Like most investors, you invest in the stock market to get a decent return on your money. You may own dividend stocks to collect some income along the way and take advantage of the compounding effect. If you are a long-term-oriented investor holding a portfolio of equities in any stock sector or even one stock, then a covered call option strategy may fit your needs.

You can collect rent in the form of options premiums from your stocks with this strategy. This is especially suitable for stocks that you plan on holding for a longer time horizon, ranging from quarters to years. You are comfortable with your stock prices going up as well as coming down. In this article, we’ll review the covered call strategy and use an example to help you better understand it.

What are options contracts?

It’s important to have a basic understanding of stock options contracts. Options are contracts for specific stocks that give you the right but not the obligation to buy or sell the stock at a specified price on or before a specific expiration date. With a covered call strategy, we will be using call contracts. These are contracts that give the holder the right to buy stock at a specified price, the strike price, up to the expiration date of the contract.

If the underlying stock doesn’t rise higher than the strike price, there would be no need for a holder to exercise the option. If the stock price surpasses the expiration price, the call holder can exercise their option to buy the stock at the strike price.

How are call options exercised?

For example, if you own a $25 call on XYZ stock that expires next Friday and the stock is trading at $28, you can exercise the call option and acquire the stock at $25. Or you could decide to sell the actual call contract for a profit and not have to put up the capital to purchase the stock. Sounds good. So, who is offering me this stock at $25 when it's trading at $28? That would be the option seller.

Obviously, the seller would prefer the stock not to rise $3 points above the strike price, but that was the risk they took to collect the option premium that you paid to purchase the call contract. Most call options expire worthless. In the long run, the options sellers or call writers win in the end. That would be you if you use a covered call strategy.

Monthly income with an options-covered call strategy.

To get started, your brokerage account needs to have options trading permissions turned on. You will have to request permission to trade options at your brokerage. Once it's approved, then you can start.

The basic strategy is to pick a strike price and expiration date to sell or write a covered call. Since you already own the stock and are planning on holding it, think of this as just collecting rent. Let’s assume you own semiconductor stock Intel Co. NASDAQ: INTC for the long term. You can collect more premiums as the strike price gets closer to the current price and the expiration is further out.

Identify support and resistance levels.

The first thing to do when considering implementing a covered call trade is to identify support and resistance levels for your stock. On the INTC candlestick chart, we can see that the $45 level is a double top resistance as it attempted to break out first on Nov. 20, 2023, to form a market structure high (MSH) sell trigger on the low of the lower high candle the next day at $43.20.

It attempted a second breakout attempt on Nov. 29, 2023, which failed and triggered the MSH sell, triggering when it broke down under $43.30. The daily relative strength index (RSI) was overbought on the first attempt near the 80-band and fell through the 70-band when it failed the second breakout attempt and triggered the MSH on the breakdown through $43.30.

The $45 resistance level can be our selected strike price due to a double top and the RSI coming back down. The pullback support levels are at $40.53, $39.19 and $37.53. The daily 200-period moving average is rising at $33.40.

Setting up the trade

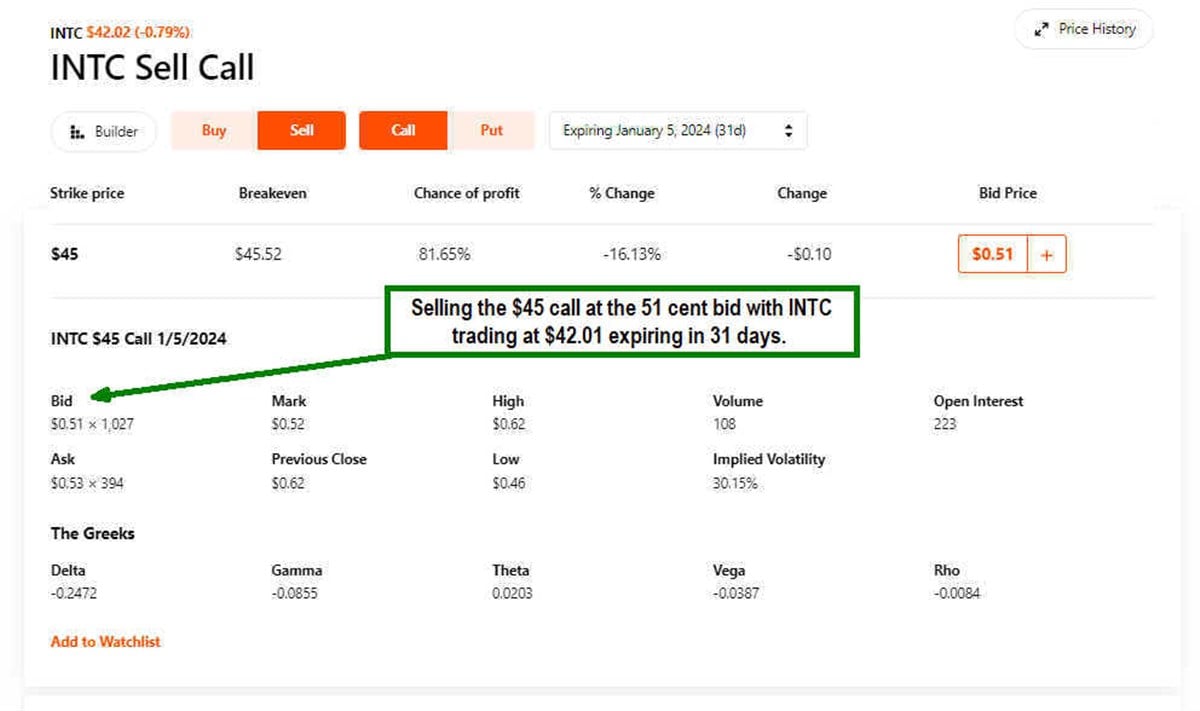

Assuming today is Dec. 5, 2023, and the Jan. 5, 2024, $45 strike calls are bidding 51 cents while INTC is trading at $42.02. The option contract has 31 days until expiration. The calls are out of the money by $2.98. INTC would have to rise $2.99 or 6.6% within 31 days to be in the money.

What happens after expiration if INTC closes above $45?

Upon expiration, if INTC is in the money, which means above the option’s strike price of $45 on expiration, then you would have the stock taken from your account at $45.00. However, that's still a 6.6% return in 31 days, and you would also keep the 51-cent premium for a total of 7.7% return. You can use a pullback to reenter the position at the support levels and write another covered call. Rinse and repeat.

What happens after expiration if INTC closes below $45?

If INTC closes below the $45 strike price on expiration day, you keep the premium of 51 cents per share and can write the covered call again either at the same strike price or higher if INTC rises or lower if INTC falls below support levels.

The support levels are $40.53, $39.19 and $37.53. Even if these levels break, you can measure the next resistance level to write another covered call after this one expires. Since you are planning on holding INTC long-term, the short-term pullbacks shouldn't concern you. Rather, you are collecting premium payments monthly as "rent" for holding the INTC position.

Final thoughts

This is a very simplified example of a covered call trade. There are many variations, like selling weekly calls to collect premiums more often, which requires more analysis and time. INTC is not a volatile stock, so the price movements and premiums will be smaller compared to a more volatile stock like Tesla Inc. NASDAQ: TSLA or Nvidia Co. NASDAQ: NVDA. Start with the slower low-beta blue-chip stocks and exchange-traded funds (ETFs) first and then move up slowly when it comes to volatile underlying stocks. We will cover many more options and strategies in future articles.

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.