Having been used in currency, jewelry and royal architecture for centuries, precious metals like gold and silver have an inherent, alluring quality. For investors, the allure of gold and silver goes far beyond their vibrant hues and versatile decorative nature, acting as a hedge when assets like stocks tend to dip, or inflation rates rise.

You can use multiple methods to invest in gold and silver, from putting money into companies that operate gold mining and processing facilities to purchasing physical metal. Read on to learn more about the many ways to invest in gold and silver (including how to invest in silver and gold ETFs).

Understanding the Basics of Investing in Gold and Silver

Investing in gold and silver can act as a valuable addition to a fully diversified portfolio and are valuable to investors for many reasons. Gold and silver (and other precious metals like platinum) have historically retained value, making them an appealing choice during economic uncertainty. Gold, in particular, is often classified as a strong alternative asset, which means it tends to show less volatility and may even rise in value when the overall market is bearish.

Gold and silver are alternative assets — investments beyond traditional funds, stocks and bonds. Alternative assets usually fall outside the U.S. Securities and Exchange Commission (SEC) realm, although certain aspects of alternative investments may still be subject to regulation. While you'll face fewer limitations on when you can place buy orders and how you store and use your investments, you may be at a greater risk of financial loss if you don't combine this risk with research. Other examples of alternative assets include cryptocurrencies, real estate and hedge fund investments.

Ways to Invest in Gold and Silver

You can use multiple methods to invest in both gold and silver itself, as well as the many companies associated with fine metal unearthing and processing.

ETFs and Mutual Funds

An exchange-traded fund (ETF) and a mutual fund are both types of investment vehicles that involve pooling investor funds to accomplish a particular goal. These assets allow you to benefit from price increases in precious metals without directly owning the assets. Learning to invest in a gold and silver ETF may also allow you to gain exposure to other investments, as these products diversify across multiple holdings.

Stocks

Stocks are shares of ownership in a publicly traded company. If you're looking to invest in companies that refine and produce precious metals, buying shares of stock can be ideal. Buying gold and silver stocks also allows you to benefit from dividend payments, which are shares of a company's profits paid to stockholders.

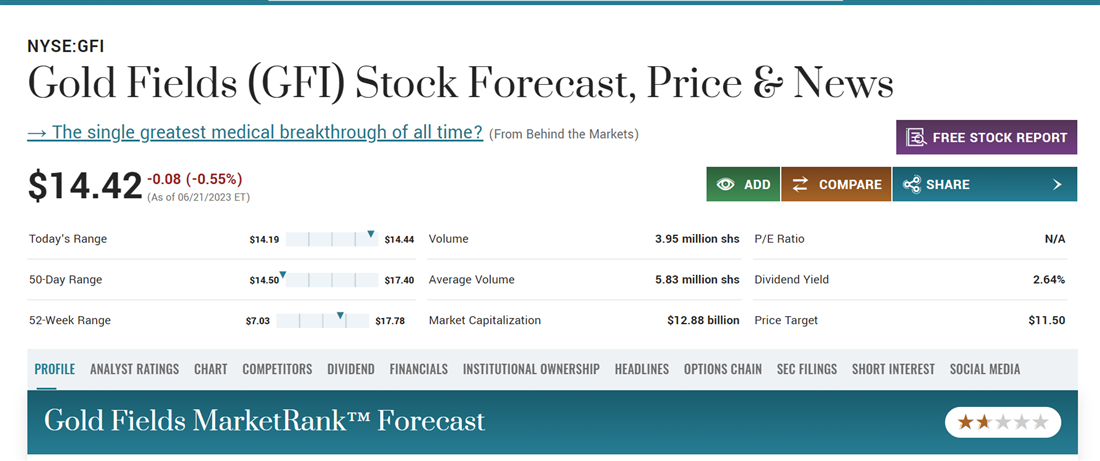

Image: Gold stocks like Gold Fields (NYSE: GFI) can provide investors with indirect exposure to the gold market.

Image: Gold stocks like Gold Fields (NYSE: GFI) can provide investors with indirect exposure to the gold market.

Futures

Futures contracts allow you to capitalize on future changes in gold and silver prices. These contracts act as agreements between two investors to buy or sell a commodity at a specific price in the future. By learning how to invest in silver and gold using futures contracts, you can sell the contract before it expires to see a profit without purchasing the underlying asset.

Options

Options contracts are agreements between two parties to buy or sell an underlying asset at a specific date in the future. Like futures contracts, you can use options as a silver and gold investment by strategically purchasing contracts and selling them before the execution date to avoid buying the underlying asset.

Of course, gold that you hold in physical forms also retains value. You can use multiple methods to hold physical gold, though you'll need to consider storage fees associated with them.

- Bullion: Gold bullion refers to bars, ingots or coins made of pure gold, typically with a high level of purity, and is used as a store of value and investment asset.

- Coins: Gold coins are some of the most common storage methods for highly pure gold. Not every coin is made of pure gold or silver, especially if historically used as currency and is valuable as a collectible rather than a unit of precious metal.

- Jewelry: Gold and silver jewelry retain value but are rarely made of pure metal. For example, gold jewelry is commonly made of 14-karat gold (only about 50% gold by volume). Gold jewelry is made with a blend of metals to prevent scratching, as pure gold (24-karat gold) is too soft to wear in practice.

How to Invest in Gold and Silver

How to Invest in Gold and Silver

The method that you'll use to invest in gold and silver will vary depending on how you're investing. Use the following steps to learn how to buy gold and silver.

Step 1: Choose your investment method.

The method you'll use to invest in gold and silver will dictate the buying process. Start by opening a brokerage account if you're using a financial product like options, stocks or ETFs to invest in companies that process or refine precious metals. Note that while most brokers will offer access to ETFs and stocks, you may need to seek a specific broker offering level 1 and 2 options trading and futures.

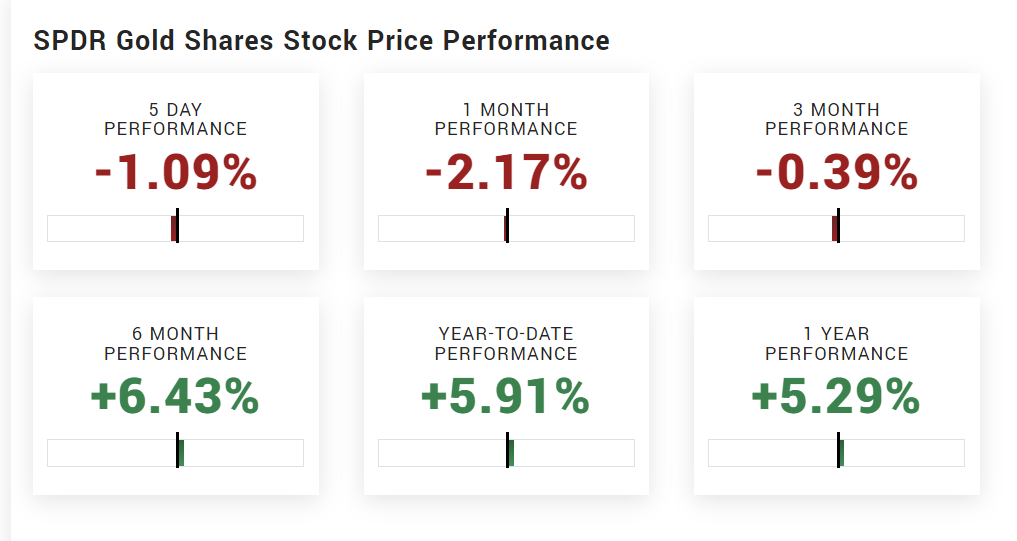

Image: ETFs like the SPDR can help you benefit from price changes in precious metals without holding the underlying assets directly.

Image: ETFs like the SPDR can help you benefit from price changes in precious metals without holding the underlying assets directly.

When purchasing physical gold, you'll need to research a method to hold the gold in a physical form and how to store it. If you're using a tax-advantaged account like an IRA to invest in physical gold, you'll need to select an SEC-approved custodian to invest through. Be cautious of holding physical gold or silver in your dwelling, as homeowners' and renter's insurance options will usually not cover a major portion of investment losses without a rider.

Step 2: Open an investing account.

Choose an investment account that matches your needs after choosing how you want to invest in gold and silver. For example, compare brokers based on fees and commodity contract offerings if you want futures contracts. If you're investing in physical gold in a way that requires a custodian, compare storage security features and storage fees, which will impact your overall return.

Step 3: Place a buy order.

After opening and funding your investment account, place a buy order to purchase gold or silver directly or through the asset you're interested in. If you're buying using a brokerage account, consider using a limit order to control the price you pay per share.

Step 4: Monitor your investment.

If your broker can close your buy order, you'll see the shares or contracts in your account. Keeping your long-term goals in mind, monitor how your investment changes in value over time.

Tips for Successful Gold and Silver Investing

Successful gold and silver investing relies on a solid trading investment strategy. Use the following tips to cultivate a strategy before buying.

- Research and education: Gain a solid understanding of the precious metals market, including factors influencing gold and silver prices, supply and demand dynamics, historical performance and market trends. Stay updated on relevant news and events that impact metals' prices. MarketBeat's headlines newsfeed can be an ideal source to stay up-to-date on market movements.

- Define your goals before buying: Define your investment goals, whether long-term wealth preservation, portfolio diversification or short-term speculation. This will help shape your investment strategy and guide your decision-making process. Keeping your overall goals in mind can also help avoid the psychological pressure of selling too soon or too late.

- Consider long-term investment costs: Keep an eye on costs associated with investing in gold and silver, such as management fees for ETFs and storage fees associated with holding bullion. Consider the impact of these costs on your overall returns, and calculate them when mapping financial goals.

How to Diversify Gold and Silver Investments

In investing, diversification refers to investing in multiple types of assets or classes of assets. You can diversify precious metal investments in multiple ways when investing in gold and silver:

- Asset allocation: Asset allocation refers to dividing your capital between multiple types of investments. Investing in multiple asset classes listed above can help diversify your portfolio, providing wider exposure to the precious metal market.

- Geographical diversification: Consider investing in gold and silver assets from different regions to spread risk associated with geopolitical factors, economic conditions and mining operations specific to a particular location. International stocks are a great place to learn about non-domestic gold and silver investment opportunities.

- Overall portfolio diversification: Overall portfolio diversification is the most important type of diversification when it comes to precious metals investing, as these alternative assets enjoy fewer oversight protections. Use gold and silver investments as complements to an overall portfolio of multiple types of assets.

Pros and Cons of Investing in Gold and Silver

Invest in gold and silver to complement a fully diversified portfolio to maximize your investment and limit risk. Consider both the benefits and drawbacks of this type of investment before placing a buy order.

Pros

Unlike stocks and ETFs, precious metals have an inherent value that helps them better retain value in times of economic uncertainty.

- Better retain value: Gold and silver have a long history of retaining value and act as a hedge against inflation and economic uncertainties, which can add another layer of stability to your portfolio.

- Portfolio diversification: These metals have a low correlation with other asset classes, providing diversification benefits to investment portfolios. A common precious metal investment strategy involves buying gold and silver when the overall market is bullish to retain value better during negative periods.

- Liquidity: Gold and silver have long been valued by both investors and collectors, making them highly liquid.

Cons

The drawbacks of investing in gold and silver are similar to other alternative assets and may come with additional costs related to storage. They include:

- No income generation: Unlike stocks or bonds, gold and silver do not generate income or dividends, so their returns rely solely on price appreciation. This might mean waiting longer to see a return.

- Storage and security: Owning physical gold and silver requires proper storage and security arrangements, which may involve additional costs and risks.

Which is Better, Gold or Silver?

Which is best to buy: gold or silver? The answer might vary depending on your budget and investing goals. Historically, gold has been considered a more valuable product when measured by the ounce and has retained value better than pure silver overall. However, silver's value as an industrial product contributes to its value, while gold's softness makes it impractical for commercial use. Silver also generally has a lower price per ounce, making it more appealing for budget investors.

FAQs

Is gold or silver a better investment when compared to traditional assets like stocks and ETFs? The answer will vary depending on your investment goals. Read on to learn a few answers to some of the most common questions that you might still have about investing in gold and silver.

What is the best way to invest in gold and silver?

The best way to invest in gold and silver depends on individual preferences, risk tolerance, and investment goals. If you're looking for direct investment, futures contracts or physical gold and silver could be the best options. If you're looking for a more passive way to invest in precious metals, investing in major stocks or ETFs that include these investments might be a better option.

What is the most trusted place to buy gold and silver?

The most reputable place to buy gold and silver is through authorized bullion dealers. Several professional associations, including the Professional Numismatists Guild and the London Bullion Market Association, admit members based on strict quality and sourcing guidelines. Look for a professional association seal when purchasing gold and silver.

How to invest in gold for beginners?

The easiest way for beginners to invest in gold is to purchase shares of a gold stock or ETF. These products are overseen by regulators like the SEC, providing a higher level of stability for the investor and less risk of loss compared to alternative assets like pure gold bullion.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.