The overall markets have been on a tear lately, set to close the year off in style, near their 52-week highs. The popular S&P 500 ETF, the SPDR ETF Trust NYSE: SPY, made a new 52-week high last week and looks set to continue its impressive surge as the end of the fourth quarter approaches.

This renewed optimism has resulted in increased risk tolerance, speculation, and capital allocation into equities. As a result of the recent allocation adjustments and widespread optimism, a popular theme has begun to re-emerge: Stocks with a high short interest are becoming increasingly popular.

At the height of the previous bull market, stocks with considerable short interest were hugely popular among retail investors and traders aiming to squeeze the shorts. As the market has continued its impressive run higher in recent months, the talk about highly shorted stocks has picked up and once again gained momentum online.

So, as this theme looks to be re-emerging, quickly gaining popularity, and going mainstream again, let's look at three stocks with an unusually high short interest.

Kohl's NYSE: KSS

Kohl's Corporation is a US-based retail company that operates both physical stores and an online platform, offering a wide range of branded products, including apparel, footwear, accessories, beauty, and home goods. Some of its prominent brand names include Croft & Barrow, Sonoma Goods for Life, LC Lauren Conrad, Nine West, and Simply Vera Vera Wang.

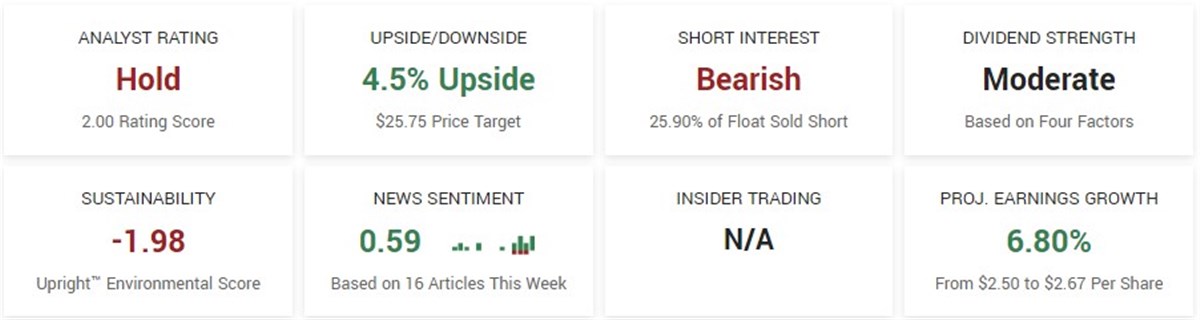

Kohl's, boasting a market capitalization of $2.73 billion, is slightly red this year, with its stock down 2.38%. However, shorts have piled into the name as they forecast a significant downside for the retail company.

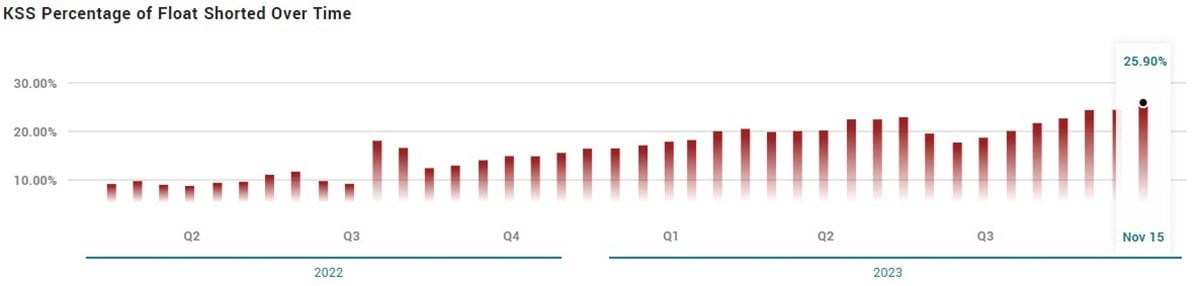

As of November 15, the short interest was a staggering 25.90% in KSS, up over 6% from the previous month. That short interest equates to 27.3 million shares currently sold short. And the recent increase in short interest is nothing new for the stock, as its short interest has steadily increased each month since July.

Cassava Sciences NASDAQ: SAVA

Cassava Sciences is a biotechnology company that develops drugs for neurodegenerative diseases. Their primary drug candidate, simufilam, a small molecule drug, has completed a Phase 2b clinical trial. Additionally, they're working on an investigational diagnostic product called SavaDx, aimed at detecting Alzheimer's disease through blood-based biomarkers.

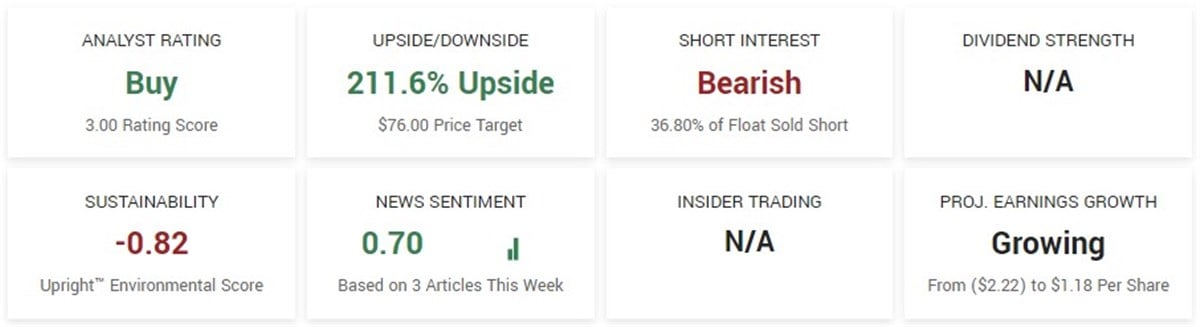

Shares of SAVA have had a year to forget, as the stock has declined over 17% year-to-date. However, the stock has surged over 24% over the past month, which might create unease and panic among those positioned short.

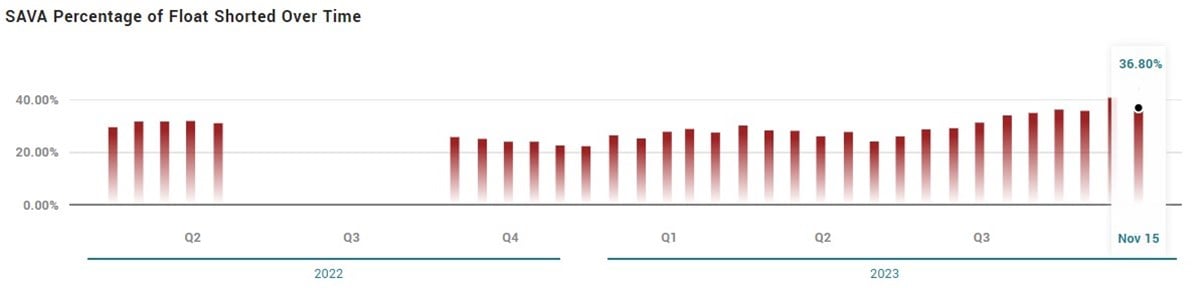

SAVA has an unusually high short interest, as almost 37% of its 39.5 million float is sold short. Currently, 14.5 million shares are sold short, equaling about $317 million. As the stock breaks its downtrend and looks to be staging a rebound, that abnormal short interest might spur a larger-than-expected rebound.

Enovix NASDAQ: ENVX

Enovix Corporation, based in Fremont, California, specializes in manufacturing advanced lithium-ion batteries in electric vehicles, consumer electronics, and grid storage. Their pioneering battery design, featuring a 3D cell architecture, provides superior energy density, enhanced safety, and extended cycle life compared to conventional lithium-ion batteries.

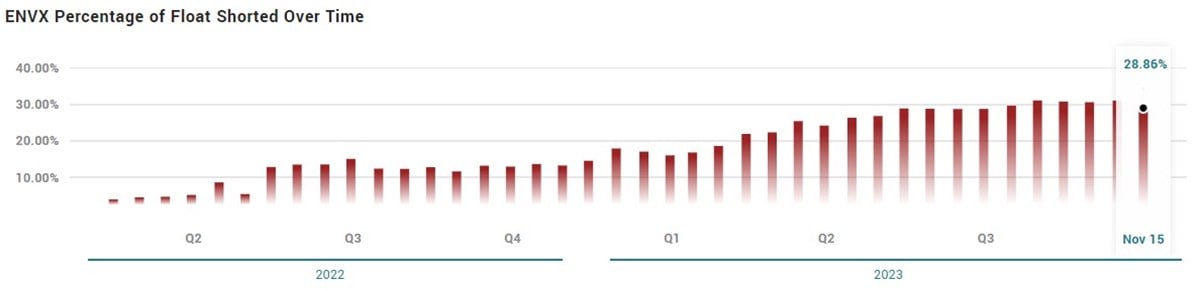

Although shares of Enovix are slightly negative on the year, down 5.47%, the stock has experienced significant volatility and is down more than 50% from its July high. Like SAVA, the stock has recently broken its downtrend and boasts an unusually high short interest.

As of November 15, 28.86% of the float was sold short. Notably, the short interest has remained elevated within a couple of percent of that figure since June. As the stock has already retraced by more than 50% from its peak earlier in the year and now has broken its downtrend, its unusually high short interest might be a catalyst for a rebound higher.

Before you consider Kohl's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kohl's wasn't on the list.

While Kohl's currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

We are about to experience the greatest A.I. boom in stock market history...

Thanks to a pivotal economic catalyst, specific tech stocks will skyrocket just like they did during the "dot com" boom in the 1990s.

That’s why, we’ve hand-selected 7 tiny tech disruptor stocks positioned to surge.

- The first pick is a tiny under-the-radar A.I. stock that's trading for just $3.00. This company already has 98 registered patents for cutting-edge voice and sound recognition technology... And has lined up major partnerships with some of the biggest names in the auto, tech, and music industry... plus many more.

- The second pick presents an affordable avenue to bolster EVs and AI development…. Analysts are calling this stock a “buy” right now and predict a high price target of $19.20, substantially more than its current $6 trading price.

- Our final and favorite pick is generating a brand-new kind of AI. It's believed this tech will be bigger than the current well-known leader in this industry… Analysts predict this innovative tech is gearing up to create a tidal wave of new wealth, fueling a $15.7 TRILLION market boom.

Right now, we’re staring down the barrel of a true once-in-a-lifetime moment. As an investment opportunity, this kind of breakthrough doesn't come along every day.

And the window to get in on the ground-floor — maximizing profit potential from this expected market surge — is closing quickly...

Simply enter your email below to get the names and tickers of the 7 small stocks with potential to make investors very, very happy.

Get This Free Report