Global aluminum and materials products maker

Alcoa NYSE: AA stock has been a stronger performer in 2021 representing the skyrocketing demand in

materials. It’s a key benefactor from the U.S. infrastructure and the

green wave. Aluminum is a key component of the green transition which is causing prices to spike. The higher prices are what tend to move the shares proportionately. The Company’s Q1 2021 earnings release was a blowout yet provides opportunities to scale in on pullbacks as it continues to trade in a seven-point price channel. The

rebound has a long runway thanks to the strength in housing,

consumer demand,

infrastructure rebuilding, and the green agenda. Prudent investors looking to monetize on these tailwinds can watch for opportunistic pullback levels to scale into shares of Alcoa.

Q2 FY 2021 Earnings Release

On July 15, 2021, Alcoa released its fiscal second-quarter 2021 results for the quarter ending June 2021. The Company reported an earnings-per-share (EPS) profit of $1.49 excluding non-recurring items versus consensus analyst estimates for $1.31, an $0.18 beat. Revenues grew 31.9% year-over-year (YoY) to $2.83 billion beating analyst estimates for $2.64 billion. Adjusted EBITDA rose 234% to $618 million versus $601.4 million analyst estimates. The Company ended the quarter with $1.65 billion in cash. The Company expects a strong 2021 based on the continued economic recovery and increased demand in aluminum but expects inflationary pressures on raw materials.

CEO Comments

Alcoa CEO Roy Harvey commented, “Across our Company, we have been working relentlessly to ensure that Alcoa is successful through all market cycles, and this steadfast resilience and consistent performance has allowed us to capture the benefits from strong aluminum pricing and improved customer demand. Today, we have a strengthened balance sheet with lower debt and additional cash to continue to pursue our strategic priorities.”

Conference Call Takeaways

CEO Harvey set the tone,” While we will continue to improve our portfolio of assets, our Aluminum segment saw our companies highest ever third-party realized price. Also, ongoing strength and customer demand and China’s efforts to reform its industry suggests continued strength in global Aluminum pricing. The metal we produce is an important material for the future and more sustainable solutions. We’re ready for that future through existing low carbon products and the development of breakthrough technologies that we’re working to bring to the market. I look forward to discussing this and more”

Outlook 2021

Alcoa CFO William Oplinger chimed in on the Company’s outlook for 2021, “Moving to our outlook for the remainder of the year. Our outlook for the full year 2021 is improving slightly in several areas; shipments, the expected ranges are increasing, 100,000 tons in both the Bauxite and Alumina segments, and increasing 200,000 tons in the Aluminum segment. On the income statement, transformation costs are improving $5 million. In cash flows, there are two expected improvements, pension and OPEB cash funding is expected to be $5 million better, and environmental and ARO spending is expected to be $10 million better than the last time we showed this chart.” He also added, “We will see some partial offsets these benefits as we are seeing cost inflation in the form of higher raw material costs, energy and transportation costs. Finally, with current market prices indicative of another quarter of substantial earnings, we expect our operational tax expense to be over $100 million in the third quarter.”

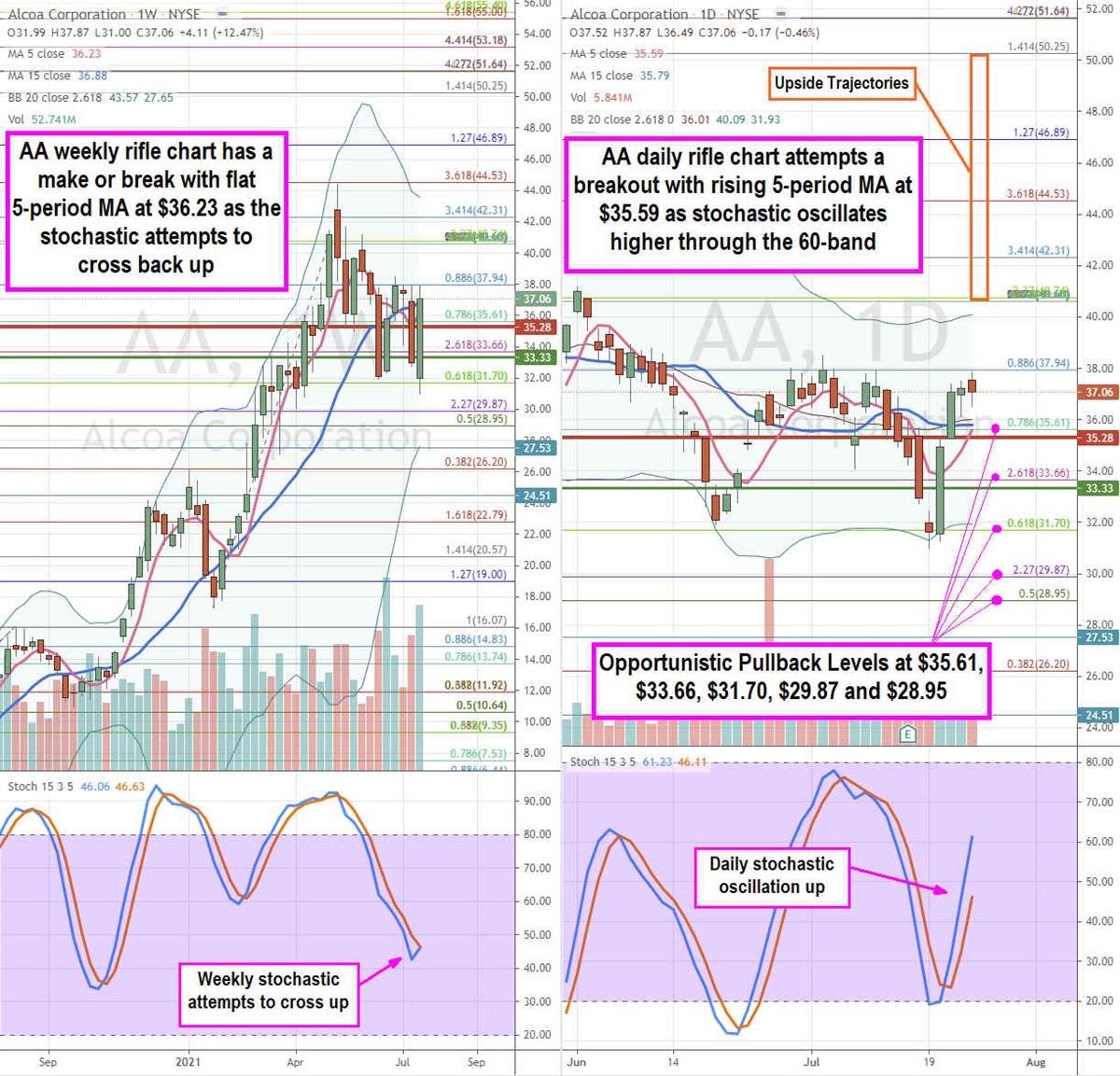

AA Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precision view of the price action playing field for AA stock. The weekly rifle chart uptrend peaked near the $44.53 Fibonacci (fib) level. This formed a weekly market structure high (MSH) sell trigger on the breakdown below $35.28.The weekly 5-period moving average (MA) at $36.23 crossed over the weekly 15-period MA at $36.88 to form a stalled downtrend. The weekly stochastic has been in a down oscillation that stalled and is attempting to cross back up at the 45-band. The daily rifle chart formed a market structure low (MSL) buy trigger on the bounce through $33.33. The daily stochastic is oscillating up as the rising 5-period MA at $35.59 attempts to crossover the 15-period MA at $35.79 to stage a breakout. Prudent investors can monitor for opportunistic pullback levels at the $35.61 fib, $33.66 fib, $31.70 fib, $29.87 fib, and the $28.95 fib. The upside trajectories range from the $40.60 fib to the $50.25 fib.

Before you consider Alcoa, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alcoa wasn't on the list.

While Alcoa currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.