If you believe that a stock in any stock sector will make a large price move, you can make an options trade called a straddle to capitalize on the anticipated big price move. How large of a move are we talking about? That depends on the total cost of the premiums. We’ll explain in a bit.

In earlier articles, we covered how to trade options if you believe a big price drop is coming with bear put debit spreads and how to pay less for options if you think a big up move is coming with bull call debit spreads. In this article, we'll review how to trade options if you believe a big price move is coming but aren't sure in which direction.

There are many reasons for expecting a large price move; these are the potential catalysts usually occurring on a specific date.

Catalysts that could trigger a big price move

Catalysts that can trigger a large price move could be stock-specific or general to the overall markets or sector, like a Federal Open Market Committee (FOMC) interest rate decision. Stock-specific catalysts can range from an earnings report, FDA advisory meeting or announcement, product launch, regulatory or court ruling, or management changes.

SEC investigations, management changes and short squeezes are unforeseen and unexpected events that can cause big stock price moves as well.

The mechanics of a straddle

An options straddle is comprised of 2 legs, buying a long call option and a put option at the same strike price and same expiration date. The total cost of premiums paid for the two positions is also how much the underlying stock needs to move in order to break even.

If the total premiums paid for a $29 straddle on XYZ is $2 ($1 for the call option and $1 for the put option), then XYZ will need to move $2 above or $2 below the $29 strike price ($27 or $31) in order to be profitable. Profits are made when XYZ moves more than $2 on either side of the $27 strike price. Let’s use semiconductor giant Intel Co. NASDAQ: INTC as an example.

Perform your technical analysis

The first thing to do on all trades is to perform your technical analysis. This requires identifying the trend, support, and resistance levels, and any pattern set-ups. Using a daily candlestick chart on INTC as an example, the daily 50-period moving average is rising at $43.63, followed by the 200-period moving average (MA) at $35.78.

This indicates an uptrend. The daily relative strength index (RSI) rejected off the 60-band and has turned back down. Upside resistance sits at the $49.77 daily market structure high (MSH) and $51.28 swing high. Pullback supports are at $45.92, $43.63 daily 50-period MA, $41.17, and $39.19.

Putting on the trade

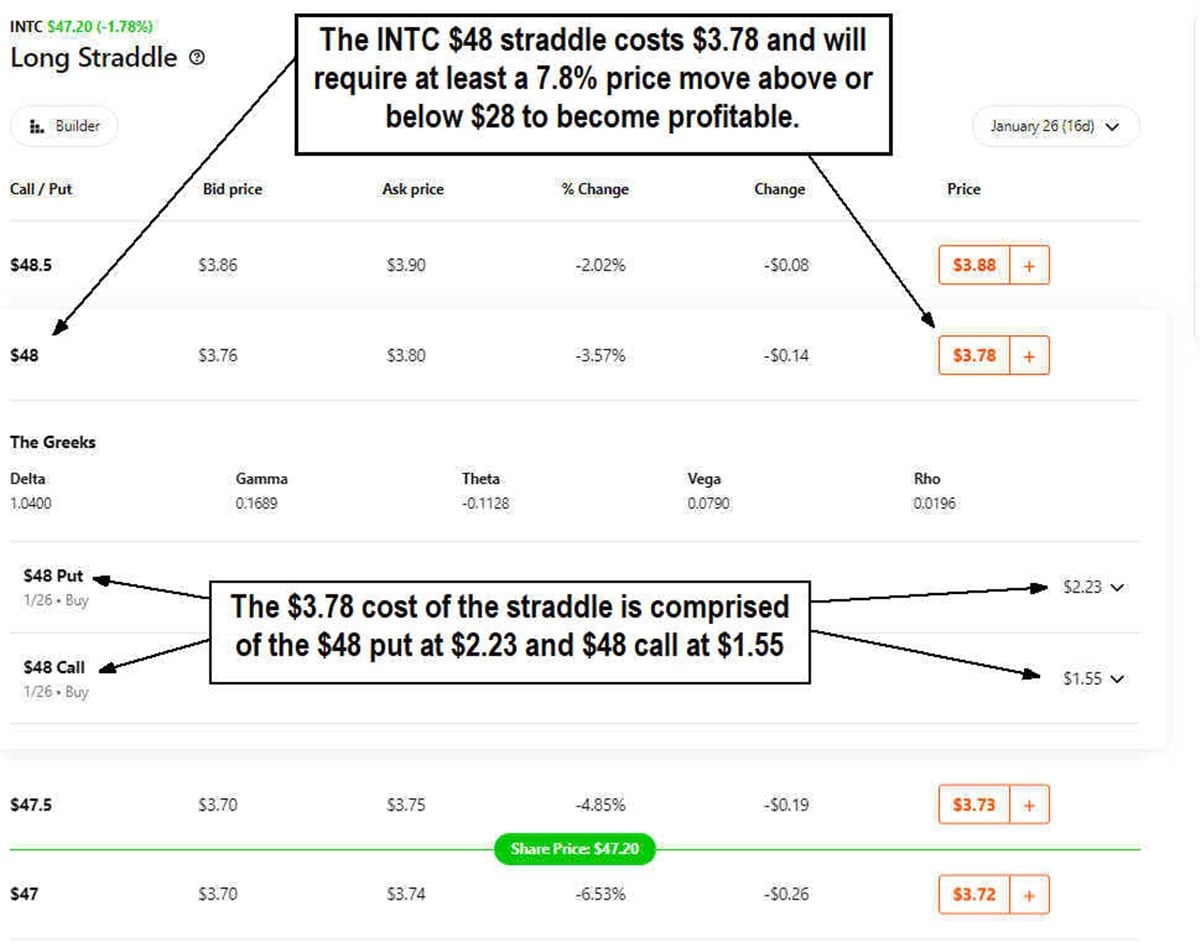

Let's consider INTC's earnings report coming out on January 25, 2024, after the close as the catalyst. We can see there is an expiration on January 26, 2024. That would give us one day before expiration. We don't know which way INTC will move up or down, but we are certain it will make a large price move. Since $48 is a gap-fill level, we can choose that as our strike price. If INTC is trading at $47.20, we can look to buy the $48 call option at $1.55 and the $48 put option at $2.23, for a total cost of $3.78 for the spread.

Since INTC is trading at $47.29, the in-the-money (ITM) on the $48 put option costs more than the $48 out-of-the-money (OTM) call option. It’s rare to get a spread with the exact cost for both legs of the straddle. Rather than manually placing each trade, check if your broker can perform an options straddle in a single trade.

So the trade would cost $3.78 for the INTC $48 straddle expiring on January 26, 2024. The catalyst is its fourth-quarter 2023 earnings report release on January 25, 2024.

Potential outcomes

If the INTC $48 straddle costs $3.78, we can calculate the price envelope that will be our breakeven prices on the trade. This is calculated by adding and subtracting the cost of the trade, $3.78, from the $48 strike price. The upper envelope would be $51.78, and the lower envelope would be $44.22. INTC stock has to trade above $51.78 or below $44.22 for the $48 straddle trade to be profitable.

That means INTC needs to get at least a 7.8% price reaction in either direction to make profits. The further away INTC stock trades from the price envelopes, the more profitable the trade becomes. Of course, if INTC fails to trade beyond the price envelopes of $51.78 and $44.22 and stays within the range of the envelopes, then the straddle trade becomes unprofitable.

Conclusions

Depending on the catalyst, a large price move can also be fairly choppy. It's possible to have an earnings price gap reverse the next morning. This makes exits just as important as getting the trade right.

Be sure to lock in profits or take some of them off the table when the trade turns profitable and key a trailing stop. The rule of thumb is to take your profits or losses after the catalyst triggers the price reactions.

Depending on your experience level as a trader, you may also consider closing the losing leg of the trade if a strong price emerges. The INTC trade doesn’t leave much room to trade a trend since the straddle expires the day after options expiration.

It is also helpful to play straddles closer to the date of the catalyst to avoid the time decay (theta) eroding your premiums.

Before you consider Intel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intel wasn't on the list.

While Intel currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report