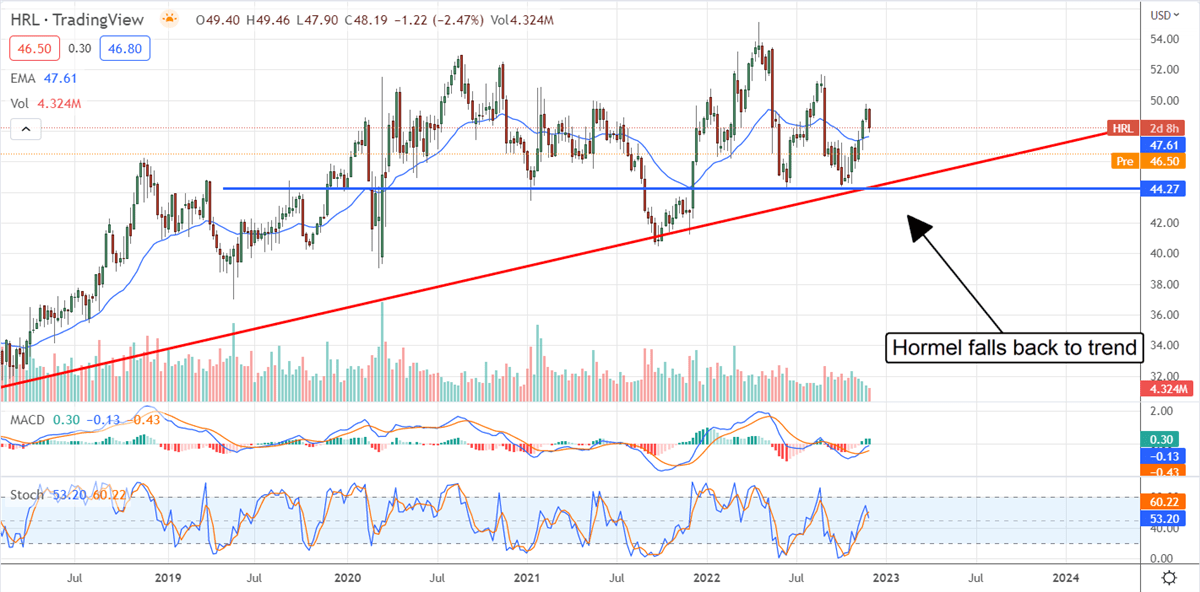

For those who’ve balked at Hormel’s (NYSE: HRL) high valuation the time to buy may be at hand. The company’s FQ4 results were weak and came with weak guidance that has this Dividend Aristocrat down at the lowest levels in weeks and trading near the 2022 lows. While the earnings release is no catalyst to buy the company is a healthy, dividend-paying consumer staple with a fundamentally sound business. As an income stock, it is among the highest quality for long-term oriented investors and that can be seen in the charts. The post-earnings action has the stock down at low levels but above the twin supports of a range bottom and a primary trend line. Technically speaking, if there was ever a good time to buy Hormel stock now is it.

"We expect to operate in a volatile, complex and high-cost environment again in fiscal 2023," said Jim Snee, chairman and CEO of Hormel Foods. "We have benefited from our balanced business model, which is not heavily dependent on any one channel, protein, input or product category. Our long-term strategy to meet consumers where they want to eat, with a broad portfolio of trusted brands and products, will continue to be a key differentiator for our business, helping to drive growth for our customers and operators."

Hormel Falls On Lackluster Results, Capital Returns Remain Safe

Hormel did not have a bad quarter by any means. The company produced $3.28 billion in revenue which is down -4.9% and missed the consensus estimate but the miss is slim and offset by margin strength. The company’s revenue missed by a mere 150 basis points and the contraction is due in large part to the fact there was one less week in Q4F22 than in the previous year.

Organic sales for the quarter, adjusted for the extra week, are up 2% YOY. For the year, the company produced record revenue which was up 9% headline and more than 6% organic. On a segment basis, all segments were down on a quarterly basis but two were up for the year. The International segment is down YOY but this is because of Russia and not operational problems.

The margins were good as well although the operating margin contracted YOY for the quarter. The mitigating factor is that the quarterly operating margin came in well ahead of the Marketbeat.com consensus estimate and was able to more than offset the top-line weakness. The operating margin is also up for the full year. The $0.51 in adjusted EPS is flat versus last year’s record results and beat the consensus by 400 basis points or more than 500 basis points when adjusting for the top-line miss.

The guidance is the only truly bad news and even it is not without promise. The company is expecting revenue to be $12.9 billion and earnings of $1.99 at the high end which are both slightly below the consensus estimate. The upshot here is that growth is expected on both the top and bottom lines and supports additional dividend increases and share repurchases.

The Technical Outlook: Hormel Falls Back To Trend

Hormel did not buy back any shares during 2022 and that may be because the share price was so high. Trading at 26X its earnings it is well above the sector laggards like Kraft-Heinz (NASDAQ: KHC) which trades closer to 15X its earnings. The company still has the authorization to buy up to 4 million shares so that trend may change now that price action is back at more attractive levels.

Assuming the market follows through on the opportunity in front of it, shares of Hormel should begin to move higher within the next week or so if not days. In this scenario, the market may consolidate at this level but show an upward bias driven by the trend line. If not, Hormel could fall below the trend and present an even better opportunity. In that scenario, however, there is a risk the stock could fall even lower and get its valuation back in line with the broad market.

Before you consider Hormel Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hormel Foods wasn't on the list.

While Hormel Foods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.