Whitestone REIT NYSE: WSR is a real estate investment trust (REIT) with a unique community-centered approach. REITs offer investors a streamlined way to participate in the real estate market without the burdens of direct property ownership, providing potential for dividend income and portfolio diversification. Whitestone carves its niche by focusing on convenience-based, open-air retail centers located in the high-growth Sun Belt markets of Texas and Arizona. This emphasis on local connection forms the bedrock of Whitestone’s investment strategy.

Whitestone's Strategic Approach: Cultivating Community and Value

Whitestone REIT's business model is built on a foundation of strategic acquisitions and targeted redevelopment. Rather than undertaking risky ground-up development, Whitestone identifies existing properties in prime locations with untapped potential.

"We historically buy properties that we can come in and apply our operational and strategy to, and add value," CEO Dave Holeman explained in a recent interview with MarketBeat’s Bridget Bennett.

This approach allows Whitestone to integrate its operational expertise quickly and tailor each center to the specific needs of the surrounding community.

Central to the company’s success is its focus on fostering strong tenant relationships. Shorter lease terms, a hallmark of the Whitestone approach, enable regular communication and create opportunities for the company to adapt to evolving market dynamics.

"We're very active in using technology to understand the community, what the buying needs are, what the void analysis is," Holeman said, emphasizing Whitestone’s data-driven approach to tenant selection.

This involves analyzing vacancies and identifying complementary businesses that enhance the overall tenant mix and cater to the local demographic. By integrating data with local knowledge, Whitestone can not only anticipate what will drive the business for individual tenants but also create a synergistic retail environment that benefits tenants and the surrounding community. By structuring leases to accommodate shifts in market demand, Whitestone can better serve the local community and maintain stronger, more fruitful relationships with its tenants.

Community-Focused Strategy Drives Financial Strength

Whitestone REIT Today

WSR

Whitestone REIT

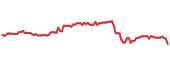

$15.22 +0.04 (+0.26%) (As of 12/17/2024 ET)

- 52-Week Range

- $10.77

▼

$15.29 - Dividend Yield

- 3.55%

- P/E Ratio

- 37.14

- Price Target

- $15.67

Whitestone REIT's earnings report for the third quarter of fiscal year 2024 (Q3 FY2024) showcased the effectiveness of its community-focused strategy, demonstrating strong operational execution and positive momentum. The company reported a 4.6% increase in same-store net operating income (NOI), reaching $24.2 million, driven by strategic tenant selection and proactive remerchandising efforts.

"Growth is something that we focus on every day," CEO Dave Holeman said in the recent MarketBeat interview.

He also noted that growth for Whitestone is multifaceted, including the organic growth seen within its existing portfolio.

This strategy has contributed to a robust 94.1% occupancy rate, which is one of the highest in the company's history. These strong fundamentals have further translated into impressive leasing spreads of 25.3%, underscoring the high demand for Whitestone's well-located properties.

Revenue for the quarter climbed to $38.6 million, compared to $37.1 million in Q3 2023. Net income attributable to common shareholders was $7.6 million ($0.15 per diluted share), a significant improvement over the $2.5 million ($0.05 per diluted share) reported in the same period last year. Funds From Operations (FFO), which is a key profitability metric for REITs that adds back depreciation and amortization reached $13.0 million ($0.25 per share). Core FFO, which further adjusts for non-recurring items to provide a clearer picture of ongoing profitability, also landed at $0.25 per share, exceeding the $0.23 reported in Q3 2023.

Whitestone’s balance sheet contributes to its positive financial outlook. While the current dividend payout ratio of 119.51% raises questions about long-term sustainability, the company maintains a healthy debt-to-equity ratio (D/E) of 1.49 and a current ratio of 2.17, suggesting ample liquidity to meet short-term obligations.

A Multifaceted Growth Strategy for the Sun Belt

Whitestone REIT's growth strategy encompasses organic expansion within its existing portfolio, strategic acquisitions in thriving Sun Belt markets, and proactive remerchandising initiatives. This approach allows Whitestone to leverage multiple avenues for value creation.

Organic growth is a cornerstone of Whitestone's strategy, and the company achieves it through maximizing occupancy rates, increasing rents in line with market demand, and capitalizing on the strength of their existing properties.

CEO David Holeman points out, "If you look at our same-store growth in our properties, it's among the best in the sector."

This internal growth engine is fueled by Whitestone's deep understanding of local communities and their evolving needs.

Strategic acquisitions play a key role in expanding Whitestone's footprint. The company targets properties in high-growth Sun Belt markets, aligning with favorable demographic trends and strong economic fundamentals. Over the past two years, Whitestone has invested approximately $100 million in acquisitions, demonstrating its commitment to expansion.

Beyond acquisitions, the company also seeks to add value through development and redevelopment within existing centers. Holeman highlights opportunities to "add a very valuable pad site" on underutilized land within their portfolio, creating additional revenue streams and enhancing the appeal of their centers.

Whitestone REIT Stock Forecast Today

12-Month Stock Price Forecast:$15.672.90% UpsideModerate BuyBased on 4 Analyst Ratings | High Forecast | $16.00 |

|---|

| Average Forecast | $15.67 |

|---|

| Low Forecast | $15.00 |

|---|

Whitestone REIT Stock Forecast DetailsWhitestone's proactive remerchandising efforts further bolster its growth trajectory. By continuously evaluating tenant mixes and identifying opportunities to upgrade, the company ensures its centers remain relevant and attractive to the surrounding communities. This ongoing optimization of tenant portfolios drives revenue growth and reinforces Whitestone's community-centered approach.

Management remains optimistic about the long-term prospects for convenience-focused retail centers. Holeman notes the positive supply environment, with limited new development in recent years, creating a favorable backdrop for existing centers. While acknowledging the potential impact of interest rate fluctuations and inflation, Whitestone's focus on shorter-term leases provides flexibility to adjust rents and maintain profitability.

The company's disciplined capital allocation and emphasis on core FFO per share growth further underscore management's commitment to long-term shareholder value.

"We've worked well with the rising rates," Holeman said. "And I think we all think there's going to be an environment with a little lower interest rates coming."

A Promising Outlook for Whitestone REIT

Whitestone REIT's community-centered approach, coupled with its strategic focus on high-growth Sun Belt markets, uniquely positions the company for continued success in the retail sector.

"I think momentum is a word that I would use to describe where we are today," Holeman said, encapsulating the company's positive trajectory.

While potential risks should be carefully considered, Whitestone's strong financial performance, active management style, strategic growth plan, and commitment to shareholder value make it a compelling investment opportunity in the REIT sector. With its focus on building community, one center at a time, Whitestone REIT appears poised for continued growth and value creation.

Before you consider Whitestone REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Whitestone REIT wasn't on the list.

While Whitestone REIT currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report