The

Nasdaq 100 index NASDAQ: QQQ index has been the star performer of 2020 with a 46% performance. However, 2021 is proving to be a difficult year as year-to-date (YTD) performance went red at (-1.6%). The Nasdaq 100 was home to the

pandemic winners as stay-at-home mandate and lockdowns spawned the acceleration of the migration to digital and cloud. The pandemic accelerated a decade’s worth of migration in less than a year’s time as businesses adopted digital transformation to adapt to work, play, learn, entertain-at-home lifestyles. The return to normal accelerated by

COVID-19 vaccinations spurred a rotation out of growth back into value stocks which were hit the worst during the pandemic. The sell-off in the Nasdaq 100 index has been much worse than the S&P 500 index just because there’s more room for reversion. The market is again going through a price discovery period where it’s trying to figure out which pandemic stocks will remain a part of the “new normal” and which stocks were short-lived beneficiaries of a black swan event.

The Hare Versus Turtle

Markets tend to overshoot extremely setting up reversions that can also turn into strong reversals. The pre-pandemic highs on the QQQ was $237.47. As the QQQ starts to breakdown, it’s important to keep things in perspective. While the Nasdaq 100 beat the S&P 500 performance in 2020, the shoe is on the other foot in 2021 as value is outpacing growth, very anecdotal to the hare versus tortoise tale. The S&P 500 is beating the Nasdaq 100 performance at 2.61% year-to-date (YTD) versus (-1.61%) respectively.

New Normal Stickiness

As rotation into the value stocks concludes, the market will then revert again to the pandemic winners that have transformed into an embedded piece of the “new normal”. The components will be the leaders in the cloud, digital transformation, telemedicine, remote work and engagement, EVs and renewable and zero-emissions energy. The new “sin” stocks will be digital sportsbooks/iGaming and cannabis stocks as cash-strapped states find new revenues streams via regulation rather than prohibition.

Bearish Catalysts

The Nasdaq 100 shares the same fundamental bearish catalysts as the S&P 500 as it pertains to systemic risk. These range from interest rates and geopolitical threats to tariff wars, inflation, credit crisis, and or another pandemic. Some or all of these factors can lean the QQQs lower, but mostly act as the “reason” why the Nasdaq sold off.

QQQ Price Trajectories

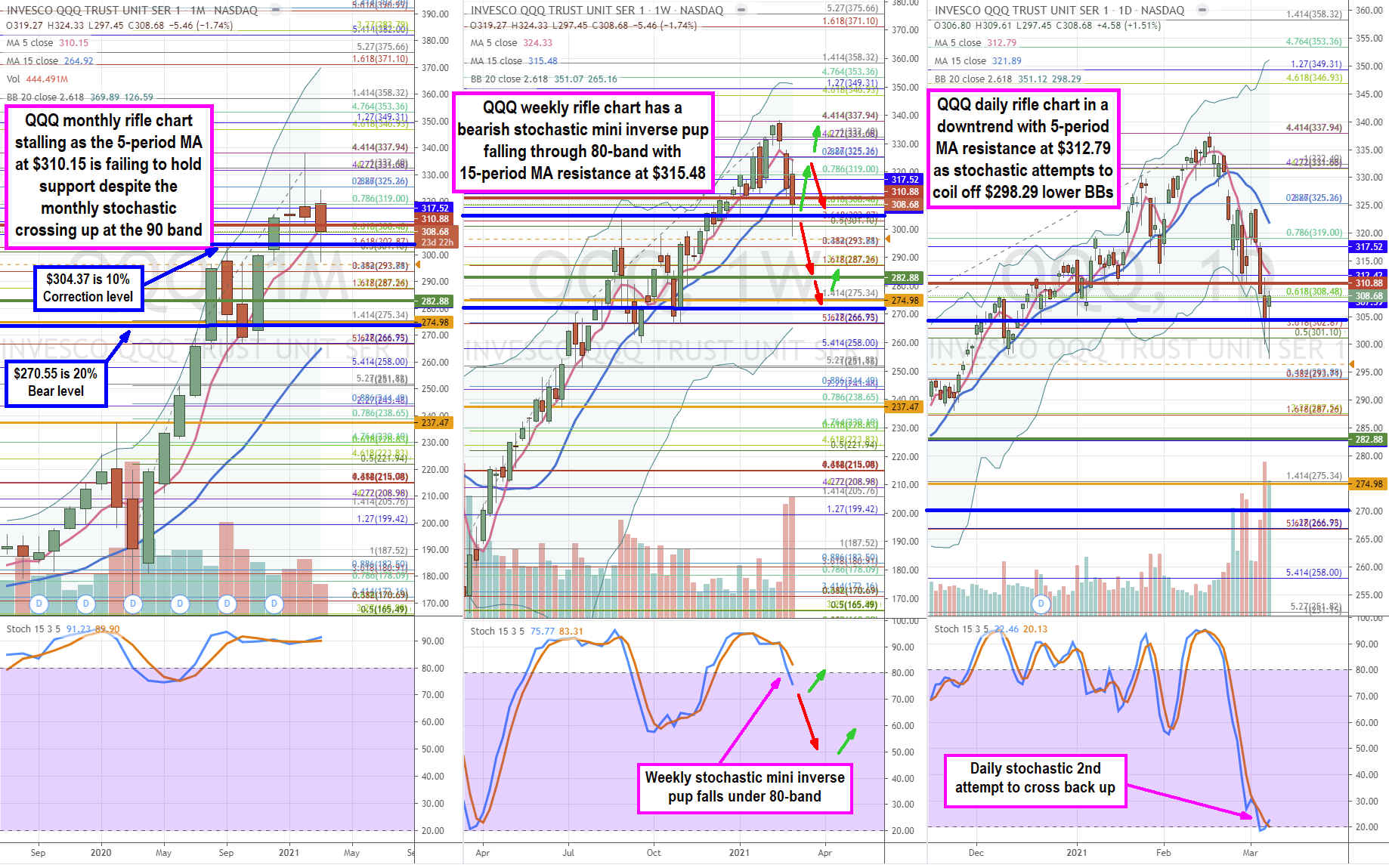

Using the rifle charts on monthly, weekly and daily time frames, we lay out the full near-term to longer-term playing field for the QQQ. The monthly rifle chart has been uptrending since surpassing its pre-COVID-19 highs in June 2020. The monthly uptrend has stalled out as the 5-period moving average (MA) flattens out at $310.55. The February shoot star candlestick sets the tone as March lows set the market structure high (MSH) sell trigger in April. So far, the low trigger has $297.45. The weekly rifle chart peaked out at the $337.94 Fibonacci (fib) level. The weekly 5-period MA is sloping down at $324.33 as the QQQ collapsed quickly through the weekly 15-period MA at $315.48 and has yet to retest that level. The weekly market structure high (MSH) sell triggered under the $310.88. The most dangerous component is the weekly stochastic mini inverse pup fell through the 80-band. The (-10%) correction level at $304.37 was tested and needs to hold support as a failure there can eventually set-up a move towards the (-20%) bear market level at $270.55 in the coming weeks. The daily rifle chart has been in a downtrend with a falling 5-period MA resistance at $312.79 and 15-period MA at $321.89. The daily stochastic is attempting to coil off the 20-band but needs to recover through the daily 5-period MA and 15-period MA to gain traction. The weekly 5-period MA at $324.33 seems daunting but needs to break back up through in order to offset the potential for a weekly breakdown. The near-term trajectory for the QQQ would be a rebound attempt back towards the weekly 15-period MA at $315.48 and 5-period MA at $324.33. The bull case could call for a move towards the daily and weekly upper BBs near $350 upside. If they reject, then a deeper sell-off first towards the $270.55 bear market level and then towards the weekly lower BBs at the $265.15 is the downside trajectory.

Before you consider Invesco QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco QQQ wasn't on the list.

While Invesco QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.