Age 50 is a crucial milestone for retirement savers. Most workers' 50s are prime earning years, and building up a retirement nest egg should take on increased importance.

But not everyone keeps up with retirement savings goals. Some Americans have no retirement savings at all. Saving for retirement at 50 sounds like a scary scenario, but the truth is that we all need to start somewhere, and it's never too late to start preparing for your post-working career.

Read on to learn how to invest for retirement at age 50, which accounts to use and what level of risk you should take with your savings.

How Much Should You Have Saved at Age 50?

Differing viewpoints exist on how to save for retirement in your 50s. Several factors come into play: salary, preferred retirement lifestyle, current savings and plans for Social Security. One size rarely fits all when it comes to investing, and retirement saving is another facet that should tailor to your goals and wishes.

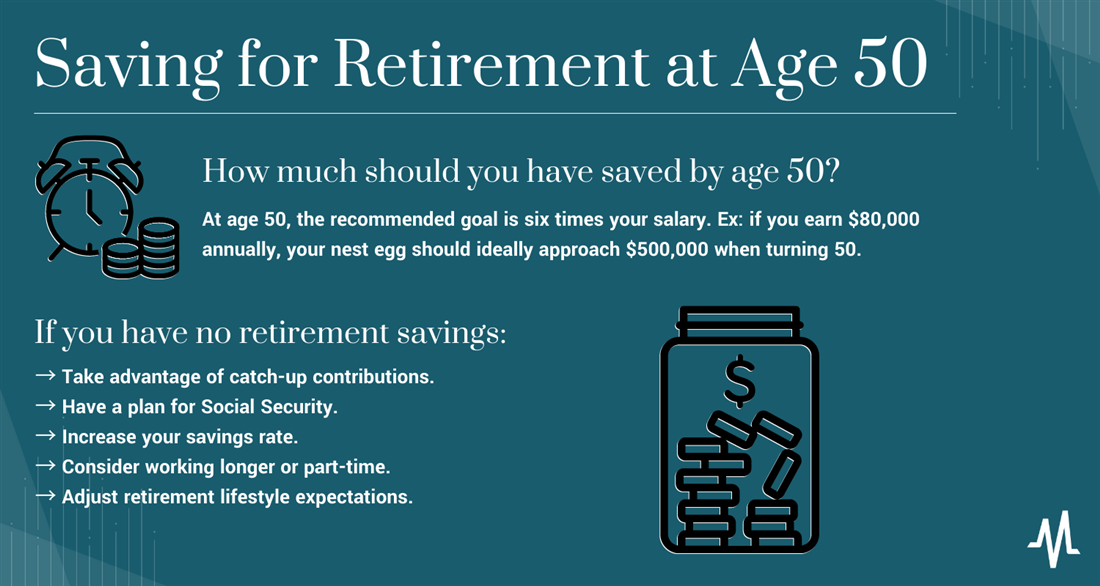

According to Fidelity, retirement savers should plan for their nest egg to match a multiple of their salary at specific ages. In their hypothetical scenario, a retirement saver planning to quit working at age 67 should have 10 times their salary saved by the time they hang it up. At age 50, the recommended goal is six times your salary. For example, if you earn $80,000 annually, your nest egg should ideally approach $500,000 when turning 50.

In a different study, T. Rowe Price recommends a 15% savings rate for those in their 50s, but higher rates are always encouraged. Their recommended nest egg total for a 50-year-old is three to six times your salary, with 4 1/2 to eight times your salary saved by age 55. For a person earning $80,000 per year, that's a balance of $240,000 to $480,000 by their 50th birthday.

It's always important to remember that these are loose heuristics and don't incorporate personal data like retirement lifestyle and Social Security plans. No need to panic if you don't have $400,000 saved by age 50! You have some options to consider that can help you get where you want to go.

What to Do if You Have No Retirement Savings at 50

If you wait to start saving for retirement at 50, you'll certainly be behind the curve, but getting your nest egg whipped into shape is possible.

Thinking that it's already too late or that you'll never meet your goals is a mental trap that only causes inertia. Even if you've waited to learn how to invest at 50, you can still build good money habits and carry them into retirement. You don't need to pinch pennies or take excessive risks in your portfolio, but you must approach things more urgently than a 30- or 40-year-old. Here are five points on how to plan for retirement in your 50s:

- Take advantage of catch-up contributions: After turning 50, you can put extra cash into your IRA or 401(k) accounts. In 2023, savers under 50 can contribute a maximum of $22,500 to their 401(k), but anyone 50 or older can tack on an additional $7,500. Likewise, IRAs have a $6,500 contribution limit in 2023, but savers 50 and older can add $1,000. Use these contribution increases to pad the assets in your tax-advantaged retirement accounts.

- Have a plan for Social Security: Collecting Social Security is still at least 12 years away for someone turning 50, but it makes sense to plan for it because the date you take Social Security influences how much you'll receive. You can begin taking Social Security at age 62, but you'll receive a higher monthly payout the longer you wait. You'll receive payment based on the Social Security Administration's life expectancy tables. You can wait as long as age 70 to begin collecting. If you're starting to save at age 50, ensure you have an idea when you'll take Social Security and factor that into your plans.

- Increase savings rate: Maxing out your IRA and 401(k) plans with catch-up contributions is a good start, but if you want to pad out your nest egg, you'll have to up your savings rate. That means doing one of two things: spending less or making more. If increasing your salary isn't an option, you must redirect some spending cash into your retirement funds. If you can increase your earnings, try to maintain your current lifestyle and put as much of your extra earnings into your nest egg as possible.

- Consider working longer or part-time: If you're healthy and your work engaging, you don't necessarily need to set a retirement date at an arbitrary round number like 60 or 65. Working longer will delay Social Security, enabling you to take larger payouts later. Additionally, the internet has allowed many retirees to turn their hobbies into part-time jobs through freelancing or other side hustles. Part-time work during the early retirement years will allow you to draw down savings at a lower rate, keeping more of your nest egg secure for the days when your health or age might prevent it.

- Adjust retirement lifestyle expectations: If you don't think you'll meet your initial goals, you might need to readjust your plan and consider ways to spend less money in retirement. You could downsize to reduce living expenses or change travel plans from international to domestic. Cutting down in retirement is easier said than done and usually requires more sacrifice than skipping Starbucks in favor of coffee made at home. Everyone has different retirement expectations, so the decision to cut things out will vary from person to person.

How to Start Saving for Retirement at 50

How to Start Saving for Retirement at 50

What's the best way to save for retirement in your 50s? The answer will vary, and it's smart to work with an advisor to tailor an investment plan for your unique situation. Not everyone will be able to save at the same rate or retain the ability to keep working through retirement age, so the best investment plan at 50 must fit each individual. But if you're looking to get started today, here's a list of five basic tenets that will guide your retirement saving calculations and set you in the right direction.

Step 1: Set goals and standards for retirement.

How do you envision retirement? Is it traveling the world with your spouse or spending more time at home with friends and family? Your goals and desires will influence the amount you'll spend in retirement, influencing how much you'll need to save to get there. You'll need to determine how much you plan to spend annually in retirement and estimate how many years of savings you'll need to avoid running out of cash in old age. Your goals will also determine your portfolio's asset allocation so you know what you want during retirement.

Step 2: Have a plan for Social Security.

As mentioned above, monthly Social Security benefits increase the longer you wait, so try to hold off taking it as long as possible. Health and financial situations may limit your ability to wait until age 70 to start receiving Social Security, but the goal should be to wait as long as possible. Depending on your income, you may have to pay taxes on Social Security, so be prepared to factor payments into your annual filing to prevent unnecessary taxes when drawing down retirement assets.

Step 3: Utilize catch-up contributions in tax-advantaged retirement accounts.

Once you turn 50, the maximum contribution limit for IRA and 401(k) accounts increases. Take advantage of these catch-up contributions! Between a 401(k) and IRA, you'll have $7,500 contribution space to add to your nest egg. That's more that you can stash into tax-advantage accounts each year, and if you're currently looking at a retirement shortfall, these extra contributions can be highly beneficial.

Step 4: Consider investments based on your goals.

When you're young and have your whole career ahead of you, it's easy to take investment risk since you have decades to recoup any losses from crashes or bear markets. But the best investments at age 50 are calculated differently since time is no longer on your side. For retirement savers on target with their goals, you can spend the decade between 50 and 60 reducing risk from stocks and putting capital into less volatile assets. However, if you've fallen behind on savings, keep investment risk elevated for longer to capture higher returns. Risk appetite comes into play here, and conservative investors may not want overwhelming exposure to stocks with retirement creeping up around the bend.

Dividend-paying stocks are often a favorite of retirees since they're long-established companies with a history of rewarding shareholders. Plus, retirees love dividends for their consistent and steady income. You can frequently find funds like the Vanguard Dividend Appreciation Index Fund NYSE: VIG forming the basis of many retirees' portfolios.

Step 5: Manage your accounts and keep asset allocation on target.

Once you've set up your retirement plan and funded your preferred accounts, let compound interest work magic and leave your investments alone. A quarterly or biannual rebalancing is usually all your portfolio will need unless your goals change or some unforeseen global event occurs. Playing with your asset allocation too much can lead to high transaction costs, and overtraders tend to underperform market benchmarks. You may not be able to "set it and forget it" like someone with a target-date fund, but only adjust your allocation when it moves too far away from your preferred parameters.

Turning 50: It's Never Too Late to Start Saving

Learning how to save for retirement at 50 can be arduous. You know you're behind schedule, and the impulse to "catch up" by taking more risks is tempting. But forming a proper retirement plan is still important, and you don't want to avoid so much risk in your portfolio that you lose sleep at night. Work with a fiduciary advisor to build a personalized plan to build up assets efficiently.

If you don't have an advisor, you can still improve your situation by laying out clear steps to reduce spending and increase savings. The worst thing you can do is throw your hands up in frustration and continue pushing out your commitment to a plan. Falling behind isn't an excuse to give up, especially when you still have at least a decade of prime earning years ahead of you.

FAQs

Here are a few commonly asked questions about investment plans and retirement saving for people approaching age 50.

Is it too late to save for retirement at age 50?

No, it's never too late! There's no reason to give up if you've fallen behind on your goals. Commit to a plan and take advantage of catch-up contributions in your tax-advantaged accounts.

How much money should you have for retirement at age 50?

The ideal nest egg balance will vary depending on your sources. According to asset managers like Fidelity and T. Rowe Price, saving around three to six times your annual salary by age 50 is the general rule of thumb.

Can I retire at 50 with $1 million?

Many retirees set their goal at $1 million, but retirement security depends on several factors. How much will you spend per year in retirement? Do you have parents and grandparents who reached age 90? If you can reasonably expect to live for three or four more decades after your 50th birthday, will $1 million be enough to last for that time? It's easy to say that $1 million in savings will be enough. Still, unfortunately, factors beyond our control, like health and longevity, play a massive role in how we draw down retirement savings.

Before you consider Vanguard Dividend Appreciation ETF, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vanguard Dividend Appreciation ETF wasn't on the list.

While Vanguard Dividend Appreciation ETF currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.