Cloud storage platform Dropbox NASDAQ: DBX stock has been elevated on takeover speculation that started in December 2020. The Company has grown it’s registered user base to over 600 million worldwide spanning over 180 countries. The pandemic has accelerated the need for backing up data, further accelerated by high profile malware and hacking incidents. While shares have seen volatility, they have been tracking the benchmark S&P 500 index NYSEARCA: SPY. The underlying business is remarkably stable and growing. Dropbox has transformed from just storage to smart workspace applications that enables work collaboration, presentation, transfers, storage and syncing across all devices. The Company has much competition from giants like Google NASDAQ: GOOGL, Microsoft NASDAQ: MSFT, Apple NASDAQ: AAPL and Adobe NASDAQ: ADBE, but has grown it’s brand which has enabled it to maintain and expand its market share beyond storage to integrated workflow collaboration. A deeper look into its Smart Workspace application reveals just how much Dropbox has evolved. Prudent investors can watch for opportunistic pullback levels to consider gaining exposure.

Q3 FY 2020 Earnings Release

On Nov. 5, 2020, Dropbox released its fiscal third-quarter 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) profit of $0.26 excluding non-recurring items versus consensus analyst estimates for a profit of $0.19, a $0.07 beat. Revenues grew 13.8% year-over-year (YoY) to $487.4 million beating analyst estimates for $483.64 million. The annual run rate (ARR) rose to $1.981 billion, up 12% year-over-year (YoY). Paid users rose to 15.25 million, up from 14 million YoY. Average revenue per user (ARPU) rose to $128.03 versus $123.15 YoY. Non-GAAP gross margins grew to 80% versus 76.7% YoY. Free cash flow was $187 million versus $102.5 million YoY. The Company ended the quarter with $1.23 billion in cash and short-term investments.

Conference Call Takeaways

Dropbox Co-Founder and CEO, Andrew Houston, provided color on the quarter. Dropbox rolled out new features including Dropbox Passwords, Vault and Backup along with the new Family Plan. The new features provide better value and promote customer retention and conversions in addition to higher engagement and lower churn. The Company’s HelloSign product was recognized as two overall eSignature vendor in G2’s fall report and ranked number one for ease of adoption. This product competes with DocuSign NASDAQ: DOCU. The two new add-on products Creative Tools and Data Migration. “gives customers more choice to construct the product suite that best fits their needs.” CEO Houston summed it up, “Taking work from kickoff to the finish line can often be a complicated multi-step process, particularly for media professionals and today’s tool don’t solve all the problems the creative community faces, while trying to keep their projects on track. That’s why we made investments earlier this year to offer integrations to help take the headache out of creative, post-production and social media workflows.” Dropbox enables Smart Workspaces that integrate with most of the popular programs and suites including Adobe, Office, G Suite and Zoom NADSAQ: ZOOM. The Dropbox app center launched in Q2 to enable users to discover, lead, install and connect apps to their Dropbox account. “Customers will be able to use the Dropbox Zoom app to put together an agenda for an upcoming meeting and make sure everyone is on the same page, before, during and after the meeting.”, noted Houston. The Company aims to deliver operating margins between 28% to 30% with annual free cash flow of $1 billion by 2024, as per Dropbox CFO, Timothy Regan.

Upside Guidance

Dropbox raised its Q4 revenue guidance to a range of $497 million to $499 million versus consensus analyst estimates of $493.09 million with non-GAAP operating margins in the range of 22% to 22.5%. The Company raised its full-year 2020 revenue guidance to a range of $1.907 billion to $1.909 billion versus analyst estimates of $1.89 billion. Free cash flow is expected between $480 million to $490 million, up from $465 million to $475 million. This caused Dropbox shares to gap over $20 the next day before pulling back down to the $18s again in following days.

Takeover Speculation

On Dec. 11, 2020, The Information had floated the next big software merger prospects after Salesforce NYSE: CRMmade a surprise acquisition of work flow collaboration company Slack Technologies NASDAQ: WORK. Speculation of ideal suitors for Dropbox would be either Oracle NYSE: ORCL or ServiceNow NYSE: SERV. The suggestion was compelling enough to drive momentum buyers into Dropbox causing it to squeeze as high as $25.16 before selling off. While there are no grounded confirmations of an acquisition of Dropbox, the run up certainly brought more attention and new investors to the stock. Prudent investors seeking to gain exposure can monitor opportunistic pullbacks to scale in.

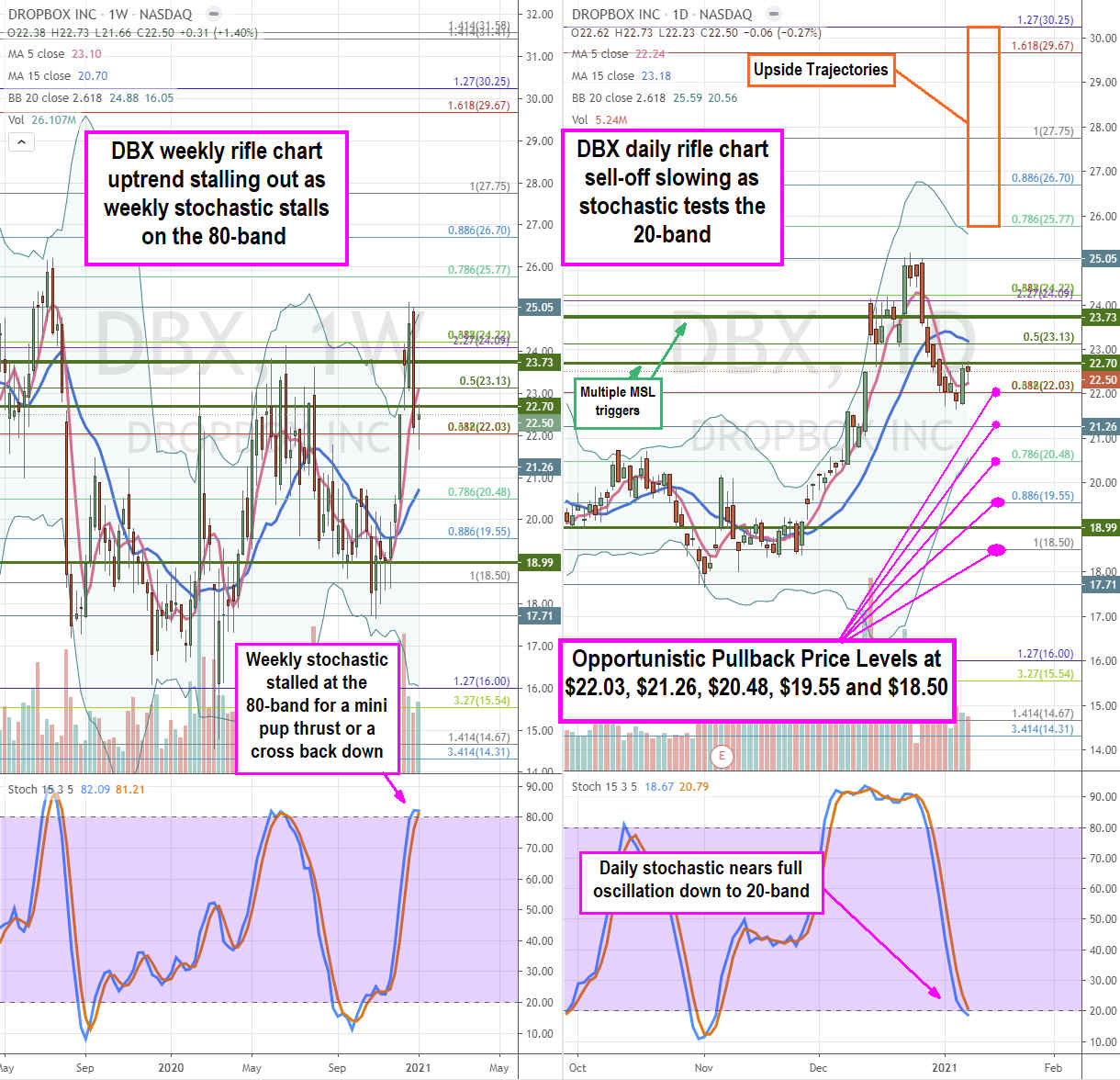

DBX Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a broader view of the price action playing field for DBX stock. The weekly rifle chart has a stalled uptrend as the weekly stochastic stalls at the 80-band. Shares are trading under the weekly 5-period moving average just under the $23.13 Fibonacci (fib) level. While the daily formed market structure low (MSL) buy triggers above $22.70 and $23.43, the weekly formed a market structure high (MSH) sell trigger under the $22.03 fib. The daily rifle chart made a full stochastic oscillation down to the 20-band setting up a make or break if the stochastic crosses up off the 20-band or forms a mini inverse pup lean through the 20-band. Prudent investors can watch for opportunistic pullback levels at the $22.03 fib, $21.26 fib, $20.48 fib, $19.55 fib and the $18.50 fib. The upside trajectories range from the $25.77 fib to the $30.25 fib. It’s also a good idea to watch peer Box, Inc. NYSE: BOX as both stocks move together.

Before you consider Dropbox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dropbox wasn't on the list.

While Dropbox currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.