Helen of Troy Is Ready To March Higher

Shares of Helen of Troy NASDAQ: HELE are up more than 5% after the company revealed it dodged a bullet. The EPA took offense at some packaging late last year and that impacted the company's operations. Not only were sales impacted but higher costs were incurred cutting into both the top and the bottom lines. The news today is that those issues are largely behind the company, the ultimate impact was far less than anticipated, and sales are bouncing back smartly. Assuming the recovery continues on the same trajectory, we see this stock breaking out to new highs very soon and continuing the uptrend that began way back in 2018.

“The EPA did not raise any product quality, safety, or performance issues. As previously disclosed in August 2021, the Company largely resolved the EPA matter with modest changes to product labeling and began executing repackaging plans for the bulk of the affected products. The Company expects to ramp up to normalized shipping activity for the vast majority of affected products at various timeframes during the third quarter.”

Helen of Troy Destroys The Consensus Estimate

Helen of Troy reported negative impacts from the global supply chain issues and inflation being reported by everyone else but those impacts were negligible compared to the company's revenue and earnings strength. The company reported $475.22 in consolidated revenue which is down 10.5% from last year but beat the Marketbeat.com consensus by 1100 basis points. Last year, sales surged 28% in the wake of the pandemic shutdowns so some giveback was expected. 10% sounds like a lot but sales are still up 14.8% versus fiscal 2020. The revenue strength was driven by demand as well as the resumption of sales of products impacted by the EPA issues. On a core basis sales are down only 7.6% from last year and are up 20.6% versus 2 years ago.

“We generated adjusted diluted EPS of $2.65 despite the significant impact of widespread inflation affecting nearly all input costs, including materials, labor, and transportation, and despite the lower Health & Home sales in the quarter due to the EPA matter,” says CEO Julien R. Mininberg.

Moving down the report there is some margin pressure evident but revenue strength was still able to show up on the bottom line. On a GAAP basis, the operating margin fell by 450 basis points while on an adjusted basis it fell a slightly smaller 330 basis points. On the bottom line, the GAAP earnings of $2.11 beat the consensus by $0.35 while the adjusted earnings of $2.65 fell nearly 30% from last year but beat the consensus by $0.41.

Looking forward, the company is expecting revenue and earnings strength to continue into the second half of the year and for margins to widen at least a little. The company is now expecting revenue in the range of $ 2.029 billion to $ 2.067 billion versus the consensus of $2 billion, and EPS of $11.26 at the low end of the range compared to the consensus for $11.00.

“Our strong balance sheet provides dry powder to further accelerate long-term value creation by capitalizing on potential acquisition opportunities and affords us the ability to opportunistically buy back our stock.”

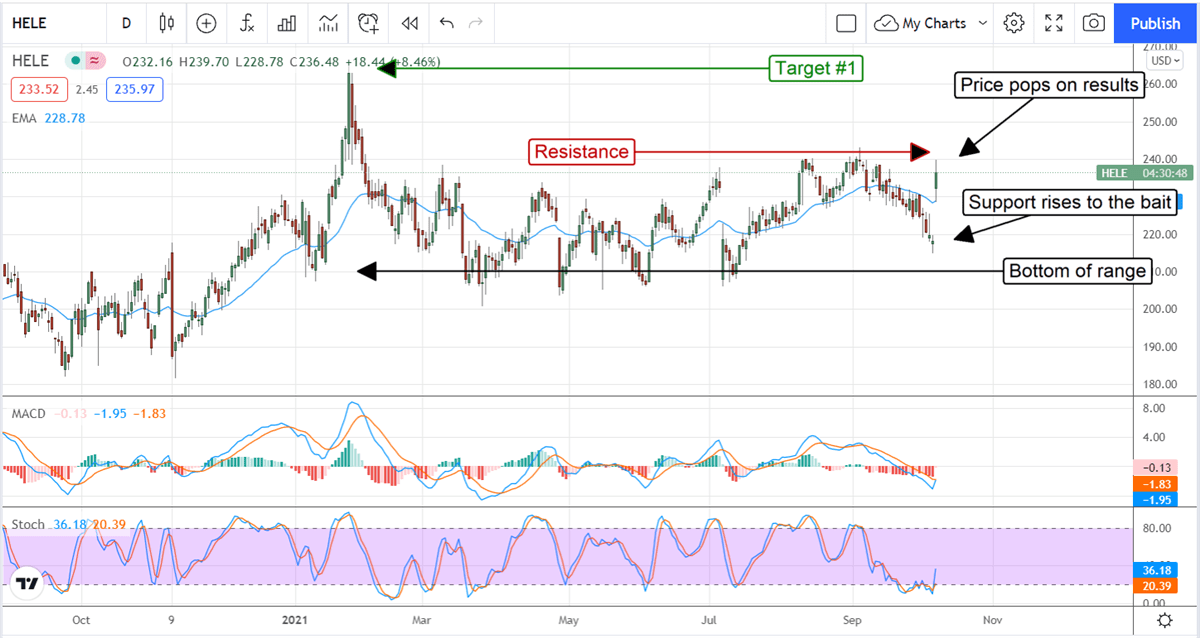

The Technical Outlook: Helen Of Troy Will Soon Retest All-Time Highs

Price action in Helen of Troy surged in the wake of the Q2 earnings report and confirmed support at the bottom of a trading range. Price action is also confirming support above the short-term moving average and indicates to us a move higher. There may be some resistance at the $240 level but we expect it to be surpassed in the near term. Near to midterm, we expect to see price action continue higher and retest the all-time highs near $260 before the end of the year and then possibly break out to new all-time highs in early 2022.

Before you consider Helen of Troy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Helen of Troy wasn't on the list.

While Helen of Troy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.