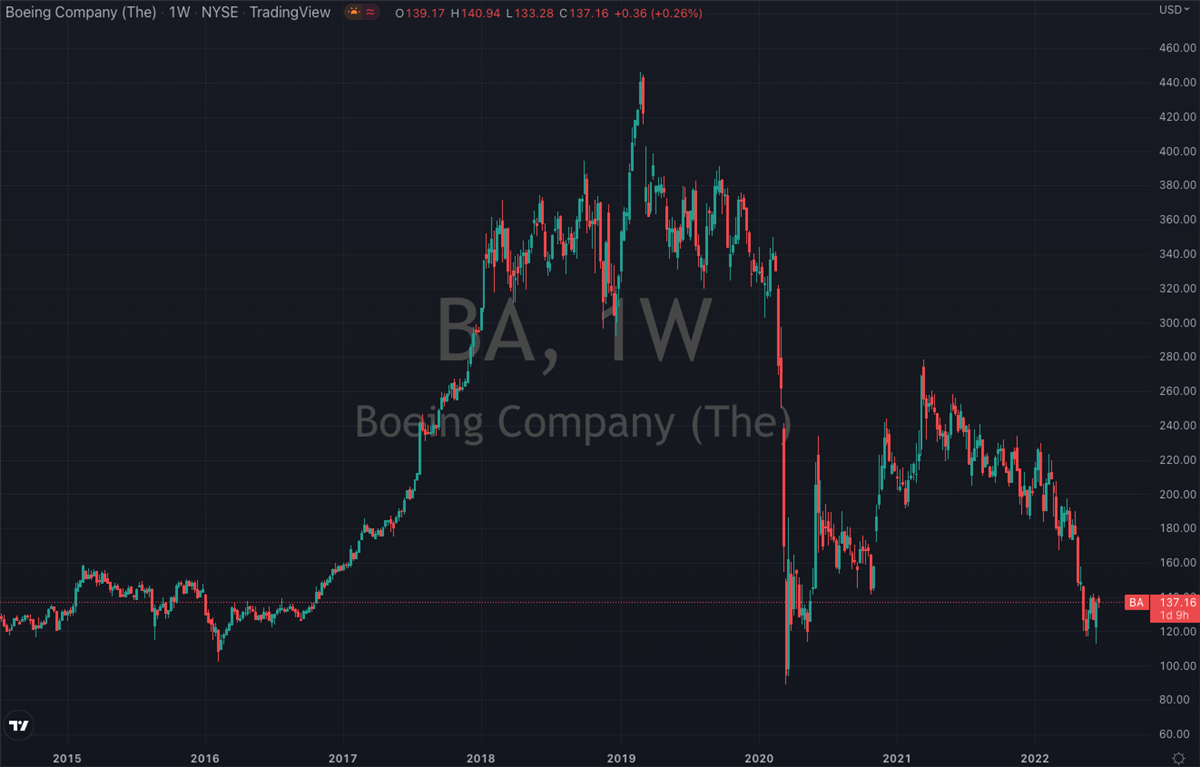

Despite shares of aerospace titan

Boeing (NYSE: BA) trading down as much as 50% over the past twelve months, and being down close to their pandemic lows of 2020, there’s a growing argument to be made for taking the long side. Boeing has gone through more than its fair share of crises in recent years, both internal and external, but it’s starting to look like the horizon is as clear

as it's been in a while.

Late last week the team over at Citi leaned on this as part of their upgrade to Boeing shares, as they moved it from a Hold to a Buy / High Risk. The fresh $209 price target they gave at the same time will be of particular interest to investors, considering shares closed at $137 last night. Indeed, were shares to hit this new price target, they would have rallied more than 50% from their current levels. This should be enough to make all but the most risk-averse of us sit up and take notice.

Fresh Catalysts

Citi analyst Charles Armitage believes the company can work its way through the medium-term risks, and wrote in a note to clients that "If the 737 MAX, 777X (both of reasonable concern to us) and the 787 programs (of less concern) achieve Citi's forecast levels of production and profitability, we estimate fair value to be $209” which is their new price target. Meanwhile, he added that “if the 737 MAX and 777X only achieve our downside case, we estimate the value to be $116, marginally below the current share price. And if all three programs go badly, we see value at ~$84, ~30% below the current price." Armitage expects 787 deliveries to resume soon and for the 737 MAX to return to commercial service, but these factors are "incrementally positive, rather than a step-change in risk."

While Airbus is actually Citi’s preferred global aerospace stock, due to its “materially lower risk”, Boeing will likely be both more accessible and more attractive as a US stock to most retail traders. Still, the company has lost ground to its main rival, with the European manufacturer leading the delivery race in May with 237 versus Boeing’s 165. But with shares having recently bounced off their lowest level since March 2020, it’s clear that the risk-reward profile is starting to become more palatable here than it has been in a long time.

It was reported last week that China Southern Airlines conducted test flights with a Boeing 737 MAX jet for the first time since March. A MAX jet reportedly took off from Guangzhou and landed two hours later in the city of Nanyang in central China, before returning to Guangzhou in the evening. This, in tandem with the recent news that 787 deliveries are due to be restarted in the very near future, is as good a catalyst for sparking a rally as any. Goldman Sachs analyst Noah Poponak noted with the 787 delivery update that “a 787 resumption would clear a significant overhang on the stock, by unlocking substantial cash flow currently tied up in 787 unit inventory, providing visibility into higher future production rates, and diminishing investor concerns around capital structure”.

Getting Involved

So while shares may have a long way to go before they’re back at their 2019 highs, it’s fair to say they’re more likely to trend up than down in the coming months. From a technical perspective they’ve put in a hard low just under the $120 mark, which is right along the line of support that they held between 2013 and 2016. Indeed, that support level was only briefly broken during the pandemic driven sell-off of in March 2020. Looking at the stock’s relative strength index (RSI), we can see it’s moving up from the low 20s of last month which indicated severely oversold conditions. Even with the 20% jump in shares seen since then, the RSI is still only at 50 so we can’t even start thinking about calling the current pop close to being overdone.

Look for shares to hold onto their gains, and certainly the $120 level, in the coming weeks. Assuming Boeing can avoid any fresh disasters, it’s fair to expect a new uptrend to begin that will hopefully see them into 2023 and beyond.

Before you consider Boeing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boeing wasn't on the list.

While Boeing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.