Artificial intelligence (AI) has hit the mainstream with fervor. Specifically, generative AI has gone viral with the explosion in ChatGPT users. However, that may have hit a peak as traffic started to unwind in June 2023 as ChatGPT traffic fell off for the first time since its launch. AI is still evolving with its applications and use cases. One area that has materially gained from AI is the drug discovery segment.

AI Optimizing Drug Discovery

AI has optimized the tedious, complex task of finding targets, matching millions of potential combinations and indications to derive treatments that can take upwards of $2.5 billion and 10 to 15 years to bring a drug to market successfully. AI-powered drug discovery saves time and costs by speeding up the discovery, analysis, preclinical testing and clinical trials process. It can predict the safety and efficacy of new drugs even before clinical trials commence.

Here are three of the most promising AI drug discovery companies on your radar.

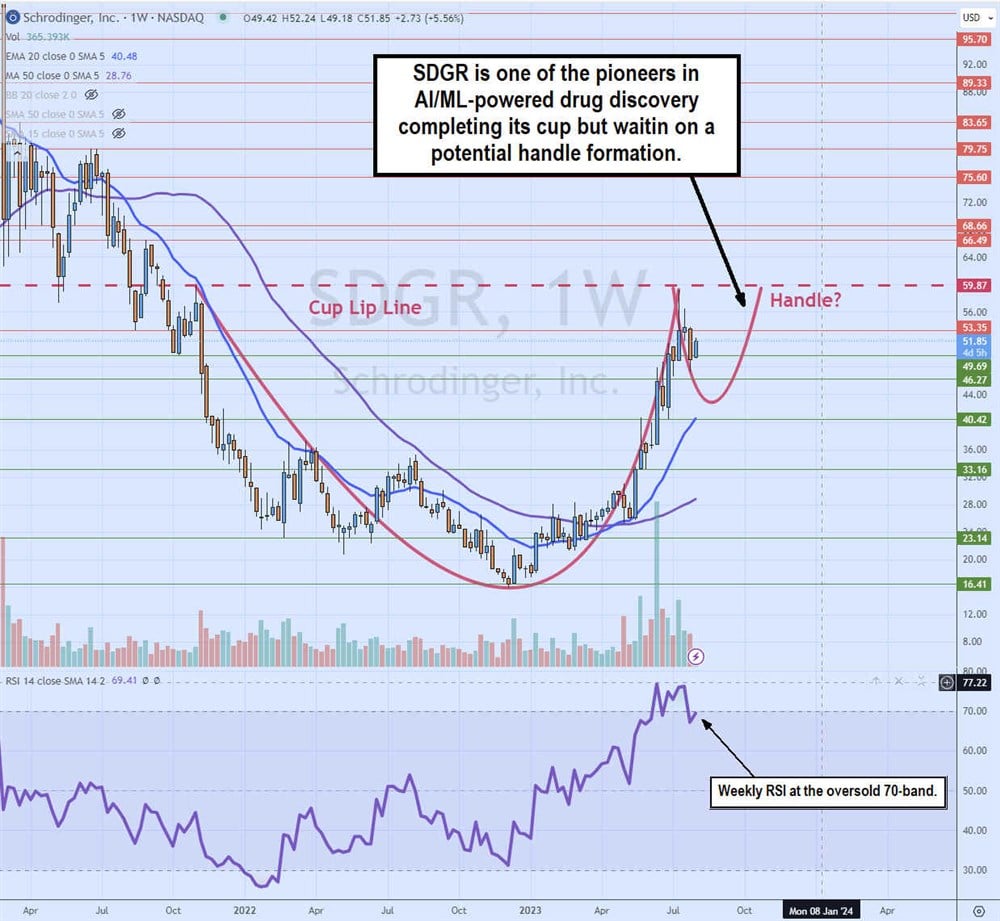

Schrodinger is one of the oldest leading drug discovery companies. It was started in 1990 and is based in New York. It operates two segments Software and Drug Discovery. Its cloud-based AI and machine learning (ML) platform helps researchers and scientists create and design new drugs by predicting interactions of molecular properties.

Its technology can dock small molecules to proteins and simulate their behaviors. The company already has two FDA-approved drugs, Obxbryta for sickle cell, approved in 2019, and Accolate for asthma in 1998. It has various oncology and immunology treatments in its pipeline like SGR-1505 to relapse/resistance non-Hodgkin's lymphoma, SGR-2921 for solid tumors and hematological cancers, SGR-3515 for gynecological cancers and LRRK2 for Parkinson's disease.

Schrodinger analyst ratings and price targets are at MarketBeat.

Recursion Pharmaceuticals NASDAQ: RXRX

Recursion made big headlines and a monstrous spike on news of a $50 million PIPE investment from NVIDIA Co. NASDAQ: NVDA. Recursion has over 23 petabytes of proprietary biological and chemical data on its Recursion Data Universe. Its Recursion Map has hundreds of billions of searchable chemistry and biological inferences supporting millions of weekly wet lab experiments. These are lab experiments using "wet" materials, which are chemical, liquid, biological and fluid samples.

Some of the common wet labs include cell cultures, DNA sequencing, gene expression analysis, protein purification and drug discovery. Recursion has four clinical trials and many preclinical projects targeting cancers and diseases.

It beefed up its AI with the $87 million combined acquisition of digital chemistry suite Cyclica and AI/ML chemistry prediction company Valence. Recursion will use NVDIA's BioNeMo platform for commercial licensing and release of its AI models.

Recursion Pharmaceuticals analyst ratings and price targets are at MarketBeat.

UK-based Exscientia is a pharmatech AI drug discovery company developing small molecule targets for hematological and inflammatory diseases, Alzheimer's and various cancers. The company pioneered personalized precision medicine to target specific receptors instrumental in inflammation, pain and cancer.

Some of its big-dollar collaborations include a lucrative partnership with Sanofi NASDAQ: SNY to develop up to 15 small molecules worth up to $5.2 billion in milestone and royalty payments.

Sanofi provided $100 million in upfront payments with the potential to earn up to $343 million per small molecule, comprised of $193 million for research and development and upwards of $150 million for achieving commercial milestones.

Bristol Myer-Squibb PKC-theta Targeting

Exscientia also partners with Bristol Myers-Squibb Co. NYSE: BMY, targeting a key protein instrumental in many inflammatory, immunological and autoimmune diseases called PKC-theta. It's also collaborating on a promising therapy to reduce amyloid plaque in the brain, which is believed to be a main contributor to Alzheimer's disease. Its EXS74539 has shown some success in animal models of Alzheimer's by improving cognitive functions.

Collaboration with GT Apeiron

Its latest milestone is enrolling the first human patient in its trials of ELUCIDATE for treating advanced solid tumors in colorectal, hand and neck, breast and ovarian and non-small cell lung cancer patients. This is achieved by blocking the CDK7 protein. It's partnered with Chinese biotech company GT Apeiron on the study.

Exscientia analyst ratings and price targets are at MarketBeat.

Before you consider Schrödinger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Schrödinger wasn't on the list.

While Schrödinger currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.