Shares of iconic donut and coffee shop retailer Dunkin’ Brands Group, Inc. NASDAQ: DNKN have nearly recovered back to its February 2020 pre-COVID highs powered by the recovery of the benchmark S&P 500 index NYSEARCA: SPY. The Company was able to operate most stores during the height of the pandemic pushing forward with store upgrades to boost operating efficiencies. As the restart narrative for peers like Starbucks NASDAQ: SBUX gains momentum as more commuters take to the roads heading back into offices, shares should recover as top-line resumes growth moving forward. This asset-light recovery play deserves a closer look as the restart narrative sees money rotating into the dining industry. Prudent investors may also get opportunistic pullback entries as the SPY enters a contraction period.

Q2 FY 2020 Earnings Release

On July 30, 2020, Starbucks released its second-quarter fiscal 2020 results for the quarter ending June 2020. The Company reported an earnings-per-share (EPS) profit of $0.49 excluding non-recurring items matching consensus analyst estimates of $0.49 EPS. Revenues fell (-20%) year-over-year (YoY) to $287.4 million but beat consensus estimates of $275.52 million. Domestic same-store sales dropped (-18.7%) YoY due to COVID-19 impacts, but average ticket sales were higher due to more family-size bulk orders. Baskin-Robbins domestic same-store sales fell (-6%) offset by higher average tickets due to rise in take-home products including ice cream cakes and quarts. The Company will be closing 800 Dunkin locations including the 450 Speedway locations previously announced as part of its real estate portfolio rationalization. This represents a (-8%) of its U.S. stores and approximately 2% of Dunkin 2019 systemwide sales. The permanent shutdowns represent locations with low weekly sales that can’t support the next-gen remodeling or add a drive-through. Dunkin has surpassed over $1 billion in retail sales for its packaged coffee and K-cup sales. The Company has reinstated its quarterly dividend of $0.4025 per share, underscoring the acceleration of its recovery.

Recovery is Well Under Way

As of the Q2 conference call, 96% of Dunkin stores in the U.S. are open and operating. The $2 to $5 value-priced options are a favorite way to drive new customer traffic. The recovery is well underway indicated by the recovery in YoY sales. The pandemic peak in April saw (-32%) YoY sales followed by recovery to (-17%) in May and only (-9%) in June. Through the week ended July 25, the sales drop was only low single digits underscoring an accelerated recovery.

$2 Dunkin Refreshers Driving Growth

The $2 Dunkin Refreshers is a key driver for high trial and new customers making it the single most successful launch since its Cold Brew offering in 2016. This was a gateway for new customers to migrate to the On-the-Go mobile ordering and DD Perks app-based loyalty program. The Perks loyalty enrollment grew 110% YoY with Perks transactions growing to 20% of rooftop sales. Dunkin Refreshers have a proven a high attachment (add-on) rate of 70% with the average check around $7. The Company also noted that a significant number of loyalty program users purchased Dunkin Refreshers in addition to their usual beverages. The mid-day Dunkin snack products like Croissant Stuffers and Snackin’ Bacon have “paired perfectly” with the iced beverages carrying an attachment rate of greater than 95% according to Dunkin President of the Americas, Scott Murphy.

Dunkin franchisees are seeking to hire 25,000 new employees as restarts accelerate. Same-store sales have been improving sequentially.

Next Generation Store Remodels

Even before COVID-19, Dunkin had been well underway with the NextGen remodels which include new smart expresso and beverage machines and layout designs. During the second quarter, 34 restaurants completed NextGen upgrades bringing the total to 700 restaurants. NextGen implements faster contactless service and higher quality products with higher margins from cost-savings. Almost 90% of NextGen Dunkin restaurants are outfitted with a drive-thru. During the pandemic, the drive-thru business had seen unprecedented traffic as drive-thru stores vastly outperformed non-drive thru locations pushing some locations into positive YoY comps on the last two weeks of Q2. Delivery options are also available for 93% of locations through Uber Eats NASDAQ: UBER. Prudent investors looking for a consistent narrative recovery play should monitor Dunkin for opportunistic pullback entries.

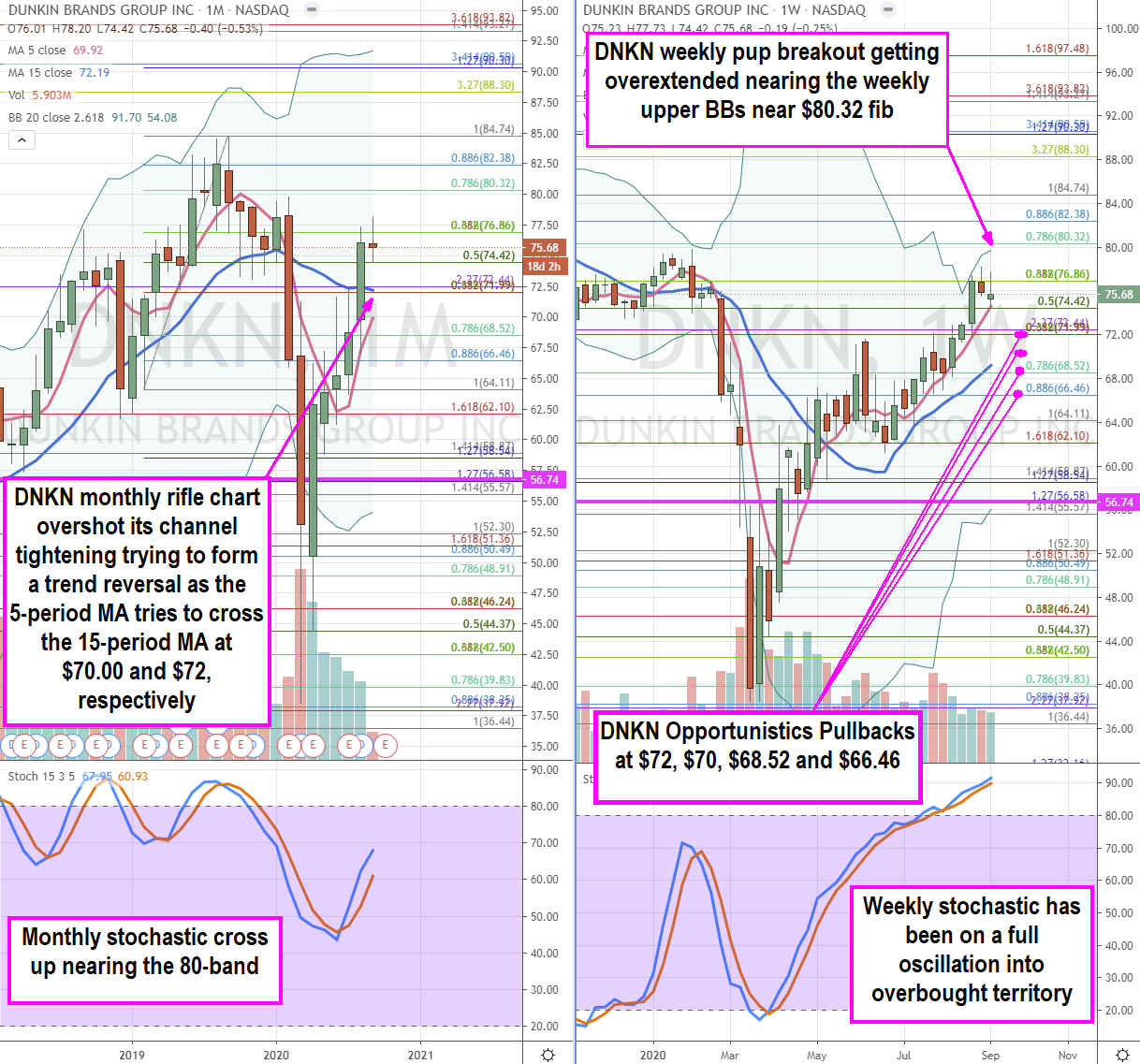

DNKN Opportunistic Price Levels

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for DNKN stock. The monthly rifle chart completed a channel tightening overshooting the 15-period moving average (MA) at $72 while the 5-period MA is steadily rising. Usually, reversions will form back to these bumpers when shorter time frames peak out. The monthly and weekly rifle charts both triggered a market structure low (MSL) buy trigger above $56.74. This fueled the weekly stochastic mini pup grind that also turned into a weekly pup breakout at the $66.46 Fibonacci (fib) level. The weekly stochastic is nearing the 100-band targeting the upper Bollinger Bands near the $80.32 fib. A market structure high also formed under the $74.42 fib, which can set up opportunistic pullback levels at the $72.00 monthly 15-period MA and overlapping fib, $70.00 monthly 5-period MA, $68.52 fib and $66.46 fib. The SPY ETF may be forming a near-term weekly top setting up a reversion sell-off. As the technology leaders also sell-off, money flow may be seeking shelter in the hardest-hit segments like travel, leisure, dining, and entertainment. This can drive shares of DNKN higher before a pullback, so its best to be patient and agile.

Before you consider Dunkin' Brands Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dunkin' Brands Group wasn't on the list.

While Dunkin' Brands Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.