HCA Healthcare Today

HCA

HCA Healthcare

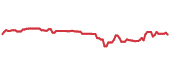

$335.87 +11.25 (+3.47%) As of 03:59 PM Eastern

- 52-Week Range

- $289.98

▼

$417.14 - Dividend Yield

- 0.86%

- P/E Ratio

- 15.29

- Price Target

- $381.67

The nation's largest hospital operator, HCA Healthcare Inc. NYSE: HCA, surged to all-time highs following its strong Q2 2024 earnings results. The dramatic growth in acute care services has driven hospital stocks to new highs, often at the expense of health insurers. Acute care services are usually short-term and intensive hospital-based services that include the emergency room (ER) or intensive care unit (ICU), encompassing surgery, trauma, and maternity care. These are expensive trips that usually require specialized equipment and a team of healthcare providers.

HCA Healthcare operates in the medical sector, competing with hospital operators such as Tenet Healthcare Co. NYSE: THC, Community Health Systems Inc. NYSE: CYH, and Universal Health Services Inc. (UHS).

The Acute Care Surge Phenomenon and What It Means for HCA

If you haven't noticed, hospital stocks are trading at record levels these days. HCA Healthcare stock is up 31%, outperforming the S&P 500 Index, which is up 14.54%. This can feel disjointed when health insurance stocks like Humana Inc. NYSE: HUM and CVS Health Co. NYSE: CVS are trading down 14.2% and 22.7% year-to-date (YTD), respectively. The phenomenon is caused by the unexpected dramatic surge in acute care (sometimes referred to as inpatient utilization) that started in the second half of 2023. This caused Humana to issue a surprise guidance cut after experiencing a spike in inpatient utilization among its Medicare Advantage plan members.

HCA Completes a Cup Pattern to New Highs

The daily candlestick chart for HCA illustrates a cup pattern. This cup lip line formed at $343.93, which was double top resistance. HCA peaked out there on June 28, 2024, as shares fell to a swing low of $312.67, where it formed a rounding bottom. HCA staged another rally back to retest the cup lip line and finally triggered the breakout following its Q2 2024 earnings release. The daily relative strength index (RSI) has risen to the 70-band. Pullback support levels are at $343.94, $335.83, $322.36, and $312.67.

HCA Healthcare Crushes Top and Bottom Line Estimates

HCA Healthcare reported Q2 2024 EPS of $5.50, beating consensus estimates by 57 cents. Revenues rose 10.3% YoY to $17.49 billion, beating $17.05 billion consensus analyst estimates. Adjusted EBITDA totaled $3.55 billion compared to $3.056 billion in the year-ago period. Cash flows from operating activities were $1.971 billion.

The same-facility growth metrics give an idea of the growth in acute care services. Same-facility admissions grew 5.8% YoY, and same-facility equivalent admissions rose 5.2% YoY. Same-facility emergency room visits rose 5.5% YoY. Same-facility inpatient surgeries rose 2.6% YoY, while same-facility outpatient surgeries fell 2.1% YoY. Same-facility revenue equivalent admissions increased 4.4% YoY.

HCA Healthcare: Raising the Bar for Full-Year 2024

HCA Healthcare revised and raised its full-year 2024 guidance. Revenues were guided higher to $69.75 billion to $71.75 billion, up from the previous estimate of $67.75 to $70.25 billion, versus $69.73 billion consensus estimates. Net income attributable to HCA Healthcare Inc. was raised from $5.675 billion to $5.975 billion, up from $5.2 billion to $5.6 billion. Adjusted EBITDA was raised from $13.75 billion to $14.25 billion, up from previous guidance of $12.85 billion to $13.55 billion. Full-year 2024 EPS estimates were raised to $21.60 to $22.80, up from previous guidance of $19.70 to $21.20 versus $20.92.

Invest in HCA as CEO Highlights Revitalization Success

HCA Healthcare MarketRank™ Stock Analysis

- Overall MarketRank™

- 96th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 13.6% Upside

- Short Interest Level

- Healthy

- Dividend Strength

- Weak

- Environmental Score

- -0.92

- News Sentiment

- 0.94

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 12.21%

See Full AnalysisHCA Healthcare CEO Sam Hazen noted that the 2% decline in outpatient surgeries in the first quarter was due to lower volumes in Medicaid and self-pay categories. ER volumes increased due to strong growth in cardiac procedures and inpatient rehab services. The acuity of inpatient services was reflected in the case mix index, which increased slightly over last year, helping generate same-facility revenue growth of 10% YoY.

Hazen commented on ER growth, “Our commercial volumes in the emergency grew almost 18%. So really strong growth in that category. Again, we are focused on throughput, patient satisfaction, and high clinical performance with what we call our ER revitalization program. And our ER revitalization program has produced positive results for us.” This program consists of boosting efficiency and cutting down times, such as seeing a patient from 11 minutes to 9 minutes. The length of stay for discharged patients is down 15% to 20% and is around 160 minutes.

HCA Healthcare analyst ratings and price targets are at MarketBeat. There are 19 Wall Street analyst ratings on HCA stock, comprised of one Strong Buy, 14 Buys, and four Holds.

Before you consider HCA Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCA Healthcare wasn't on the list.

While HCA Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.