Social media platform

Snap Inc. NASDAQ: SNAP shares have exploded to the upside since our

article on March 25, 2020, suggested buying shares in the single digits on pullbacks. We unveiled the powerful

pandemic tailwinds that could trigger a breakout for prudent investors. Snap has transformed itself evidenced by two blow out quarters as the Company successfully navigated tailwinds to monetize the benefits. Shares have more than tripled since highlighting the stock and now it’s time to consider ringing the register taking profits into opportunistic exit price levels while the momentum is still strong.

Q3 FY 2020 Earnings Release

On Oct. 20, 2020, Snap released its third-quarter fiscal 2020 results for the quarter ending September 2020. The Company reported an earnings-per-share (EPS) profit of $0.01 excluding non-recurring items versus consensus analyst estimates for a loss of (-$0.05), beating estimates by $0.06. Revenues spiked 52.1% year-over-year (YoY) to $678.67 million and blowing out the $551.36 million consensus analyst estimates. Daily active users (DAUs) were 249 million, up 39 million users or 18% YoY. Average daily Snaps grew 25% YoY. The Company refrained from providing Q4 guidance due to COVID-19 uncertainties.

Conference Call Takeaways

Snap CEO, Evan Spiegel, added more color on the quarterly performance, “the adoption of augmented reality has happened faster than we had previously imagined.” The quarter represented the highest member growth since 2017 as the investment in innovating the camera and augmented reality platform reaped rewards accelerated by pandemic triggered trends. The Company continues to reach over 90% of the Gen Z population and 75% of the combined Gen Z and millennial demographic in the U.S. This was the fourth-consecutive quarter of over 15% growth in YoY DAU. Snap will be launching a more efficient messaging infrastructure to improve speed and efficiency. Lens Studio continues to drive growth of the augmented reality platform as the global community creates rich augmented reality content. Media companies are bringing “top linear TV shows” to the platform driving 80% YoY growth in the average number of Show viewers over 35 years old exceeding 50 million Snapchatters monthly. Sports programming is also surging as over 40% of the U.S. population of Gen Z viewers watch premium sports content on Snap. The growth in Shows enabled the Company to payout 85% YoY more to partners. The Company is leveraging its platform to generate greater engagement driving more monetization. Developers' revenues have more than doubled YoY.

Analysts Bandwagon

While Snap EPS beat estimates, the lack of forward guidance could have rocked the stock, but Wall Street analysts focused on the improving metrics and top-line growth. Over 15 analysts reiterated or upgraded their ratings and price targets on Snap shares after the conference call. This triggered a 20% price gap the following morning that extended gains north of 25%. It also triggered a rally in social media platform peers Twitter NASDAQ: TWTR and Pinterest NASDAQ: PINS.

Upside Overreaction?

While top-line performance and surging DAUs were impressive, the price reaction may have been overdone. There’s no doubt short-sellers got slaughtered on the earnings reaction. Generally, investors are more concerned about upcoming quarters based on guidance as the actual earnings releases are already in the rearview mirror. The barrage of analyst activity magnified the reaction boding the question of whether the momentum can continue to improve. The core demographic is Gen Z with many underage users which could pose problems down the road, not to mention the fickle nature of constant changing preferences. The lack of forward guidance leaves investors to rely on rearview mirror performance metrics which are laggard at best. It’s time to ring the register and cash in some profits at opportunistic exit price levels.

SNAP Opportunistic Exit Levels

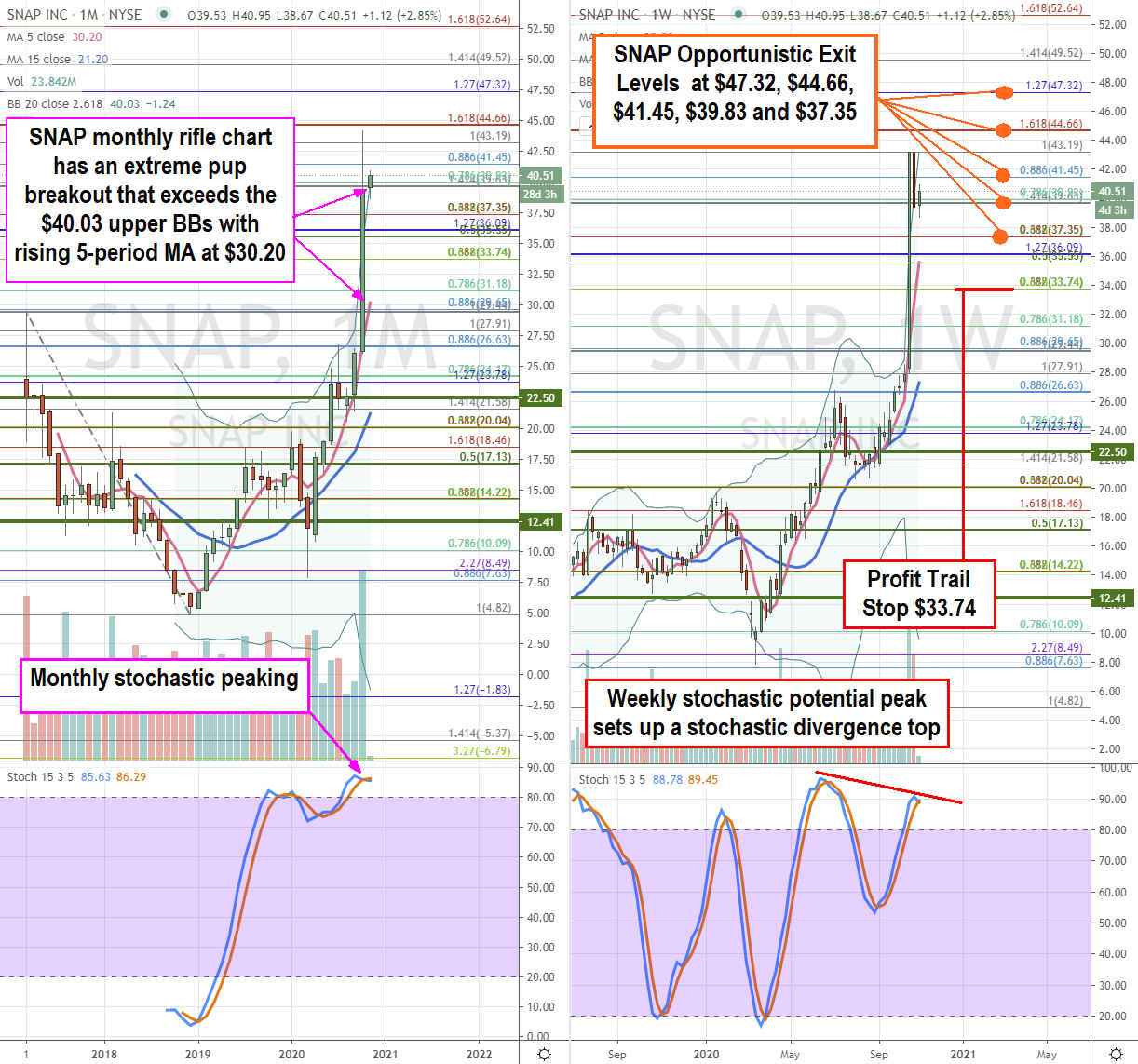

Using the rifle charts on the monthly and weekly time frames provides a broader view of the landscape for SNAP stock. The monthly rifle chart formed a pup breakout as the stochastic mini pup grinded through the 80-band forming an extreme upside breakout that overshot through the upper Bollinger Bands (BBs) at $40.03. Keep in mind that stocks rarely stay above the monthly upper BBs for extended periods of time. Think of it as having no gravity above the upper BBs but gravity kicks in when shares fall back under the upper BBs like a spaceship reentering the earth’s atmosphere. The weekly stochastic could be forming a divergent top if the stochastic crosses back down. Divergent tops are formed when consecutive lower stochastic peaks are made. Investors should use opportunistic exit price levels ranging from the $47.32 Fibonacci (fib) level, $44.66 fib, $41.45 fib, $39.83 fib and $37.35 fib. Profits should be taken on the rise through each fib level or taken off at each level with a final trail stop at $33.74 on the smallest final share position.

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.