- If you follow the rules, Roth IRAs have the advantage of tax-free growth and withdrawals.

- You can have as many Roth IRAs as you desire, but the annual contribution limit applies to all your IRAs cumulatively.

- Having multiple IRAs enables diversification but also makes managing them more complex.

Understanding the basics of IRAs

IRAs, or individual retirement accounts, are powerful financial tools that can help you save for retirement while enjoying certain tax advantages. There are two main types of IRAs: traditional IRAs and Roth IRAs, each with its unique features, tax implications and eligibility criteria.

Traditional IRAs allow you to make pre-tax contributions, meaning that the money you contribute is not subject to income tax at the time of contribution. This allows for potential tax savings in the year you contribute. The money within a traditional IRA grows tax-deferred, meaning you're not taxed on any investment gains within the account until you withdraw during retirement. At that point, the withdrawals are subject to income tax.

On the other hand, Roth IRAs work differently. Contributions to a Roth IRA are made with after-tax dollars, meaning you've already paid income tax on the money you put into the account. However, the advantage of a Roth IRA is that any growth within the account is tax-free, and qualified withdrawals in retirement are also tax-free.

Can you have multiple IRAs?

Now, back to the question: How many Roth IRAs can one person have?

The answer is simple: there's no limit to the number of IRAs you can have. You're allowed to open and contribute to multiple IRAs if you wish.

However, the annual contribution limit still applies to all your IRAs cumulatively. For example, if the current annual contribution limit is $7,000 and you have three Roth IRAs, you can only contribute $7,000 across all three accounts in 2024.

Having multiple IRAs can offer certain advantages. One of the main benefits is diversification. By spreading your contributions across different IRAs, you can invest in various assets and use different investment strategies. This can help mitigate your risk and potentially enhance your returns.

Having multiple IRAs can also provide flexibility to access your funds during retirement. With multiple accounts, you can choose which one to withdraw from based on your specific financial needs at any given time. This can be particularly useful if you have different goals or expenses in retirement that require varying amounts of money.

Limits on IRA contributions

To get a handle on the impact of having multiple IRAs, let's delve into the annual contribution limits and any recent changes that may have occurred.

In 2024, people under 50 can contribute up to $7,000 per year, while those 50 and older can make an additional catch-up contribution of $1,000, bringing their total limit to $8,000.

However, it's worth noting that these limits are not individual to each IRA you may have. Instead, they apply to all your IRAs combined. If you're 50 or older and have multiple IRAs, you can't contribute more than $8,000 to them. For example, if you have a traditional IRA and a Roth IRA, you'll need to decide how much you want to contribute to each IRA and ensure that the total doesn't exceed $8,000.

How many Roth IRAs can you have?

Regarding individual retirement accounts (IRAs), you may prefer a Roth IRA to avoid being hit with taxes when you start taking withdrawals during retirement.

You make Roth IRA contributions with after-tax dollars. Unlike traditional IRAs, where you pay income taxes on any investment gains upon withdrawals, Roth IRA withdrawals are free of taxes, including income and capital gains. You may ask yourself if having too much of a good thing is possible — and "How many Roth IRAs can I have?"

After finishing this article, you will have enough knowledge to decide on having multiple IRA accounts.

Can you have multiple IRA accounts? Can you have both traditional and Roth IRA? Can you have more than one Roth IRA? Can you have multiple Roth IRAs?

The answer is yes to all. When it comes to how many Roth IRAs one person can have, the answer is as many as you desire.

However, the IRS considers the cumulative total of all your IRA accounts when applying contribution limits and other rules. You can open as many IRA accounts as you want, but the question is whether it's right for you and if you have the time and energy to manage them. While you can own no maximum Roth IRAs, be aware that the Roth maximum contribution limit applies to all your IRAs combined.

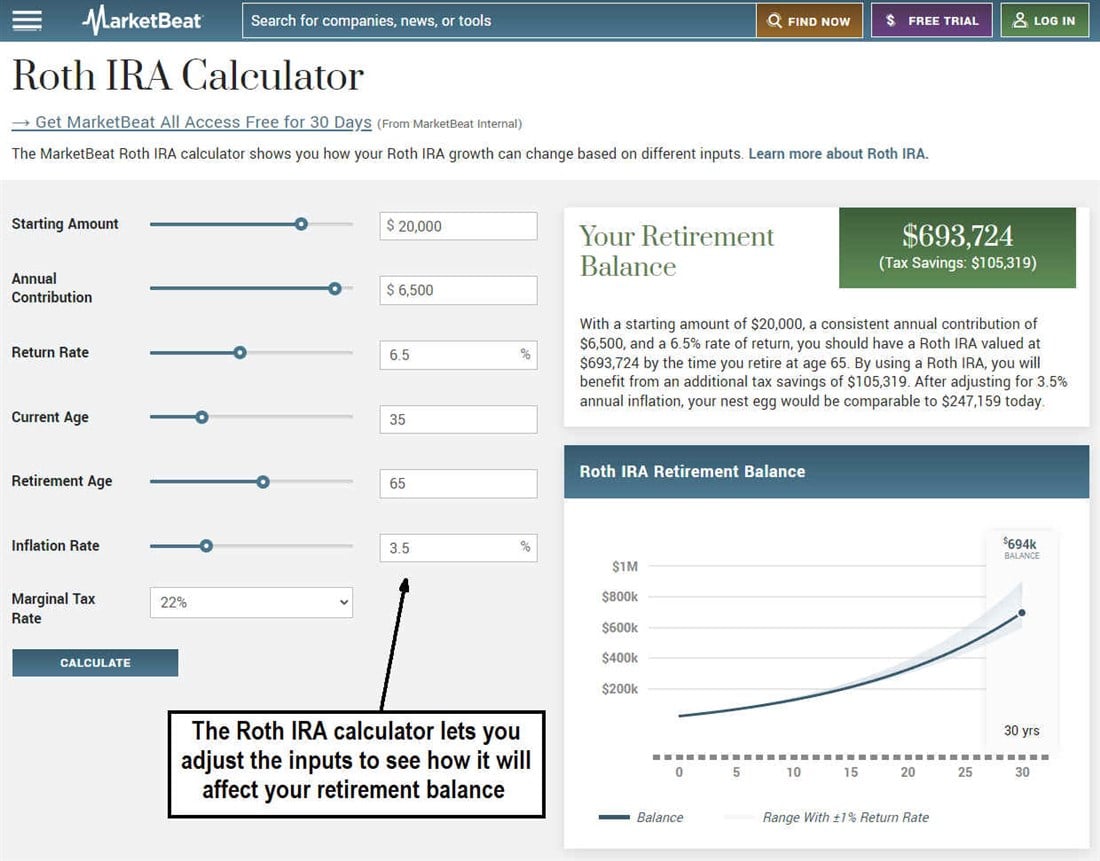

The MarketBeat retirement calculator can help you plan and see potential outcomes.

Why consider multiple IRAs?

If you're wondering why you should consider having multiple IRAs, there are many reasons.

Having a single IRA makes things simpler to track and follow; having multiple IRAs can help diversify your investments and strategies to optimize performance. While having one IRA can be passive, having more requires active management. Here are some key reasons to consider utilizing multiple IRAs. Remember, this can include different types of IRAs, including traditional, Roth and SEP IRAs. Here are some reasons to consider having multiple IRAs.

Investment strategies

You may have several investment strategies that you want to administer. Having multiple IRAs enables you to delegate different strategies to different IRA accounts. The strategies may have varying levels of risk and volatility. Avoid having volatile growth stocks mixed with income-generating dividend stocks. You can calculate Roth IRA potential returns for each strategy.

Investment options from different providers

Different financial institutions offer various investments with IRAs. Banks are more narrow in their investment options, limited to certain mutual funds and fixed-income assets. Online or full-service brokers provide access to many more investment choices for your IRAs, ranging from individual stocks, exchange-traded funds (ETFs) and bonds to a broader selection of financial assets from treasuries to corporate debt.

Diversification

Diversification enables you to spread the risk across multiple asset classes and strategies. While you can't short-sell or use margin in IRA accounts, you may consider hedging strategies with bonds in one IRA, stocks in another or investments in different sectors or themes. You may allocate an IRA account focusing on various sectors and stocks trending within multiple industries.

Different advisors

Some financial institutions may have more personalized investment advisors that fit your persona. You may be a wealth management client at several institutions. Every advisor has a style that may or may not match your preferences. They may also favor specific investment strategies and have differing performances. Diversification can also apply to having multiple financial advisors.

Changes in beneficiaries

Regarding estate planning, you can allocate various IRA accounts to multiple beneficiaries. One of the key benefits is the ease of distributing proceeds without having to divide up a single IRA account among multiple beneficiaries. The financial status of different beneficiaries may be a factor.

You may choose a Roth IRA for a beneficiary in a high-income tax bracket while delegating a traditional IRA to a beneficiary in a low-income tax bracket. Designating different IRA accounts to specific beneficiaries can also help to alleviate disputes among the heirs regarding the division of assets, especially if you still need to prepare a will.

Eligibility rules for a Roth IRA

While tax-free growth and withdrawals sound appealing, not everyone can have a Roth IRA. Roth IRAs come with rules that need to be adhered to. There are limits to Roth IRA contributions. Suppose your modified adjusted gross income (AGI) is higher than $161,000 as a single tax filer or higher than $240,000 as married filing jointly or as a qualified widow(er). In that case, you can't contribute anything to a Roth IRA.

Here are some essential rules to be aware of with Roth IRAs:

- You must hold Roth IRAs for at least five years to avoid penalties before making qualified withdrawals.

- To make tax-free withdrawals from a Roth IRA, you must be 59 1/2 years old and have opened and contributed to the Roth IRA for at least five years.

- Roth IRAs have no required minimum distributions (RMDs) like traditional IRAs.

Pros and cons of having multiple IRAs

Remember that having multiple IRAs also requires managing multiple IRAs. Having multiple IRAs comes with its own set of pros and cons. It's best to weigh the pros and cons before making a move.

Pros

Here are some pros to having multiple IRA accounts:

- Diversification of investments and strategies: Having multiple IRAs can enable you to allocate funds towards different investment asset classes and methods. Perhaps you want to have other IRAs based on the risk level of the underlying stocks or instruments. You may opt to have a high-beta Roth IRA composed of technology and biotechnology stocks while having a traditional IRA composed of Dividend Aristocrats. The possibilities are limitless but tracking multiple IRAs and strategies requires active management.

- Consider various promotions: To grow their IRA business, financial institutions periodically offer enticing promotions to open an IRA account. For example, you can get up to $700 to open and fund an IRA account with Chase.

- Benefits for young savers in lower tax brackets: Young savers in the lower income tax bracket starting their careers can have their gains compound for a more extended period. By paying the lower taxes off early, the investment has more time to compound and grow tax-free and avoid capital gains taxes upon withdrawal in retirement. The bottom line is that it's never too early to invest in an IRA. The sooner one starts investing, the more one can benefit from the power of compounding over time.

Cons

Here are some cons of having multiple IRAs:

- Complexity: Keeping track of multiple IRAs can be time-consuming, depending on your strategies. At the very least, you must split your attention between your multiple accounts. When you hold IRA accounts at different institutions, it can get more complicated and confusing. At the very least, managing an IRA requires tracking and analyzing performance, adjusting allocations, and adding or divesting investments based on performance, analysis and tax filings. Multiply that against each IRA account.

- Fees can add up quickly: The maintenance fees for IRAs can differ based on the financial institution, ranging from $25 to $50 per account. Since heavy competition exists for your IRA accounts, many financial institutions waive the fees, but conditions may apply. Some financial institutions may require a minimum balance for an IRA account. Be sure to check the disclosures in your IRA account paperwork.

- Penalties for exceeding contribution limits: The IRS is strict about annual total contribution limits regarding IRAs. The contribution limits apply cumulatively to all your AGIIRAs. If you contribute more than the yearly contribution limit to your IRAs, you will pay a 6% penalty tax on the excess amount (for each year it goes unfixed) for up to six years. Remember, the total 2024 contribution limits are all your IRAs are $7,000 (or $8,000 for those aged 50 and older). However, you must know your modified adjusted gross income (AGI) to determine how much you can officially contribute to your Roth IRA. Suppose you should have contributed more to your IRA(s). In that case, you can avoid the penalty by notifying your financial institution. They will distribute the excess return to you before the tax filing deadline.

How to get multiple Roth IRAs

If you've weighed the pros and cons and concluded that having multiple Roth IRAs works for you, consider whether you want to keep them all at one financial institution or several.

Having them all under one roof helps to simplify record keeping, but it may also limit the number of strategies, especially if your IRAs are at a bank.

Plan and start calculating your Roth IRA growth based on adjusting certain inputs. You can use the Roth IRA calculator from MarketBeat to understand how little adjustments can make an impact. You can choose the most relevant stocks based on a high media sentiment stocks list.

There are many methods to find, select and analyze candidates to include in your IRAs. Keep track so that the investments from one IRA are separate from another.

Managing multiple IRAs effectively

Managing multiple IRAs requires careful organization and regular reviews to meet your goals. When juggling multiple accounts, here are some practical tips to simplify the process.

- Consolidate where possible: If you have multiple IRAs spread across different banks, consider consolidating them into one institution. This will streamline recordkeeping and make tracking and managing your investments easier. It can also reduce fees.

- Establish a clear investment strategy: Determine the risk level and asset allocation for each IRA based on your financial goals and risk tolerance. Having a clear strategy will help guide your decision-making.

- Regularly review and rebalance: Regularly review the performance of each IRA and make any needed adjustments. This includes rebalancing your portfolio for the asset allocation you want. Keep track of the investments in each IRA and analyze their performance so you can pinpoint any underperforming assets or chances to improve.

- Stay organized: With multiple IRAs, organization is key. Keep detailed records of your contributions, withdrawals, and transactions within each account. This will make tax reporting and tracking your progress easier.

Should you have multiple Roth IRAs?

Having multiple Roth IRAs is not for everyone. For many, it's not a matter of "How many Roth IRA accounts can I have?" — it's a matter of how many you can handle.

Having multiple Roth IRAs requires being able to manage multiple accounts. The complexity rises with the more IRAs you open and the number of strategies and investments you take.

If you apply the same investment strategy using the same investments across multiple IRAs, you may want to keep it under a single IRA account.

FAQs

Here are some answers to frequently asked questions about having multiple IRAs.

Can you have several Roth IRAs?

Yes, you can have as many Roth IRAs as you desire. However, the annual contribution limit applies to all of your Roth IRAs cumulatively. How many IRAs can one person have is not as relevant as how many IRAs can one person handle?

What’s the difference between a Roth and traditional IRA?

Roth IRA contributions are made with after-tax dollars, while traditional IRA contributions are usually made with pre-tax dollars. Qualified withdrawals from Roth IRAs are both income tax and capital gains tax-free. Traditional IRA withdrawals are taxed as ordinary income. Traditional IRAs also have a required minimum distribution (RMD) that requires annual withdrawals for investors at 73 years if born between 1951 and 1959 and at 75 years if born after 1960.

What is a disadvantage of a Roth IRA?

Not everyone can have a Roth IRA. While you may have been able to open a Roth IRA if your AGI was under the limits, if your income rises above the maximum allowable AGI limit, then you won't be able to contribute to it. If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $161,000 for tax year 2024. If you're married and file jointly, your MAGI must be under $240,000 for tax year 2024.

Before you consider Chase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chase wasn't on the list.

While Chase currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.