Healthcare is a necessity in our everyday lives. Advancements in medicine and medical treatments have helped people live longer and healthier. While they say you can't put a price on good health, you can invest in it. Healthcare is a big business.

Healthcare is one of the 11 sectors that comprise the S&P 500 index. With hundreds of stocks within the sector, navigating through them can be daunting. This article will take a deep dive into the healthcare sector from an investor's standpoint to make better decisions when investing in healthcare sector stocks.

Overview of the healthcare sector

According to the World Bank, global healthcare spending accounted for 9.7% of the world GDP in 2021. The healthcare sector accounts for more than 18% of the U.S. gross domestic product (GDP).

With over 18 million workers, the healthcare industry is one of the largest employers in the U.S. Many of the largest healthcare companies are listed in the stock market, allowing investors to profit from its continued growth.

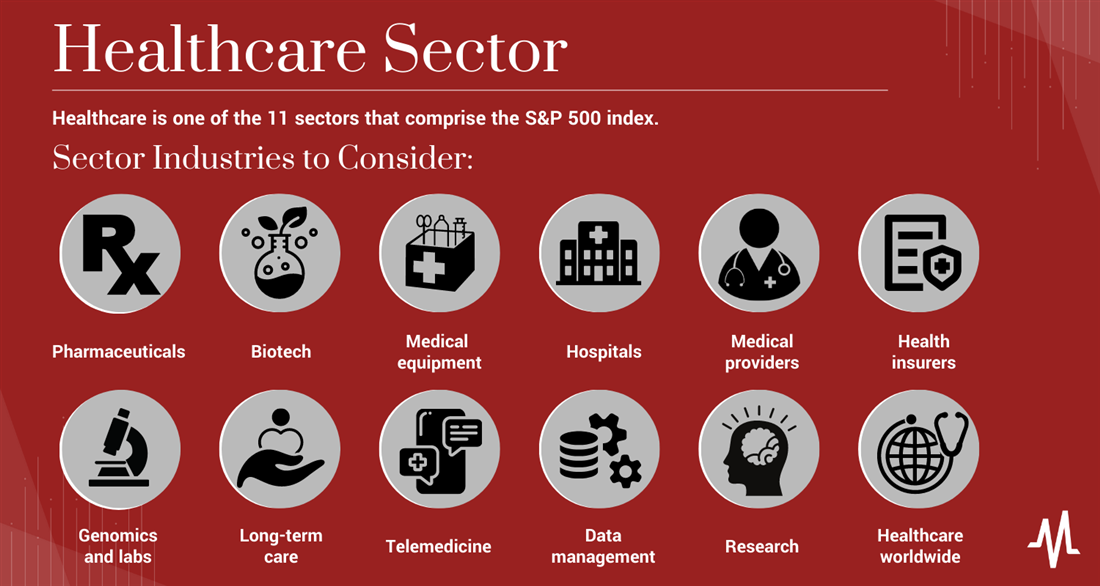

A sector is a broad classification generally describing a part of the economy. Stock sectors comprise many related industries and companies within each industry. The healthcare sector is broad and diverse. It includes many industries focused on various parts of healthcare, from treatments, medical products and services to medical providers, facilities and payers. Many companies partake in multiple industries within the healthcare sector. Some of the best blue-chip companies and dividend aristocrats are major healthcare companies.

Understanding market trends

In addition to macroeconomic factors like inflation and GDP growth, understanding how market dynamics influence investment decisions can lead to better decision-making in investing in companies within this sector.

For one, the aging population means an opportunity for growth in healthcare products or services geared toward elder care. Diseases commonly associated with old age also increase demand from elderly populations, which makes them crucial markets for some medical treatments and facilities specializing in geriatrics.

Technology has allowed developments that have improved patient outcomes while making medical practice more efficient (eHR, telemedicine and remote monitoring, to name a few). Artificial intelligence (AI) has already started to disrupt areas like medical diagnosis and robotics have improved surgery outcomes.

Healthcare sector industries

The healthcare sector comprises many industries. Here is a list of industries and the kinds of companies in them.

Pharmaceutical

Pharmaceutical companies develop and sell drugs. It takes tremendous time and money to bring a new drug to market. Most drugs need to pass the FDA approval process. The average time to bring a drug to market with full FDA approval can range from 10 to 15 years at the cost of up to $2 billion.

Major pharmaceutical companies have a portfolio of approved FDA medications and a pipeline for new drugs in clinical trials. Due to the high costs of drug discovery, larger pharmaceutical companies will often let smaller biotechnology companies do the research and legwork through a partnership with milestone payments.

If the drug gets positive clinical trial results or FDA approval, the biotechnology company has the potential to be acquired. It's easier and less of a gamble to acquire a company with an FDA-approved drug than to create one from scratch.

Biotechnology

Biotechnology (biotech) companies take on the risk of developing drugs and therapies to get FDA approval. They differentiate themselves from pharmaceutical companies by utilizing living organisms like genes, enzymes, and cells in their research, focusing on biological techniques to develop new therapies and drugs — the riskiest industry in healthcare.

They conduct the research and clinical trials, which take years to complete before submitting for approval by the FDA.

Most biotech companies are bleeding money and have little revenue, so they often partner with deep-pocketed pharmaceuticals or look to get FDA approval and get acquired. The larger biotech companies have established portfolios of drugs and a pipeline of new drugs in development.

They are a speculator's dream due to the ability for stocks to skyrocket on good news but also collapse hard on bad news.

Medical equipment, products and devices

This industry comprises companies that provide the tools for doctors to undertake medical treatments. These companies can make equipment like masks, scalpels, radiology equipment stents, glucose monitoring devices and pacemakers.

Hospitals

Why not invest in where patients get treated for outpatient and inpatient medical care? While most hospitals are nonprofit organizations, some of the largest hospital groups are profitable publicly traded companies. The industry continues to consolidate as larger hospital groups grow through acquisition.

Medical providers

This industry includes doctors, specialists, surgeons, nurses, radiologists, counselors, therapists and anyone providing medical treatment, therapy and patient care. Medical providers include behavioral and mental healthcare providers, including psychologists and psychiatrists.

Health insurers

There has been a consolidation and vertical integration trend as many health insurance companies have evolved into the medical provider space. These health insurance companies pay medical providers and hospitals under their fee schedule as per contract.

They collect health insurance premiums from patients and employers, process medical claims, and payout providers. They create their network of providers and continue to expand, adding pharmaceutical benefits managers (PBM) to control drug costs.

Genomics, testing and labs

Many companies develop medical and diagnostic tests administered by healthcare workers and patients. These companies are on the cutting edge of medical technology. They may focus on mapping the human genome to create novel therapies and molecules or the diagnostic labs for your blood work.

Long-term care

The aging population continues to grow. Long-term care includes retirement homes, assisted living facilities and other facilities that provide care for elderly patients with chronic illness and other age-related disorders. These companies usually tend to own the real estate, land and facilities on the land.

Telemedicine

The pandemic brought this industry to light. Telemedicine companies connect patients with doctors remotely. These companies build a network of on-call physicians and nurses ready to handle consultations and address medical inquiries. Many medical provider groups also offer this service to patients using specialized software to conduct remote appointments.

Data management

These companies collect, store and analyze healthcare data and medical records. They provide technology for medical providers to accurately and efficiently collect and document patient data for electronic medical records.

Research

Many software companies specialize in utilizing artificial intelligence (AI) machine learning algorithms to process big data for drug discovery. This industry can include drug discovery and clinical trial companies. These companies work with pharmaceutical and biotech companies during drug discovery and testing, helping to effectively and efficiently work through the various phases toward FDA approval.

Healthcare worldwide

Healthcare is a global business. While healthcare in the U.S. is among the best in the world, there is a need for more quality healthcare worldwide, especially in developing nations. Global healthcare industry statistics show that 30% of the world's data volume becomes generated in healthcare.

Many companies in the healthcare sector have their products distributed worldwide. These can include the major pharmaceutical companies and device and product manufacturers. While each nation has its version of a medical regulatory approval agency, countries often provide approvals when a drug has U.S. FDA approval. Many healthcare companies selling products in the U.S. are also headquartered overseas.

Keys to investing in the healthcare sector

Investing in the medical sector can be tempting when the healthcare sector performance stays strong. However, this can lead to chasing entries, putting you on the wrong foot.

Avoiding buying at the top is easier said than done. While investing in the healthcare sector sounds compelling, it's essential to adhere to some basic rules specific to the sector and general investing rules.

Research the healthcare sector and industries

Rather than trying to learn everything about the healthcare sector, it helps to select a few industries to get started. It's better to take smaller bites by selecting one or two industries to familiarize yourself with. The industries and types of stocks vary in volatility and potential for larger gains and losses.

The riskiest and most volatile industry would be biotech stocks. Biotech stocks place large bets on single or several drugs. These stocks can spike triple-digit percentages daily on positive clinical data, partnerships, rumors, FDA approvals and merger announcements. However, they can lose double-digit percentages as fast on lousy news like unfavorable clinical data, FDA notices, regulatory investigations, legislative changes, negative media attention and short-sellers.

The least volatile healthcare stocks would be the blue chip mega-cap diversified healthcare companies that are Dividend Aristocrats. These massive companies are diversified in multiple industries and have a history of consistency through bull and bear markets. They tend to be S&P 500 index component companies with substantial institutional ownership, further stabilizing the volatility. Make sure to find companies that are suitable to your risk tolerance.

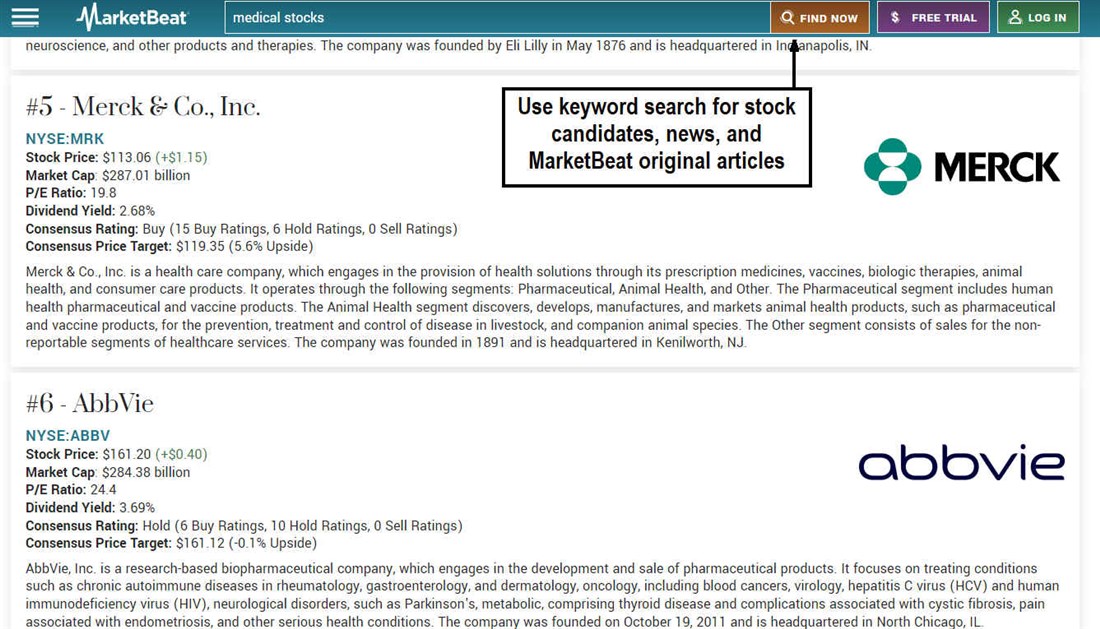

Find stock candidates for investment

To find healthcare stocks, head to stock research and analysis sites like MarketBeat.com to use their tools to do much of the legwork. You can also do a keyword search on MarketBeat using keywords like "FDA approvals" or any specific industry in healthcare to pull up stocks and articles. You can also use the premade lists like medical stocks on MarketBeat. Compile a list of stocks and their industries. To narrow your list of candidates, compare stocks on MarketBeat and pick the most suitable to research.

Do your research on each stock

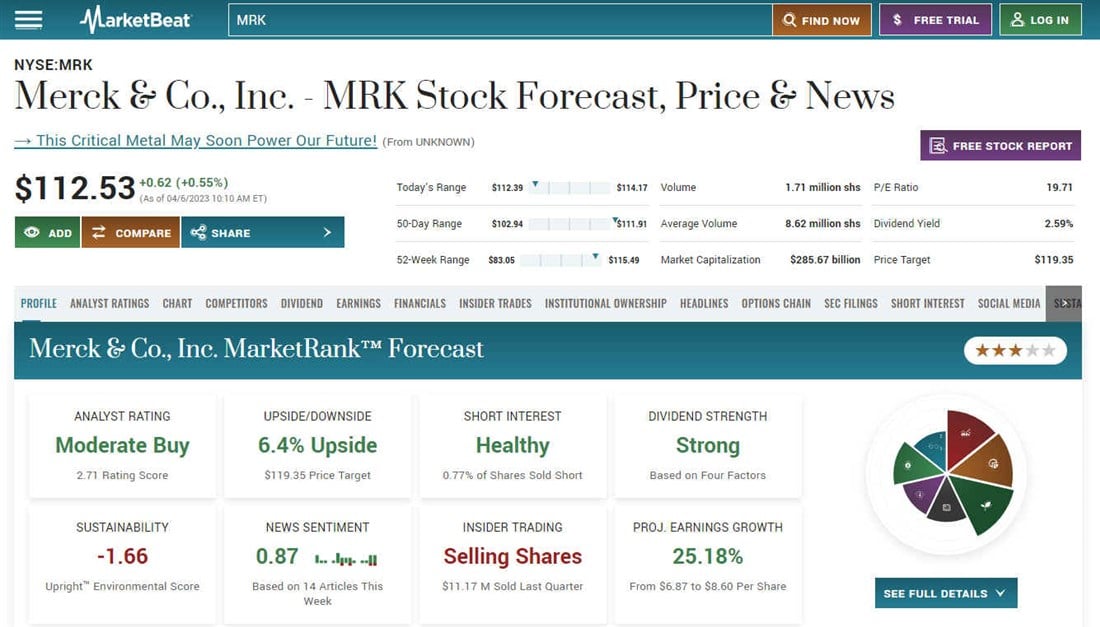

Once you have a list of stock candidates, it's time to do the actual legwork. You can continue to use MarketBeat to go through the fundamental data, including a summary of the business, news, earnings reports, research reports and financial metrics like price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, price-to-sales (P/S) ratio and net margins.

There are various tabs, from the profile and analyst ratings to SEC filings and short interest. The MarketBeat MarketRank™ Forecast provides a quick snapshot of the company along with a rating out of five stars and price targets. Reading through the most recent earnings report to understand how the business manages the current environment is imperative. Using charts to determine the current price trend, supports, and resistance levels is also prudent. You can use these to decide at what prices you want to purchase shares.

Scale into your entries

The market is constantly moving and dynamic. It's almost impossible to get a perfect entry in one shot. It makes sense to average in your entries to get a better average price. First, determine how many shares you want to purchase and at what prices. Use an online broker or a zero-commission app to place and execute your orders.

It can take a day or several days to complete your position. If you have predetermined entry levels, you can also use good-to-cancel (GTC) limit orders, keeping your order active until it's filled or the time limit runs out. This way, you're not stuck watching the stock tickers constantly.

Consider having target price levels where you will sell some or all of your stock and stop-loss price levels to exit some or all of your position if shares fall too much. You can also set alarms with your broker or charting software to alert you when the prices hit. You can also use MarketBeat stock price targets and analyst ratings to help you decide on price levels.

Many brokers also allow you to place GTC conditional orders and stop orders ahead so you won't constantly fixate on the stock price. If you are stuck to the quote screen and worried about losses, you may have taken too many shares. It would help if you were comfortable with the investment or trimmed down your position.

If you can't decide on individual stocks to invest in, you can always consider a healthcare industry exchange-traded fund (ETF). These trade similarly to stocks and hold a diversified portfolio of healthcare stocks about a particular industry.

Manage your positions

Once you purchase healthcare stocks in your portfolio, stay abreast of news like earnings reports to stay current on its operations. If fundamentals change drastically, consider adjusting your stop-loss and target price levels. As mentioned before, you should be able to sleep at night with your positions.

If you are losing sleep, trim down the number of shares you hold and even consider trimming down the number of stocks. Be disciplined with price targets and stop-losses.

Global perspectives: Healthcare investing beyond borders

By researching international trends and investing in foreign companies, you can also diversify your portfolio geographically.

Of course, factors such as demographics, government regulations and health services delivery capacity vary significantly between different markets worldwide. The rise of digital tools like telemedicine has opened opportunities for investing in global firms even from afar, with access to real-time data analytics about patient visits or treatment outcomes just a few clicks away.

International market research firms can provide valuable data points comparing national regulations that govern retail sales, manufacturing and distribution of pharmaceutical and medical products. You can use this to identify healthcare companies in favorable regulatory regions.

For example, India's government has prioritized improving the healthcare system through various initiatives, with plans to allocate 2.5% of GDP by 2025. In 2022, approximately 860 billion Indian rupees were allocated to the Ministry of Health and Family Welfare, and the health tech sector received investments worth $1.7 million in 2021. By 2022, India's healthcare market is estimated to reach up to $372 billion and is one of the largest revenue and employment growth sectors.

You can also consider investing in international healthcare ETFs. These funds hold a diversified portfolio of healthcare stocks from multiple countries and can provide access to companies you won't find on traditional U.S. exchanges.

ESG considerations in healthcare investments

Environmental, social and governance (ESG) factors are increasingly important in healthcare investing. ESG examines how companies balance economic progress with human rights, climate change action, environmental stewardship and workplace practices.

You can use metrics like water usage or carbon emissions to assess the sustainability of certain products, processes or services offered by a medical firm before making an investment decision. Investors can also review corporate policies for diversity and inclusion, access to high-quality care building on existing public health initiatives, ethical distribution and promotion of necessary medications versus luxury items. Governments worldwide are beginning to impose stricter regulations mandating transparency around healthcare spending.

Risk vs. reward: Navigating the healthcare investment landscape

Investing in healthcare can be lucrative and rewarding but comes with risks. Healthcare companies move quickly to keep up with changing regulations, increasing competition, technological breakthroughs, pandemics or other events that can affect their operations and bottom line.

By understanding these potential pitfalls and the nuances of fundamentals like product pipelines or reimbursement models when selecting stocks; you can create a portfolio that offers tremendous rewards yet mitigates risk through diversification.

Technological disruption: The role of health tech

The healthcare industry is undergoing a disruptive transformation. Innovations such as telemedicine, AI, remote monitoring, wearables, and gene editing are transforming patients' care. Companies are bringing new treatments to the market.

Healthtech has opened up new possibilities for investment with some promising potential returns. For instance, AI can automate routine tasks in hospitals or practices, freeing up personnel time; genomic sequencing can revolutionize drug discovery; medical devices with sensors let doctors and nurses monitor patient data remotely and reduce trips to the hospital. By evaluating health tech startups and established companies, you can uncover investment opportunities that can benefit your portfolio.

One example of a successful health tech company is Teladoc Health Inc. NYSE: TDOC. Its telemedicine platform connects users with doctors remotely, offering a more efficient, convenient and cost-effective alternative to traditional in-person visits. The COVID-19 pandemic has also accelerated telemedicine and made the sector more appealing. Of course, not all health tech startups or companies will be successful. Be aware of any regulatory limitations that may impact a company's ability to bring solutions to market. Make sure to research their product pipeline and business model before investing.

Regulatory landscape and policy impacts

Government policies and regulations can influence the healthcare sector. Drug pricing reform, data privacy laws and reimbursement models affect corporations' bottom lines and patient access to care. For example, U.S. drug manufacturers' decisions to cut off 340b drug pricing programs to avoid government penalties — and the subsequent response — greatly impacts the companies.

As a healthcare investor, you must stay abreast of regulation changes through reviewing guidance issued by organizations like the Food and Drug Administration (FDA) or the European Medicine Agency (EMA). Also research government rules on data privacy and intellectual property protection when entering the healthcare market. Policies can have far-reaching implications on investments.

Vertically integrated healthcare companies

Healthcare is an industry that is constantly in a state of consolidation. This consolidation has brought together companies that wouldn't have merged in the past.

For example, medical providers provide medical services and medical payers, like health insurance companies, make payments for those services. The industry's evolution has created vertically integrated organizations with multiple industries under one roof, including medical providers, medical payers, pharmacies, medical labs, research departments, hospitals and facilities. These are some of the more stable dividend-paying mega-cap stocks you can hold long-term.

Before you consider Teladoc Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teladoc Health wasn't on the list.

While Teladoc Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report