Growth, It’s Where You Find It

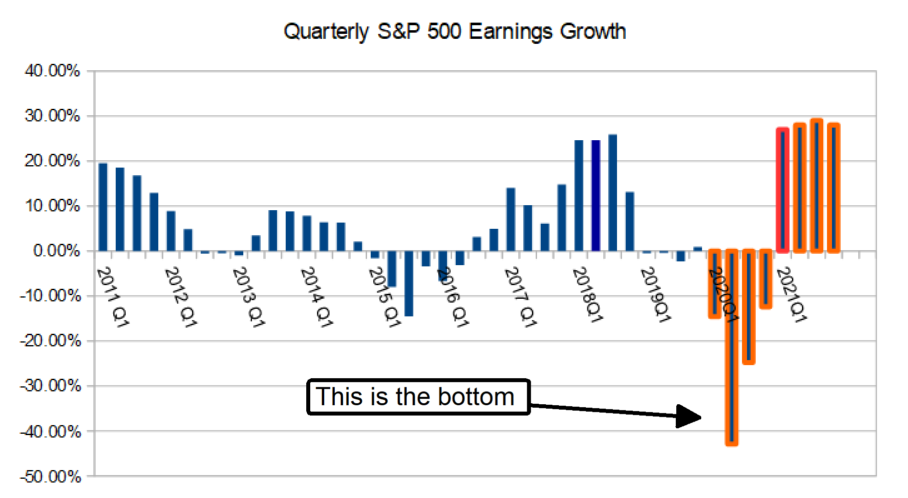

It is no secret that Q2 earnings growth among S&P 500 (SPY) companies is going to be bad. Really bad. Like in the range of -50% bad and that is no joke. Despite this, there is an outlook for growth within the market providing you know where to look. The second quarter is going to produce a robust decline in earnings, yes, but the second quarter will be the bottom of an earnings recession that is already on the upswing.

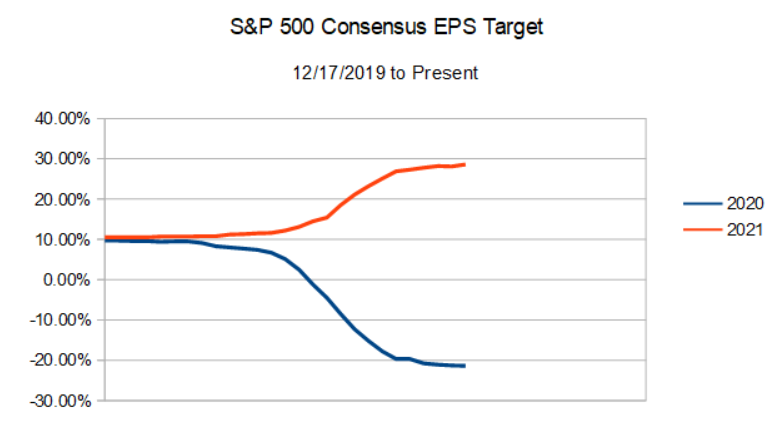

Looking forward, the outlook for earnings growth is quite good. Sequential quarter to quarter growth will resume in the 3rd quarter of 2020 and continue on into 2021. Beginning with the first quarter of 2021 year-over-year EPS growth will resume and is expected to be quite strong. The first two quarters of 2021 are looking at growth in the range of 12.9% and the estimates for next year are on the rise.

Buyer Beware, Not All Sectors Will See The Same Growth

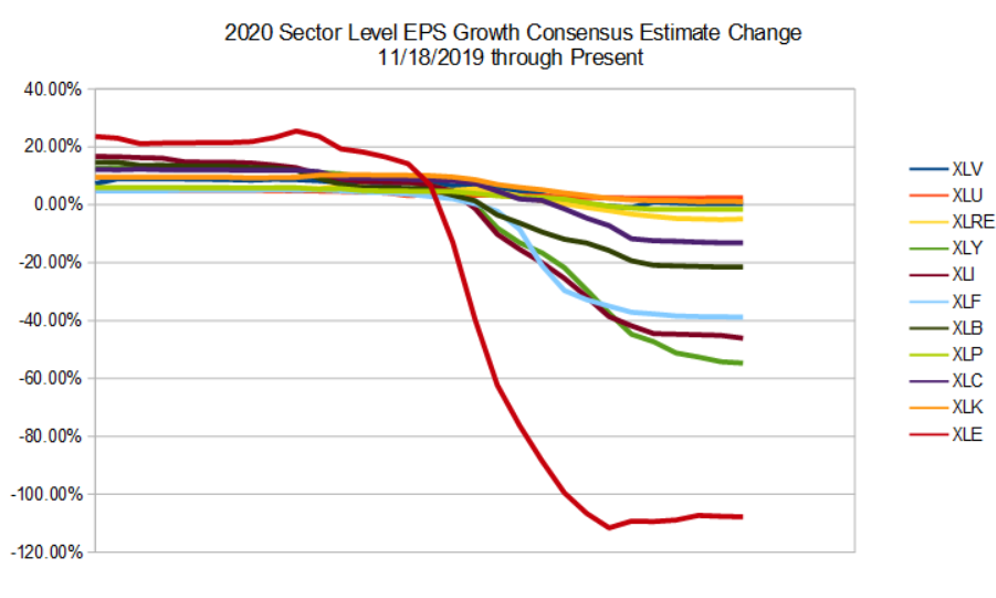

What investors need to beware of is the fact next year’s growth is predicated upon two things. The first is that Energy (XLE) is skewing all the numbers. Because of the oil price war, the Energy Sector is looking at negative EPS growth in excess of 100% this year and just the opposite next year. Ex-energy, the leading sector for losses in 2020 and gains in 2021 is the Consumer Discretionary Sector (XLY).

The second is that, ex-energy, much of the remainder of next year’s growth is more a function of this years declines than anything else. There is a clear correlation between the declining outlook for 2020 and an improving one for 2021. What this means is the analysts have yet to adjust their targets for next year, how cold with the economic environment changing so rapidly, so that opens the market to risk. If the rebound is more or less robust than expected next year’s growth could be less of more than projected.

Beware The Obvious Choices

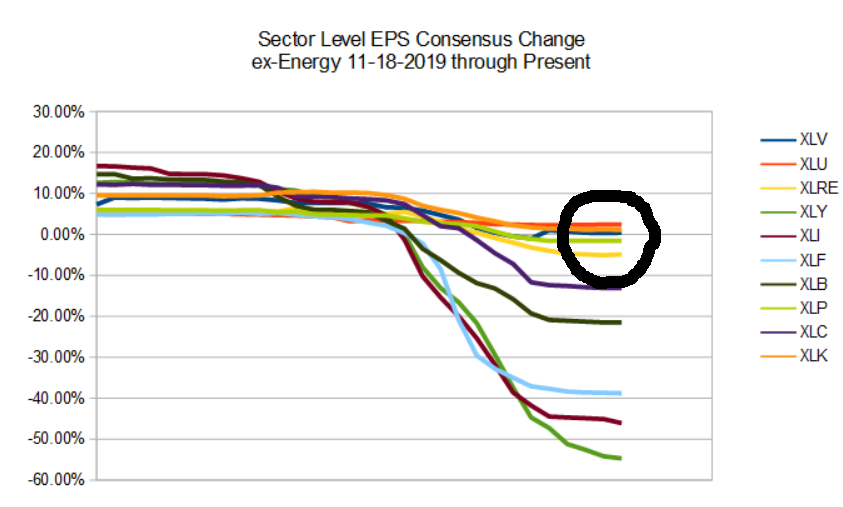

The most obvious choice for growth-oriented traders is the Consumer Discretionary Sector but I’d beware. The sector’s outlook for gains in 2021 is barely enough to offset declines in 2020 and there is little to ensure the outlook is correct. If anything, investors should expect to see revisions to 2021 figures, both good and bad, to begin as soon as the coming reporting cycle. If anything, this sector and those with comparable outlook are going to see a lot of earnings-driven volatility in the coming weeks and months.

The better choices are those sectors with the most consistent outlook for EPS growth. While there is no sector expecting positive EPS growth in the 2nd quarter there are a few with a positive outlook for the year. Those include the Health Care Sector (XLV, +0.4%), the Technology Sector (XLK, +1.1%), and the Utility Sector (XLU, +2.40%). In addition, these sectors are also looking at solid gains in 2021, enough to make the two-year comparisons far more attractive than other sectors in the market.

The Added Bonus: Dividends

The added bonus to these sectors, the Health Care, Utility and Technology Sectors, is that you can easily find safe, above-average yields with a high-expectation for future increases. The Technology Sector is perhaps the weakest in terms of the dividend environment but even it boasts blue-chip quality payers I would classify as above-average to high-yield. Juniper Networks (JNPR) is only one example. The company is a key player in the Internet/Communications networking arena and yields over 3.3%.

The Utility Sector is by far the better yielding sector with average payouts in the range of 3.0 to 4.0%. For some reason, the market continues to snub the sector so there are some great values to be found. The XLU Utility Sector SPDR is yielding a solid 3.3% on its own, stocks within the group like Duke (DUK) and Consolidated Edison (ED) are yielding over 4.0%.

The Bottom Line

If you are looking for consistent, reliable earnings growth for your next investments the Health Care, Utility, and Technology Sectors are your best bets going into the 2nd quarter EPS cycle. All three will see growth this year and next, all three are insulated and/or boosted by the pandemic, and all three pay good dividends so there is really nothing not to like.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.