Enterprise server and services giant Hewlett Packard Enterprise Company NYSE: HPE stock is benefitting from the reopening trend as workers return to offices. The enterprise-focused IT provider is a benefactor of the reopening trend as organizations no longer see digital transformation as an option but an imperative. The Company is benefitting from the pandemic induced acceleration of digital and cloud innovation and migration. The acceleration of COVID vaccinations should continue to bolster topline growth across its seven business segments including its server business Compute, High Performance, and Mission Critical Systems, Storage, Advisory and Professional Services, Intelligent Edge, Financial Services, and Corporate Investments. The cumulative effect of the business segments results in a behemoth in the IT segment benefiting from the return to work, digital transformation, and cloud connectivity tailwinds moving forward. Prudent investors seeking a play in the aforementioned segments can watch for opportunistic pullbacks in shares of HPE.

Q3 FY 2021 Earnings Release

On Sept. 2, 2020, HPE released its fiscal third-quarter 2021 results for the quarter ending July 2021. The Company reported an earnings-per-share (EPS) profit of $0.47 excluding non-recurring items versus consensus analyst estimates for a profit of $0.42, a $0.05 beat. Revenues grew 1.2% year-over-year (YoY) to $6.9 billion, missing consensus analyst estimates for $6.93 billion. Order demand rose 11% YoY. Intelligent edge revenues rose 27% YoY. Annualized revenue run-rate rose to $704 million, up 11%. HPE CEO Antonio Neri commented, “I am pleased to see how our differentiated portfolio is resonating with the market, and our edge-to-cloud strategy is driving improved momentum across our businesses. The impacts of the pandemic continue to accelerate the shift we predicted years ago to an edge-centric, cloud-enabled, and data-driven world,” he continued. “Now, more than ever, companies need secure connectivity, faster insights from data, and a cloud experience everywhere. We expect those trends to continue. Digital transformation is no longer a priority but a strategic imperative.”

In-Line Guidance

HPE issued flat in-line guidance for fiscal Q4 2021 EPS between $0.44 to $0.52 versus $0.49 consensus analyst estimates. Fiscal full-year 2021 EPS is expected between $1.82 to $1.96 versus $1.89 consensus analyst estimates.

Conference Call Takeaways

CEO Neri set the tone, “I am particularly pleased that we were able to deliver these results while mitigating against industry-wide supply constraints by taking proactive inventory measures, working closely with our suppliers, and deployed our best-in-class engineering capabilities to establish specific response plans. The impact of the pandemic continued to accelerate the shift we predict two years ago, to an edgecentric, cloud-enabled, and data-driven world. Now, more than ever, there is a greater need for secure connectivity, faster insights from data, and a cloud experience everywhere. We expect these trends to continue. Digital transformation is no longer a priority, but a strategic imperative. To help our customers transform their businesses and be future-ready today, we have been focused on doubling down in key areas that are resonating strongly in the market. We had a record number of orders in both our Intelligent Edge business and high-performance computed and mission-critical solutions business. Due to strong demand and execution, these growth businesses now make up nearly 25% of our total Company revenue. Our Intelligent Edge business accelerated its momentum again in Q3 with 23% year-over-year revenue growth driven by a record number of new orders. From customer demands for secure connectivity have generated a backlog five times greater than at the close of Q3 last year. As customers increasingly look for solutions to collect, connect, analyze and act on data at the Edge. We are leaning into this demand and continue to invest in innovated the edge. In June, we announced new AI ops, IoT, and security features for our Aruba Edge Services Platform or ESP, designed to streamline network operations, maximize IP efficiency, and more easily extend the network from the Edge to the cloud. Our Aruba ESP continues to gain traction with customers in different verticals.”

He concluded, “The momentum we have in the market compels us to move even further and faster. And our ability to transform with increasing speed is imperative. Transformation is my number one priority. At this pivotal moment, our purpose to advance the way people live and work has never been more important. Our vision to become the edge to cloud Company is [Indiscernible] its tremendous relevance. And our portfolio is winning in the marketplace. Fueled by our purpose, vision, and portfolio, we have the opportunity to build a more discipline-enabled inclusive work.”

HPE Opportunistic Pullback Levels

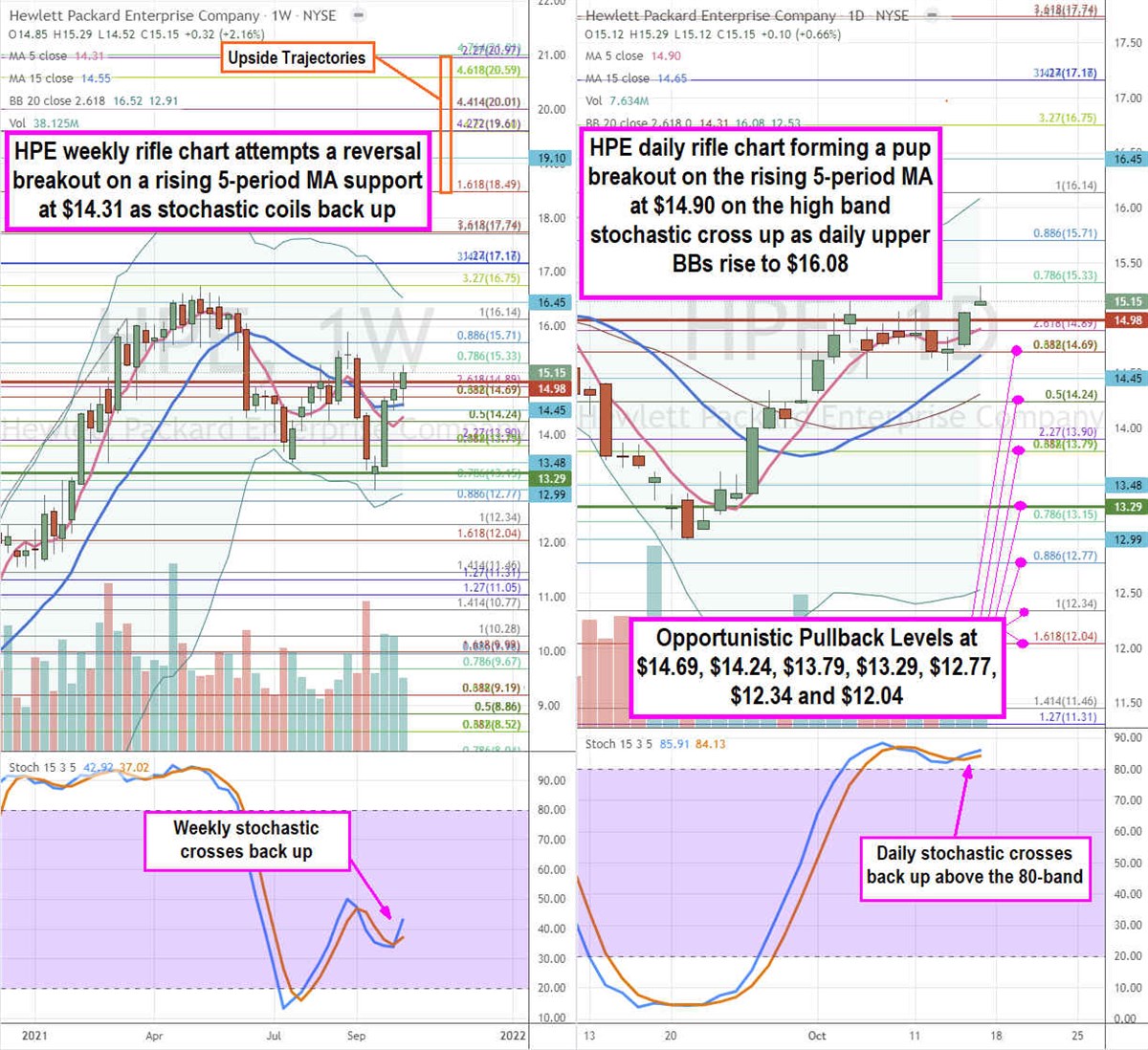

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for HPE stock. The weekly rifle chart peaked off the $16.75 Fibonacci (fib) level. Shares proceeded to collapse on a full weekly stochastic oscillation down. Recently the weekly stochastic crossed back up to form a divergence bottom signal as the weekly 5-period moving average (MA) attempt to coil up at $14.31 through its 15-period MA at $14.55 to form a breakout. The weekly upper Bollinger Bands sit at $16.52. The daily rifle chart formed a market structure high (MSH) sell triggered on the collapse below $14.98, then formed a daily market structure low (MSL) buy trigger above $13.29. After some consolidation at the $14.69 fib, it formed a pup breakout on the stochastic cross up above the 80-band. Prudent investors can wait for opportunistic pullback levels to scale into a position at the $14.69 fib, $14.24 fib, $13.79 fib, $13.29 daily MSL trigger, $12.77 fib, $12.34 fib, and the $12.04 fib level. Upside trajectories range from the $18.49 fib up to the $20.97 fib level.

Before you consider Hewlett Packard Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hewlett Packard Enterprise wasn't on the list.

While Hewlett Packard Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.