Disrupting technologies like cryptocurrencies have proven to have the potential to be very profitable. Enterprising companies and individuals are now rushing to learn how to invest in central bank digital currency. This new digital currency could offer less volatility, since a nation's central bank issues it.

In this article, we'll define central bank digital currency (CBDC) and give you a great deal of information on investing in this new technological innovation.

Read on to learn about “CBDC invest” and determine the answer to "Can you invest in CBDC?" for your portfolio.

What is a central bank digital currency (CBDC)?

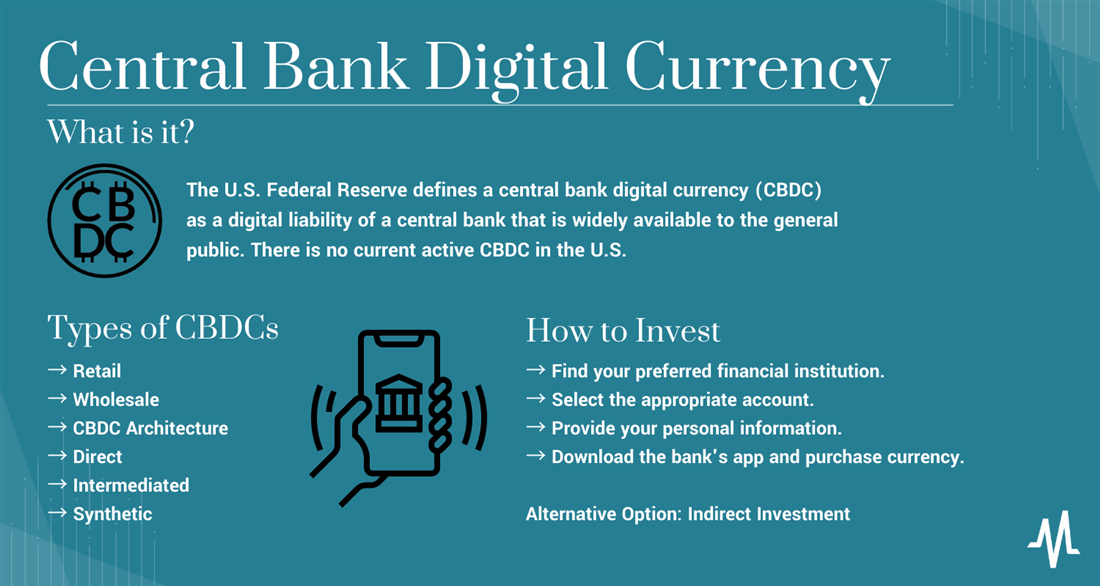

The U.S. Federal Reserve defines a central bank digital currency (CBDC) as a digital liability of a central bank that is widely available to the general public. These digital currencies are issued in the same currency type used by the issuing bank, so if a CBDC is issued in the U.S., it would be digital dollars.

At the time of this article's publication, there is no active CBDC in the U.S. However, the current presidential administration has expressed an interest in this digital currency and is pursuing a pilot program. Many of the largest nations in the world are in the same stage.

As of December 2023, 11 countries have launched a digital currency, and the European Central Bank is on track to pilot the digital euro. Over 20 other countries have aimed to pilot their CBDCs in 2023, and India and Brazil plan to launch in 2024.

Understanding central bank digital currency (CBDC)

Central bank digital currency (CBDC) is a revolutionary concept that might reshape the financial system as we know it. Unlike traditional currency, CBDC is entirely digital and is issued and regulated by a country's central bank.

It is a digital representation of a nation's fiat currency, allowing us to conduct digital transactions seamlessly.

One key feature distinguishing CBDC from traditional forms of currency is its decentralized nature. While traditional currencies are typically issued by commercial banks and operate in a centralized system, CBDC operates on a decentralized blockchain network, ensuring transparency, security and efficiency. This decentralized structure also needs no intermediaries like commercial banks, resulting in lower costs and faster settlements.

Currently, 130 countries, accounting for 98% of global GDP, are exploring CBDCs. This is a major increase from May 2020, when only 35 countries considered it.

The G20 countries have made the most progress, with 19 in advanced stages and nine already in pilot phase. China's pilot program reaches 260 million people and has been tested in various scenarios. Many other countries, such as Australia, Thailand and Russia, plan to continue piloting CBDCs or launch them by 2024. Retail CBDC progress has stalled in the U.S., but wholesale CBDC development has doubled due to geopolitical events. Currently, there are 12 cross-border wholesale CBDC projects.

Why invest in central bank digital currency?

Investing in CBDCs offers a unique opportunity to diversify your investment portfolio and potentially benefit from the growth of this technology. As CBDCs become more widely adopted, their value is likely to increase.

And with CBDC, you can enjoy lower volatility than other cryptocurrencies, since it's issued and backed by a nation's central bank. This stability gives confidence in its value.

CBDC also offers greater convenience and accessibility. Transactions can occur instantly, so you don't see the lengthy processing times associated with traditional banking. And CBDC can be accessed by anyone with a digital wallet, providing financial services to unbanked populations.

Financial institutions and corporations are also considering including CBDC in their investment portfolios. CBDC ensures transparency and security, appealing to large entities prioritizing efficiency and lower costs.

Investing in CBDCs can also contribute to financial stability on a global scale. As more countries adopt CBDCs, we'll start to see a standardized digital currency system that can easily facilitate cross-border transactions. This can eliminate the need for intermediaries and cut costs, leading to financial inclusion and economic growth worldwide.

Types of central bank digital currencies

Not all CBDCs are created equal or have the same goals. There are many differentiating characteristics of CBDCs and their intended uses. We will review a few of these key traits to give you a better idea of the general purpose of this currency before potentially investing in CBDC.

Retail vs. wholesale

CBDCs can be set up for public use, only by financial institutions or both.

- Retail: All 11 currently launched central bank digital currencies are strictly set up as retail currencies. This means they are available to the public, and their intended use is the same as cash, to purchase goods and services.

- Wholesale: Some countries are attempting to develop wholesale-only CBDCs. These digital currencies would be used exclusively by financial institutions for bank-to-bank transactions.

CBDC architecture

The means of distribution and accounting for CBDCs is also a differentiating factor. Architecture can fall into one of the following three categories:

- Direct: In this case, the CDBC is a liability of the central bank. Unlike cash, the central bank is responsible for processing payments and handling transactions.

- Intermediated: This is the most popularly used method of CBDC distribution, and it's the most similar to how cash works in the current economy. The central bank issues CBDC, but intermediary institutions, like commercial banks, handle transactions.

- Synthetic: While no countries use this type of distribution, there is the possibility for a third type of CBDC architecture, known as synthetic CBDC. In this model, a public institution, or institutions, would issue the currency with the blessing of the central bank. This would encourage competition between the private companies issuing the currencies and could be much more volatile.

How to invest in central bank digital currencies

If you're wondering how to invest in CBDC, there are a few ways to get involved in this emerging technology. The most direct way is to purchase and hold the currency in a digital wallet. The steps below outline how to purchase digital currency through one of the current programs available. They should answer the question of how to buy central bank digital currency.

The first CBDC program in the world was launched in the Bahamas. Known as the Sand Dollar, this CBDC is the standard followed by most other nations currently offering CBDC (10 out of 11 are in the Caribbean).

The steps below show the Sand Dollar's process of obtaining CBDC, and these steps are similar to what you would see if you were planning to purchase CBDC in any currently functioning economy.

Step 1: Find your preferred financial institution.

Since all currently existing CBDC models now use the intermediated distribution model, the first step is to research the banks approved to issue CBDC. Research coin infrastructure and future projects and pick the one you are most comfortable with.

Step 2: Select the appropriate account.

CBDC accounts are currently available to both businesses and individuals, and there are different options for account limits and the ability to link them to a bank account. The financial institution can help you select the right one for your needs.

There are accounts available for non-residents of the nation, but they may not have much investment potential. For example, the Sand Dollar's non-resident account only allows a maximum holding of $500. Be sure to note these limits when purchasing the currency — you may want to explore the top currency exchange rates on MarketBeat before deciding where to invest.

To receive CBDC, you must provide the central bank with your personal information via the issuing financial institution. The Bahamas has a standardized "know your customer" form, which you must complete before opening a CBDC account.

Step 4: Download the bank's app and purchase currency.

Once approved, you can purchase CBDC via the issuing bank's app using any smartphone and purchase. In the case of CBDC investment, you can hold it in your account for the long term until you decide to reconvert.

Alternative option: Indirect investment

Suppose you are interested in CBDC and see the potential in investing in its development. In that case, a better strategy might be investing in companies working to develop this technology rather than investing in CBDC itself. The goal of CBDC is to be used like cash, so purchasing CBDC as an investment is akin to hoarding cash or buying only stablecoins.

However, this strategy has more risk because CBDC is not a proven commodity.

Companies like eCurrency Mint, NZIA Limited and Bitt Inc. provide technologies to the central banks currently offering CBDC. While those corporations are not publicly traded, as CBDC continues to develop, consider staying current with the partners selected to partner with central banks to create CBDC.

Pros and cons of investing in central bank digital currencies

Now that you know how to invest in central bank digital currencies, we'll look at the potential advantages and disadvantages of investing directly and indirectly in this emerging field.

Pros

As with many emerging technologies, there is room for growth for early CBDC adopters. With almost every significant power in the world putting research into CBDCs, there is room for the industry to grow exponentially in the next few years.

- Indirect investment: The investment with the most growth potential for CBDCs is in companies supporting or innovating in the industry. Companies providing the tech behind CBDCs are not publicly traded at this point. Still, if it continues to grow, some companies will have the potential to break through and provide excellent returns on investment for early adopters. Exploring some of the top finance stocks on MarketBeat is an excellent place for novice investors to begin exploring finance giants working with smaller companies offering these services.

- Convenience and security: If you want to use CDBC for payments and are open to investing to make your life easier rather than increasing capital gains, there are advantages to using the currency where it is available. Once adopted, these funds are readily accessible and can be used to pay for goods and services quickly. Since the nation's central bank backs them, these digital currencies are as good as cash, but they're impossible to lose or misplace in a virtual wallet.

- Access: A big reason many nations are considering CBDCs is to allow access to currency to all people without the need for a bank account or financial institution. CBDCs can bridge inequality gaps and provide access to currency to all people.

Cons

While rewards are usually associated with being early to an innovation, the risks also increase. CBDC’s unique characteristics make them less-than-ideal as a pure investment vehicle.

- Designed to be stable: CBDCs should have the same value as a nation's paper currency distributed by the central bank. Directly investing in CBDCs will not provide capital gains, and simply buying CBDCs is akin to putting cash in a safe (even though CBDCs are more secure). Many nations considered creating CBDCs in response to the stablecoins of cryptocurrency, which are necessary for trading but don't increase in value. This limits their potential as an investment growth vehicle.

- Possible privacy issues: Since CBDCs are issued by the nation's central bank, there is the potential for government oversight in their use. Although this is less likely in developed countries, the issuing agency may be able to track where every digital dollar, yen, euro or other type of currency gets spent.

Regulatory landscape of central bank digital currency

As the world delves deeper into digital currencies, governments and regulatory bodies scramble to establish a framework that ensures stability, security and fairness.

Currently, the regulatory environment varies from country to country. Some nations have already put in place comprehensive regulations, while others are still formulating them. One common thread is a focus on safeguarding against illicit activities like money laundering and terrorist financing.

Future trends and opportunities in CBDC investments

As the world of CBDCs evolves, several trends could shape investment opportunities in the CBDC space and global economic factors may influence that.

Companies like eCurrency Mint, NZIA Limited and Bitt Inc. are working closely with central banks to provide the infrastructure for CBDCs. While these corporations may not be publicly traded.

As a potential investor, you must stay informed about their progress and partnerships. As CBDCs continue to develop, more companies may emerge and offer more opportunities to enter the CBDC market indirectly.

As more nations recognize the benefits of digital currencies, they may begin developing their own CBDCs or partnering with technology companies to implement them, creating a surge in demand for companies specializing in CBDC infrastructure.

CBDCs have the potential to bridge the inequality gap by providing access to currency for people without bank accounts, which may result in governments and central banks partnering with fintech companies to develop innovative solutions that address this issue.

Meanwhile, governments and regulatory bodies are scrambling to establish a framework for stability, security and fairness. Staying informed about the evolving regulatory environment will be crucial in identifying investment opportunities.

Summing up CBDC investment

With several countries already using central bank digital currencies, even more running pilot programs and others putting development and research into their own CBDC networks, there is a lot of momentum behind this new form of currency.

As with any new tech, there is an investment opportunity and the possibility of making a good return on CBDCs, but the opportunity lies in something other than direct investment.

Since they have the same value as a nation's paper currency, CBDCs can provide great features like convenience, security and access. Still, they will not increase in value as other investments might. Forex trading might be a more convenient investment route if you're concerned about the safety of bank stocks and are interested in capitalizing on differences in currency values.

The best investment in CBDC from an income-producing standpoint would be to stay up to date on innovations in the space and keep an eye out for publicly traded entities that are making headway in partnering with central banks across the world to provide the currency to their population.

FAQs

The following are some final questions investors may have about CBDCs.

Can I buy central bank digital currencies?

Yes, central bank digital currencies are currently available for purchase. However, as of April 2023, they are only available in 11 countries. Even if you are not a resident of those countries, you can still purchase their CBDCs, but there will likely be a limit on the amount you can buy.

How do I buy digital currency?

Digital currency is available in many forms, and there is a good argument to be made that central bank digital currencies were born out of the success of cryptocurrencies. To hold digital currencies, you first need a digital wallet. In the case of CBDCs, these are all currently provided by approved financial institutions that can allocate CBDCs. In the case of cryptocurrencies, many private companies provide wallets. Once you have selected a digital wallet from a provider, you can use their service to buy digital currency.

How do I get a CBDC account?

Currently, intermediary institutions (banks) fund active CBDCs. If you want to use CBDC today, you must select an approved bank in one of the nations with an active CBDC and apply for an account by providing your personal information to the institution and the central bank.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

They believe these five stocks are the five best companies for investors to buy now...