Michael Burry of

The Big Short fame recently came out with his

latest prediction for the US market, and this time the catalyst is based on the rise of passive investing.

“...passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies -- these do not require the security-level analysis that is required for true price discovery”

In this article, we’re going to attempt to answer the question that Burry has a lot of investors rethinking right now: are index funds as safe as we think?

The Rise of Passive Investing

It’s impossible to talk about passive investing’s rise without mentioning Vanguard founder John Bogle. Bogle both created and had a huge role in the popularity of index investing. His ideas have given rise to a group of devotees who call themselves Bogleheads.

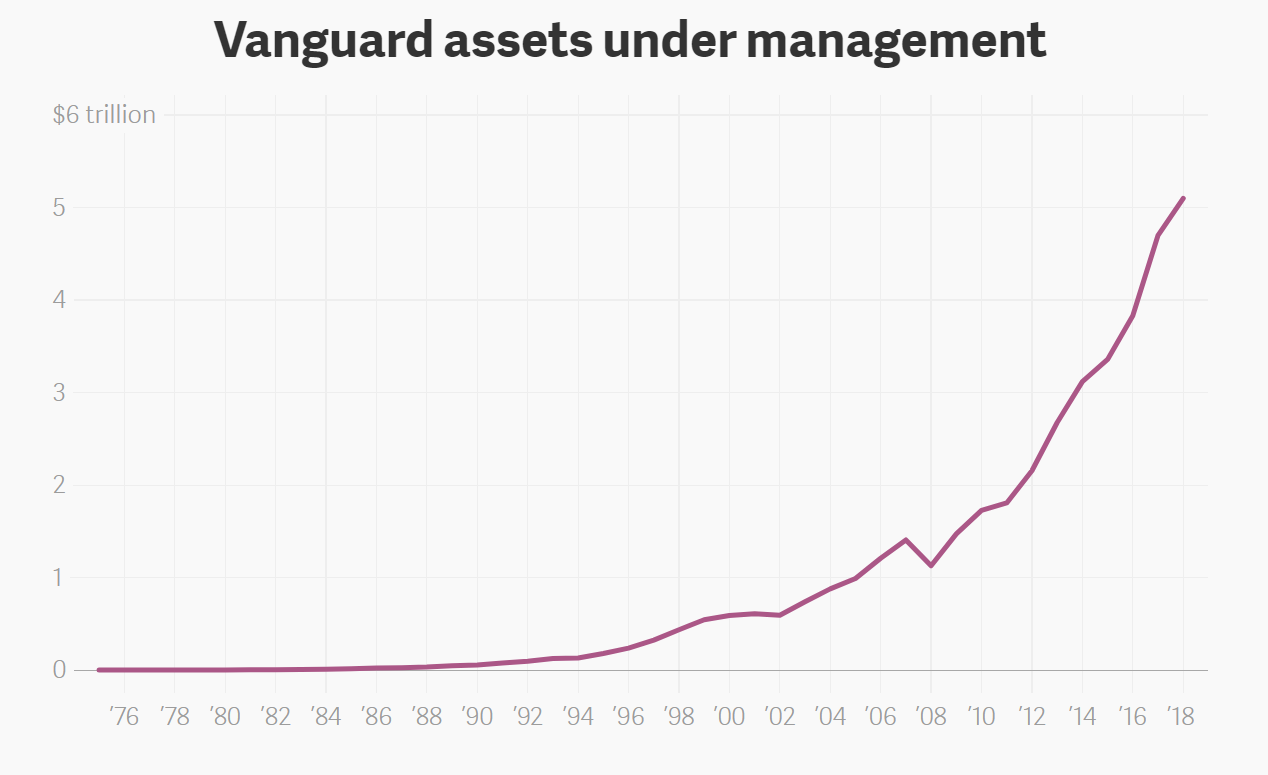

Since Bogle’s creation of index investing in 1976, there was a very slow adoption of passive indexing strategies until after the global financial crisis when the strategy grew exponentially. Just look at the growth of Vanguard’s assets under management over time:

Index investing’s rise coincided with the exponential growth of computing power, making it easy for institutions to create and manage all types of passive investment products for a low cost. It also coincided with a massive loss of trust in active managers on Wall Street.

Warren Buffett is also a huge fan of the strategy.

Blind Fund Flow

One of the most dangerous aspects of what might be a bubble in passive investing is the massive flows of funds into the strategy without much thought. Passive investment into the US equity markets has been sold to the public as a virtually guaranteed annual yield.

There are two problems with this “simple thesis,” as Burry called it.

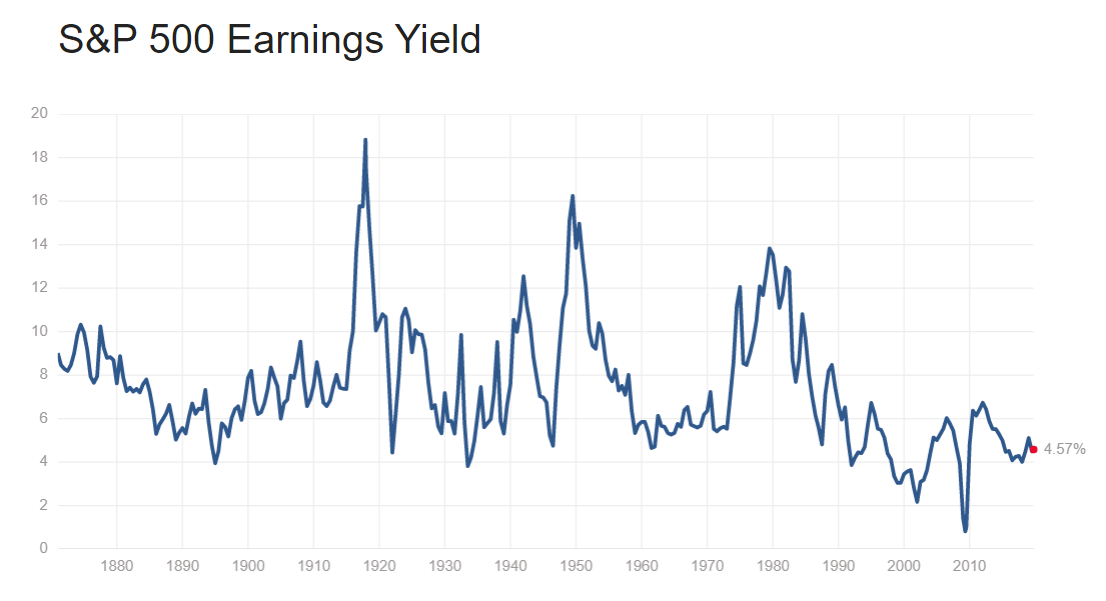

The first is that the returns that proponents of indexing refer to occurred when the S&P had a very high earnings yield. Today, the S&P’s earnings yield is towards the bottom decile of its history.

Without significant earnings growth from here, history tells us that the S&P doesn’t have a ton of upside at these yields. Market timing matters if the odds are stacked against you.

The next problem relates to the behavior of individual market participants. Stock yields don’t work like bonds. There isn’t a consistent, predictable annual return stream. The long-term return premium afforded to you by investing in stocks comes with the caveat that you’ll have to deal with periods of significant volatility and underperformance.

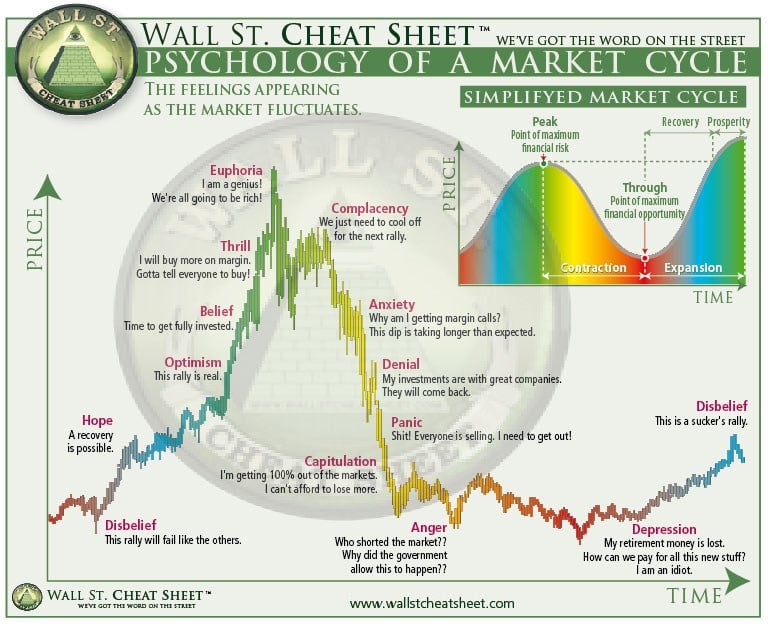

Many investors know this when they put their money into index funds, however, it’s easier to assume you’ll be able to weather the volatility during a bull market, but when a bear market hits and everyone in the financial press is telling you that the world is ending, do most investors actually stick it out?

This is the buy/sell cycle for many individual investors:

Investors in NASDAQ 100 index funds had to weather drawdowns of around 80% during the dot-com crash. Individual investors tend to sell their holdings near the bottom during periods like this.

Lack of Price Discovery

When massive amounts of funds are invested into indexes with no individual stock analysis, you get a situation where the lowest quality companies in the indexes are rewarded proportionately with the highest quality companies.

JPMorgan came out in June 2019 with the estimate that roughly 60% of the market is made up of passive strategies: ETFs, mutual funds, and the like. Another 20% is made up of quantitative strategies, which focus more on technicals and market structure as opposed to security analysis.

That leaves us with the last 20%, which is presumably ruled by active investors.

Among this small slice of the market left for active managers, a large portion of them are momentum/growth investors, overweighting in the best-performing stocks, and then there are the closet indexers. This doesn’t leave a whole lot of room for fundamentals-driven price discovery, especially at the small-cap level.

In Burry’s eyes, there isn’t enough money pursuing value within the micro and small-cap world, which he thinks has been “orphaned” by the market, evidenced by its underperformance coinciding with the rise of passive investing.

Final Thoughts

Index ETFs and mutual funds certainly have their place in the market, but betting on a “free lunch” in the form of a historical average return in lieu of a sound investing strategy can leave you with huge drawdowns in your account if Burry’s thesis proves correct. We simply don’t have enough data on passive investing’s effects on the market.

The issue with passive investing isn’t with the products, but the fact that it’s sold as a superior alternative to supposedly “outdated” active investment strategies that are based on the fundamental analysis of individual companies.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report