, and the stock has now firmly turned that area of resistance into newfound support. If the stock can continue to base above the previous resistance, a move toward April’s high might be achieved as early as next week. Afterward, $540 becomes a reasonable target.

Whether the stock can continue outperforming the market will largely depend on its earnings, which will be released on Friday.

UNH is a Top Rated Stock

UNH is on the Top-Rated Stocks list, a list of the 100 companies that have received the highest average rating among analysts in the last twelve months.

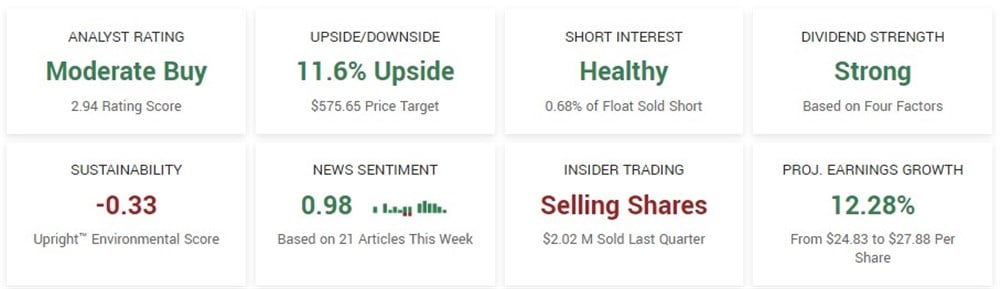

The company currently has a consensus analyst rating of Moderate Buy based on sixteen ratings. Of the sixteen, one is a Strong Buy, thirteen have UNH as a Buy and two at Hold. Notably, the consensus price target for UNH predicts over 10% upside.

UNH Set to Report Earnings on Friday

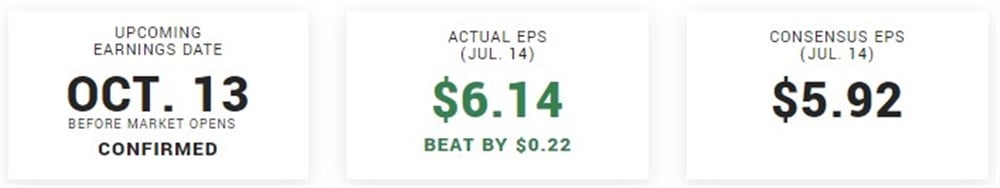

UNH shared its latest earnings on July 14, 2023. They reported earnings of $6.14 per share for the quarter, surpassing expectations by $0.22. The company's quarterly revenue was $92.90 billion, higher than the expected $90.97 billion, marking a 15.6% increase compared to the same period last year.

The next quarterly earnings report from UnitedHealth Group is scheduled for October 13, 2023, with an earnings conference call at 8:45 AM Eastern on the same day. They anticipate a 12.28% growth in earnings for the coming year, from $24.83 to $27.88 per share.

Before you consider UnitedHealth Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UnitedHealth Group wasn't on the list.

While UnitedHealth Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.