Last week shares of Carvana NYSE: CVNA broke out of a daily consolidation and soared higher. Although shares of the company started the week off in the negative, closing the day down over 4% yesterday, the stock remains up 65% over the last three months and over up over 200% YTD.

While there was indeed a catalyst that drove the price of CVNA higher last week, another catalyst, one less spoken about, contributed to the surge in share price.

Carvana is a used-car dealer that operates nationwide and is well-known for its chain of used car vending machines. The company operates an e-commerce platform that provides an end-to-end buying experience. Carvana experienced a meteoric rise and shareholders an enormous return. However, that soaring share price came crumbling as legal issues began to mount against the company in 2021, and concerns over the company’s dangerous debt levels grew.

The First Catalyst: Credit Upgrade

Last week, Carvana received a credit upgrade on its auto loan securitizations. The company received S&P Global Ratings upgrades and revisions of securitization loss assumptions due to capital structure, de-leveraging, and outperformance of S&P initial assumptions.

S&P Global Ratings increased its ratings on 21 classes across seven Carvana-sponsored securitizations that are supported by prime auto loans. In addition to that, it also maintained its ratings on 19 classes from the same transactions.

The S&P Global Ratings upgraded its rating on 15 classes within five Carvana-sponsored securitizations backed by non-prime auto loans and affirmed its ratings on nine classes from these transactions.

Carvana and the industry welcomed the upgrades, pointing towards stabilizing Carvana’s business model and the automotive industry.

The Second Catalyst: Short Interest

As of May 15, 2023, the short interest in CVNA was 25.52% or 48.2 million shares. That figure is likely higher after the recent surge in share price.

As a turnaround might be in motion for the company, and the stock is up significantly YTD, the unusually large, short interest becomes a clear catalyst and motivation for higher prices.

The positive news last week, combined with the significant short interest, accelerated the up move. As many short sellers have positioned themselves to gain from a further price decline, a short squeeze becomes a real possibility now that positive news has come out and the stock has begun to rise.

The surge in buying pressure led by short-sellers scrambling to cover their position has already and will continue to create a demand-supply imbalance resulting in a rapid rise in the company’s share price.

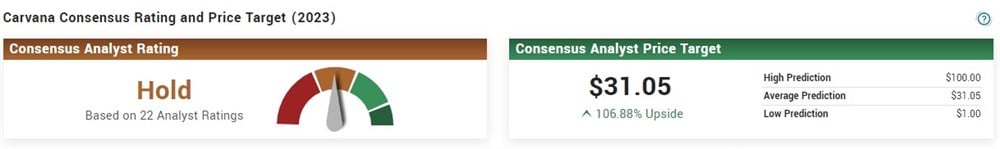

Snapshot of Analyst Ratings

Based on 22 analyst ratings, CVNA currently has a Hold rating. Of those 22 ratings, 18 are Hold, 2 are Buy, and 2 are Sell. The consensus PT is $31.05, predicting over 100% upside for the stock.

Since topping out, analyst ratings have fallen as fast as the share price, and now the ratings appear to have bottomed out like the share price.

Most recently, Morgan Stanley initiated coverage of Carvana with an Equal-Weight rating and PT of $12.

What’s Next For Carvana?

CVNA investors will feel optimistic and perhaps even relieved in the short term. The positive news last week indeed points towards a turnaround for the company, and the high short interest has the potential to accelerate an already impressive share performance.

However, concerns remain over the company’s balance sheet and FCF, which still appear to outweigh the short-term positives experienced last week.

Current and prospective investors should watch for upcoming quarters and significant improvements to Carvana’s income statement, which would serve as solid evidence that the long-awaited financial improvements and sustainability have arrived.

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.